The first day’s results of Xiaomi’s listing weren’t astonishing. But then, everything went viral and its stock price began rising. Today, the stock price rose by 5.26% and the price was HK$22 ($2.8). According to the data of HKEx, the latest market value of Xiaomi is HK$494.5 billion ($63 billion). Thus, Xiaomi’s share price has risen 29.41% since its listing.

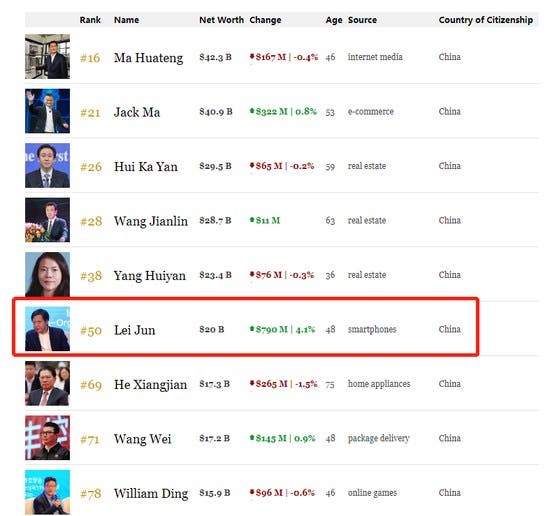

At present, Lei Jun’s net worth exceeded $20 billion for the first time. Currently, he ranks 6th in Forbes China’s richest list after Tencent’s Ma Huateng, Ali’s Jack Ma, Evergrande’s Hui Ka Yan, Dalian Wanda’s Wang Jianlin, Country Garden’s Yang Huiyan.

Xiaomi Group-W (01810.HK) issued an announcement that the Over-allotment Option described in the Prospectus has been fully exercised by the Joint Representatives, on behalf of the International Underwriters, on July 17, 2018, in respect of an aggregate of 326,937,000 Option Shares, representing approximately 15% of the total number of the Offer Shares initially available under the Global Offering before any exercise of the Over-allotment Option.

Among the Option Shares, about 107 million Option Shares will be sold and transferred by Morningside China TMT Fund I, L.P., about 18 million Option Shares will be sold and transferred by Morningside China TMT Fund II, L.P., and 201 million Option Shares will be issued and allotted by the Company, at HK$17.00 ($2.17) per Option Share (exclusive of brokerage of 1%, SFC transaction levy of 0.0027% and Stock Exchange trading fee of 0.005%), respectively, being the Offer Price per Offer Share under the Global Offering.

Hong Kong Exchanges and Clearing said it had reached a consensus with the Shanghai and Shenzhen stock exchanges that mainland investors are ‘not yet familiar with weighted voting rights companies.’ It includes three aspects:

- The further optimization and improvement of interconnection and intercommunication is the general direction of mutual recognition and efforts and will continue to develop healthily and steadily.

- The HKEx and the Shanghai and Shenzhen Stock Exchanges will add a stable trading period mechanism based on the existing inclusion system of Shanghai and Shenzhen-Hong Kong Qualified Securities.

- The three have agreed to set up a joint working group to study the specific schemes and rules for the new supplementary mechanism for the inclusion of different voting rights structure (WVR) companies in Hong Kong stocks.