We have already talked about a new report released by Counterpoint Research. But in that article, we were mainly talking about the incredible sales results of the iPhone in the Chinese market. As for now, let’s get acquainted with the performance of all major smartphone brands in China in the second quarter of 2020. Interestingly, Apple has no role in the 5G smartphones market.

As the company claims, in the second quarter of 2020, sales of smartphones in China fell by 17% year-on-year, but increased by 9% month-on-month. Although the new coronavirus epidemic has been basically controlled in China, the demand for smartphones has not yet returned to the level before the epidemic.

Counterpoint Research believes that although business activities in China have gradually recovered since the epidemic weakened, consumer confidence remains sluggish. Both OEMs and Chinese operators are promoting 5G smartphones by lowering the prices of both 5G equipment and packages. This has pushed up the 5G penetration rate. In the second quarter, 1/3 of the smartphones sold in China were 5G phones, ranking first in the world. But this still cannot offset the downward trend of the entire market.

Top Smartphone Makers In China

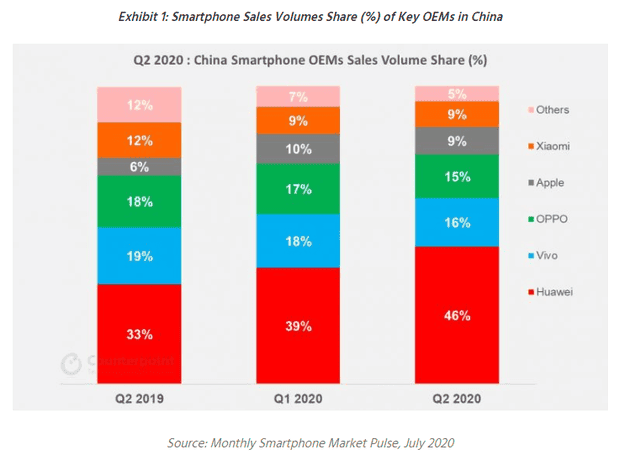

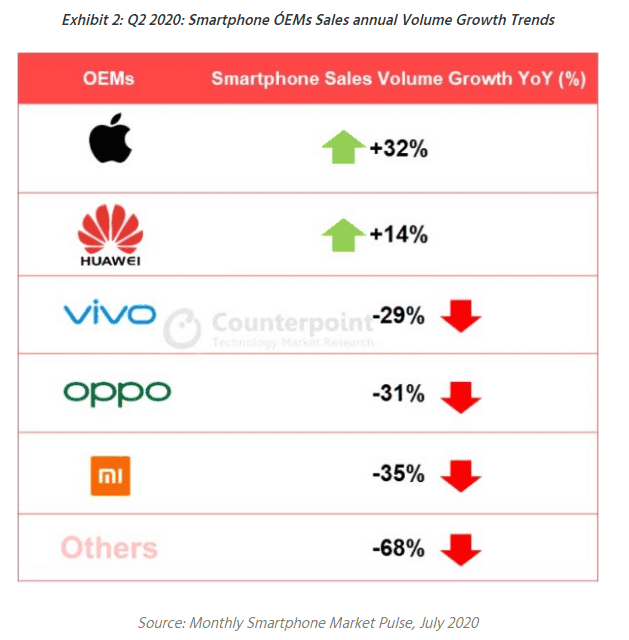

Huawei is still the dominant player in the Chinese smartphone market, with a market share of 46% in the quarter. Although the entire market has shrunk, Huawei has achieved a year-on-year growth of 14%. Interestingly, Apple’s growth rate was the fastest in the quarter, with a year-on-year increase of 32%.

June has also become the best month this year since the outbreak of the new coronavirus epidemic. Xiaomi’s sales surged 42% month-on-month, and Huawei’s sales were increased by 11%. If believing only the data of June, everything is getting better and better. So there is every reason to think, in the coming months, the smartphone market will recuperate soon.

In addition, although China’s overall smartphone market is shrinking, the 5G market is developing rapidly. In the second quarter, 33% of smartphones sold in China supported 5G technology, compared to only 16% in the first quarter. The ratio in June even exceeded 40%. HOVX (Huawei, OPPO, Vivo, Xiaomi) has a total of 96% of China’s 5G smartphone market share. Huawei’s share is as high as 60%, followed by Vivo, OPPO and Xiaomi.

Although China’s 5G smartphones are still dominated by mid-to-high-end products, they have gradually penetrated into low-priced products. Huawei dominates the high-end 5G smartphone market, while the four major HOVX manufacturers have a layout in the terminal market.