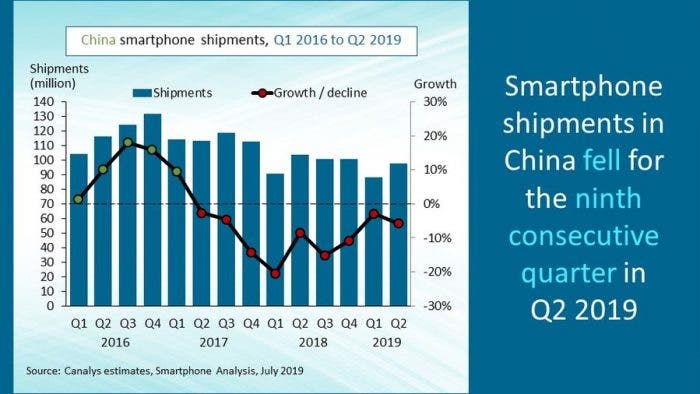

Today, Canalys released China’s smartphone market statistics report for the second quarter of 2019. According to the report, China’s smartphone shipments in the second quarter were 97.6 million units, down 6% from 103.6 million units in the same period last year. What’s more important, it’s a decline for nine consecutive quarters.

Also Read: IDC: 2018 China’s Smartphone Market Shipments Fell More Than 10% YoY

The report pointed out that the use of smartphones by Chinese consumers has become longer and the frequency of upgrades has decreased. In the first half of this year, an important factor affecting consumers’ upgrade of phones is the upcoming launch of 5G network and corresponding devices. The expectation for a new generation of the network has prompted consumers to delay the purchase of mid- to high-end LTE devices.

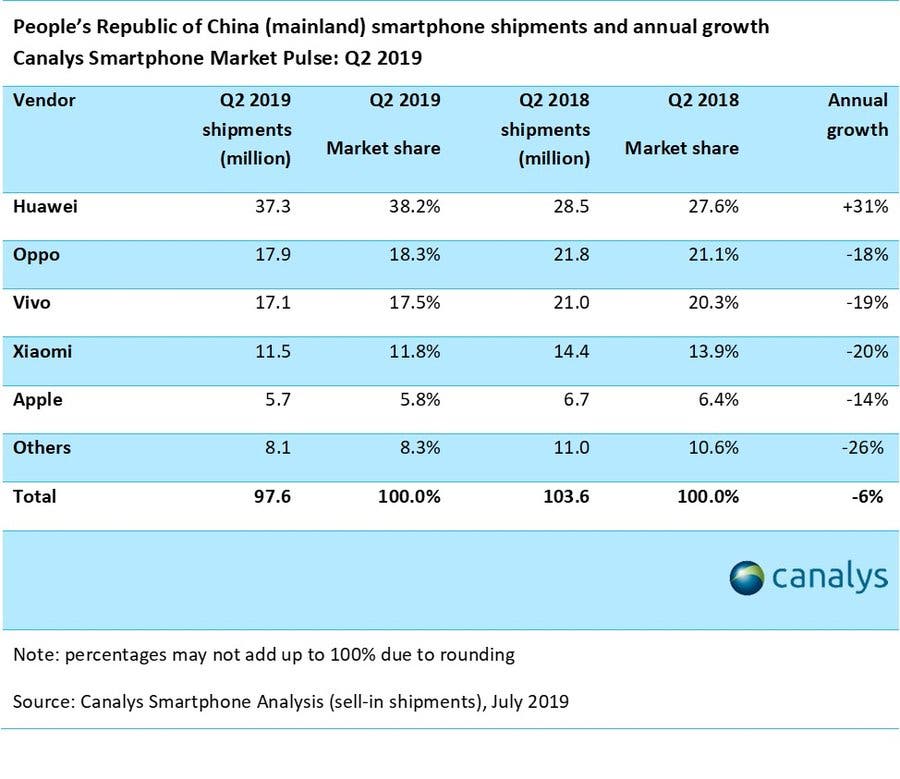

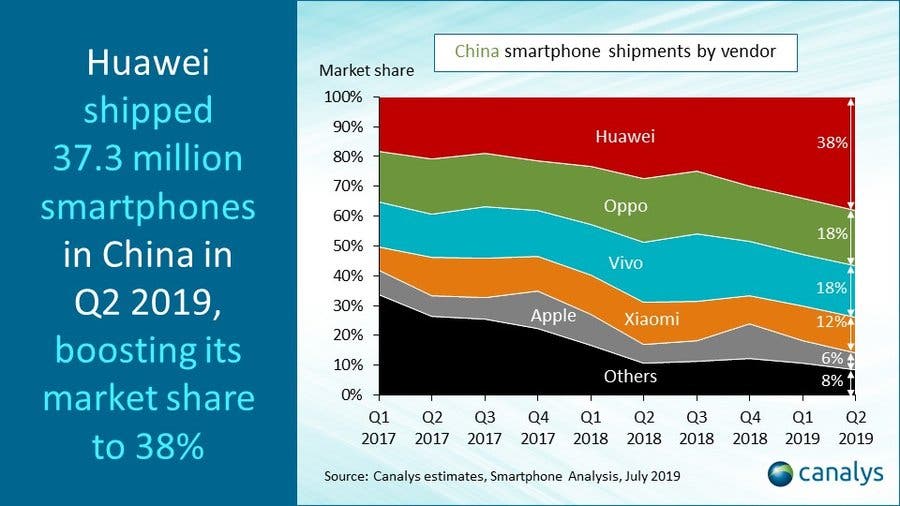

In the second quarter, Huawei’s smartphone shipments in the Chinese market soared to 37.3 million units, up 31% from 28.5 million units in the same period last year. The market share also reached the highest 38.2% among all vendors in the past eight years. Compared with the previous year’s 27.6%, it increased by 10.6 percentage points. In Huawei’s second-quarter global smartphone shipments, 64% came from China. This is the highest proportion since the second quarter of 2013.

In addition to Huawei, the shipments of smartphones from the other four major manufacturers all showed a year-on-year decline. OPPO, VIVO, Xiaomi Group, and Apple ranked second to fifth. In the second quarter, shipments of smartphones were 17.9 million, 17.1 million, 11.5 million and 5.7 million, respectively. Simply put, it’s down by 18%, 19%, 20%, and 14% year-on-year. The market shares of those four are 18.3%, 17.5%, 11.8%, and 5.8%. It turns out the gap between the first and second places is about 20%.