The startup and investment institutions database, Crunchbase recently released a report on the second quarter of 2018 global venture capital (VC) market. According to it, the number of venture capital transactions and transaction amounts in the second quarter are rising. China has contributed its strength to the warming of the global venture capital market. The data shows that in the second quarter, Chinese venture companies incorporated more venture capital than North America.

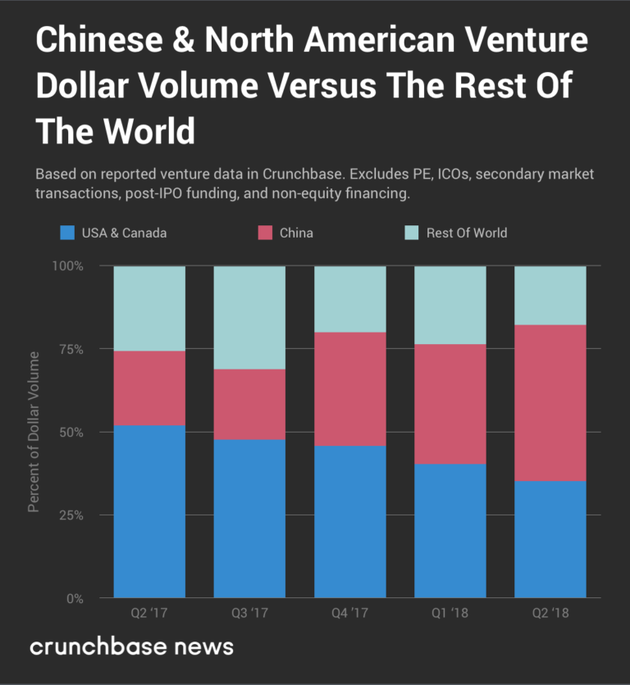

In the second quarter, among the entire venture capital volume, Chinese startups accounted for 47% of the total, while the US and Canadian companies accounted for 35%. Note that this is the first time that Chinese companies’ venture capital fundraising surpasses that of the US and Canadian companies.

In the financing of Chinese companies, block trades account for a high proportion. For example, in early June, Ant Financial Services raised $14 billion. So far, this is the largest single-round financing transaction in history. Led by Temasek Holdings and GIC (a Singaporean sovereign wealth fund), the round reportedly values Ant Financial at $150 billion. This valuation is equivalent to twice the Uber valuation.

If the fundraising of Ant Financial is removed, the Chinese startups’ financing in the second quarter is only slightly more than the first quarter. It accounts for 36% of the total global financing in the second quarter, which is the same as the proportion in the first quarter.

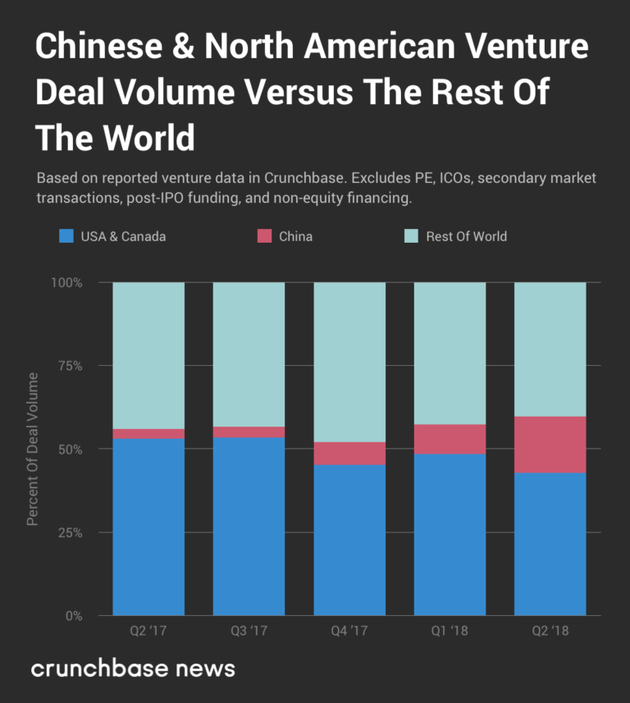

Look at the number of transactions. In the second quarter of 2018, the number of financing transactions completed by Chinese startups increased by 395% year-on-year. Due to language barriers and other factors, the collected data is difficult to cover the entire Chinese entrepreneurial market. The database only collects some of the larger financing transactions and collects information from the news.

Although the number of transactions has increased, the proportion of transactions completed by Chinese companies is not high, at least not as high as the proportion of transactions.

Tencent, Ali Baba invest a lot of money in venture capital. State-owned venture capital firms are also investing in China and overseas markets. And the on-demand services and transportation industries have merged horizontally to form stronger enterprises. As there is no sign of an immediate slowdown, China’s technology and venture capital ecosystem will maintain its current expansion and will play a more important role in the global investment market in the future.