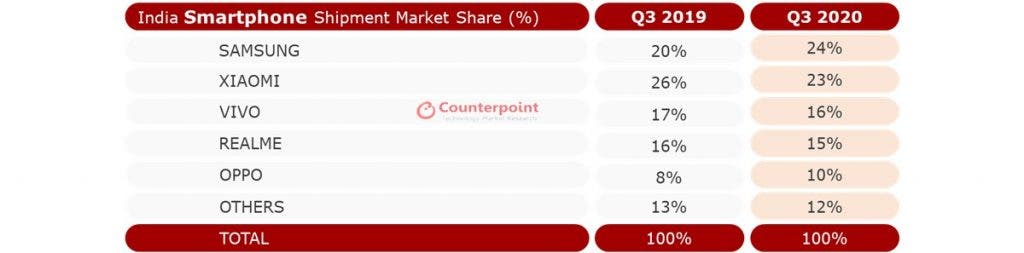

Back in the last year, Samsung decided to revive its struggling mid-range business with the Galaxy A and M series. These devices were eons beyond the old Galaxy Youngs, Primes and etc that for years made the company’s affordable phones less than interesting. With the A and M series, the company brought specifications that were only available in the Galaxy S or Note series. With better smartphones, the company conquered the user’s interest once again. Now, it seems that the company is doing pretty well in India to the point that it has reclaimed the lead of the smartphone business. According to Counterpoint Research, Samsung’s shipments grew 32% compared to Q3 2019, surpassing even the pre-COVID levels.

So far, smartphone makers shipped 54 million units in India this quarter. This represents a growth of 9% YoY. According to Senior Research Analyst Prachir Shing, the Indian smartphone market is walking across a recovery path. After all, the lockdown restrictions have been relaxed. However, most customers are still buying phones through online channels.

Xiaomi no longer reigns as the absolute leader of the Indian market and fell 4% year over year. However, analysts state that the strong sales of the Redmi 9 and Redmi Note 9 series will help the company to reclaim its position by the next quarter. In third place, we have Vivo with a strong demand for the Y-series smartphones. Realme, another BBK-owned brand, saw a 4% increase with a focus on the budget phones, mainly from the C-series. However, the company also saw a strong performance in its mid-range segment and achieved a 52% YoY boost in shipments thanks to phones. The Realme 6 and 7 series is quite successful in India. In fifth place, we have Oppo with a 30% YoY increase.

OnePlus is strong in the premium segment, but Apple still leads

According to Counterpoint Research, OnePlus remains a solid player in the “affordable premium” segment. The OnePlus 8 has been quite successful, but the OnePlus Nord is also achieving good results. The company’s premium mid-range phone is the best-selling device in its segment that covers devices between the INR 20,000 to INR 30,000 price tag. However, in the INR 30,000+ segment, Apple surpassed OnePlus with the iPhone SE (2020) and 11 sales. Now, the iPhone 12 should boost the company’s performance even further.

The companies in the feature phone segment also achieved a 5% YoY increase. This segment is lead by Itel. Samsung comes in second and is followed by Lava. For those unaware, Itel is part of the Transsion Holdings conglomerate being a sister company for Infinix and Tecno brands. Those companies saw a combined increase of 73% YoY. In Q4 2020, India will apply 10 Basic Custom Duty on display modules and touch panels. This will likely impact imported phones. However, Counterpoint states that this move will further solidify local manufacturing in India.

Now, getting back to the overall smartphone business, we are curious to see how Samsung will act to keep its lead and how Xiaomi will react to reclaim its position.

Follow Gizchina.com on Google News for news and updates in the technology sector.