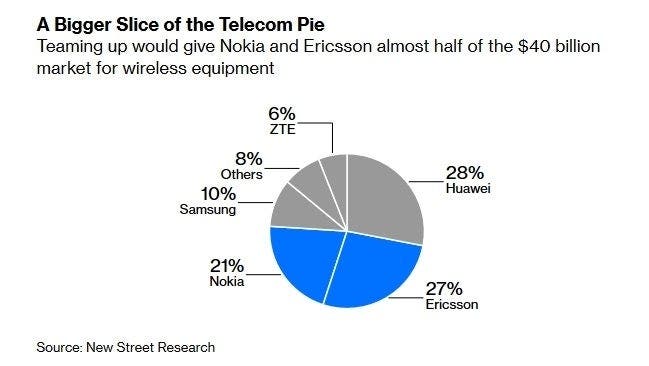

According to recent reports, Finnish telecommunications company, Nokia, is considering the option of selling assets and mergers. This immediately triggered the company’s consortium with Swedish rival Ericsson. This is to create a European giant that can effectively compete with Huawei in the 5G era. However, some analysts believe that Nokia should resist the impulse to merge. Instead, it should consider selling some of its assets to “thin down” its load.

The potential merger of Nokia and Ericsson is reminiscent of the feat of the European countries to form Airbus in the 1960s and 1970s. At that time, the move was intended to compete with American aircraft manufacturing giants such as Boeing. Since then, it has indeed formed a highly competitive duopoly pattern that dominates the global aviation industry. Unfortunately, the deal was also a strategic mistake. By comparison, asset sales are a much smarter option.

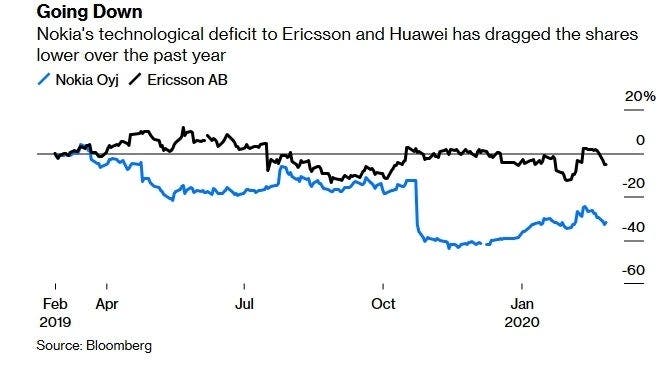

If the two Nordic companies merge, it is likely that they will complement each other. Nokia has experienced a turbulent twelve months, and its share price plummeted 25% after lowering its quarterly performance forecast last October. To a certain extent, it is in trouble because it failed to effectively integrate the last major acquisition transaction (acquisition of Alcatel-Lucent for a sky-high price of $18 billion).

Nokia – Ericsson merger will not be easy to achieve

Huawei benefits from the economies of scale brought by China’s huge market. The merger of Nokia and Ericsson will make it easier for them to compete with the Chinese company in terms of price. However, it may take several years for the transaction to get regulatory approval, let alone integrate the business. This is undoubtedly a big plus for Huawei. When the two major rivals face uncertainty, it can seize the opportunity to win more new customers.

It is important that Finland is one of Nokia’s five largest shareholders, and it will definitely take steps to block any mergers that could lead to large domestic unemployment.

If Cisco bought Nokia, it would be in response to President Trump’s call to build a 5G technology giant. However, it is not wise for Cisco to use its huge cash reserves to reach a transaction that would dilute its profit margins. Cisco’s net profit last year accounted for 24% of sales, compared with Nokia’s 2.1%.

Nokia’s 5G service means that its CEO, Rajeev Suri, cannot profit from the competition with Huawei. The company’s stock price has fallen by a third in the past year. This slump in market capitalization makes it easy for radical investors who underestimate their business to flee.

Nokia has some valuable assets to sell

Of course, Nokia can deal with this threat by listing some assets. Its intellectual property unit seems to be the first choice. It still has considerable revenues-sales of 1.5 billion euros (about $1.6 billion), gross profit margins of up to 98% – but the value of its intellectual property portfolio is gradually deteriorating. Nokia can choose to sell a large portion of these assets (such as those related to the old mobile phone business) and earn a substantial income while retaining the latest patents on 5G development.