Huawei tops Samsung, Apple & MediaTek in the Q1 smartphone processor revenue

HuaweiThursday, 09 July 2020 at 07:18

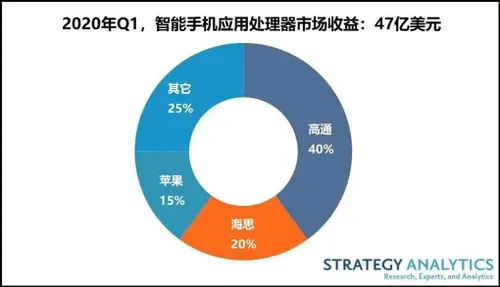

According to Strategy Analytics' recent report, the Q1 global smartphone application processor (AP) market revenue continues to rise. With the coronavirus pandemic, the market revenue was expected to decrease. However, Strategy Analytics shows that the application processor (AP) market revenue increased by 6% to $4.7 billion in 2020. According to the report, Qualcomm, Huawei HiSilicon, Apple, Samsung LSI, and MediaTek are among the top five chip makers. They are the top global smartphone application processor (AP) manufacturers for Q1 2020. While Qualcomm maintains its lead with a 40% revenue share, HiSilicon is second with 20%. In the third position is Apple with 15%.

Huawei Hisilicon still in the second spot

According to Strategy Analytics, Qualcomm has made a good start with the flagship Snapdragon 865 SoC. Its mid-range Snapdragon 765/G SoC is also doing well in the market. These 5G processors have appeared in many models from top smartphone manufacturers. Among high-volume smartphones, Strategy Analytics estimates that in Q1 2020, 5G smartphone processors account for more than 20% of Qualcomm smartphone processor shipments. However, Qualcomm faced stiff competition from 4G and 5G smartphones during the quarter."

However, with respect to memory chip shipment, the Strategy Analytics report claims that there has been an increase. The report says

“Despite the decline in smartphone shipments during the COVID-19 epidemic, the smartphone application processor market has shown significant growth in revenue driven by the increase in the average selling price of 5G application processors. Now, many of the 4G flagship application processor markets has shifted to 5G. However, 4G continues to perform well in the mid-range and low-end segments..."

As for Strategy Analytics, almost all major application processor vendors now have their focus on 5G processors. According to the company, 5G flagship processors will drive revenue growth in the second half of 2020.

In all, the surprise manufacturer on the list is Huawei HiSilicon. With all its troubles with the American government, many expected Huawei to drop fast. However fast its market revenue drops, HiSilicon can not fall out of the top 5 list so fast. Until recently, HiSilicon was still operating normally. In fact, the recent laws stopping TSMC from working for Huawei is not fully active yet. There is still a bit of debate whether TSMC can still take orders from HiSilicon if the ban becomes fully active. This report if for Q1 2020 and at the time, HiSilicon was operating in full capacity.

Loading