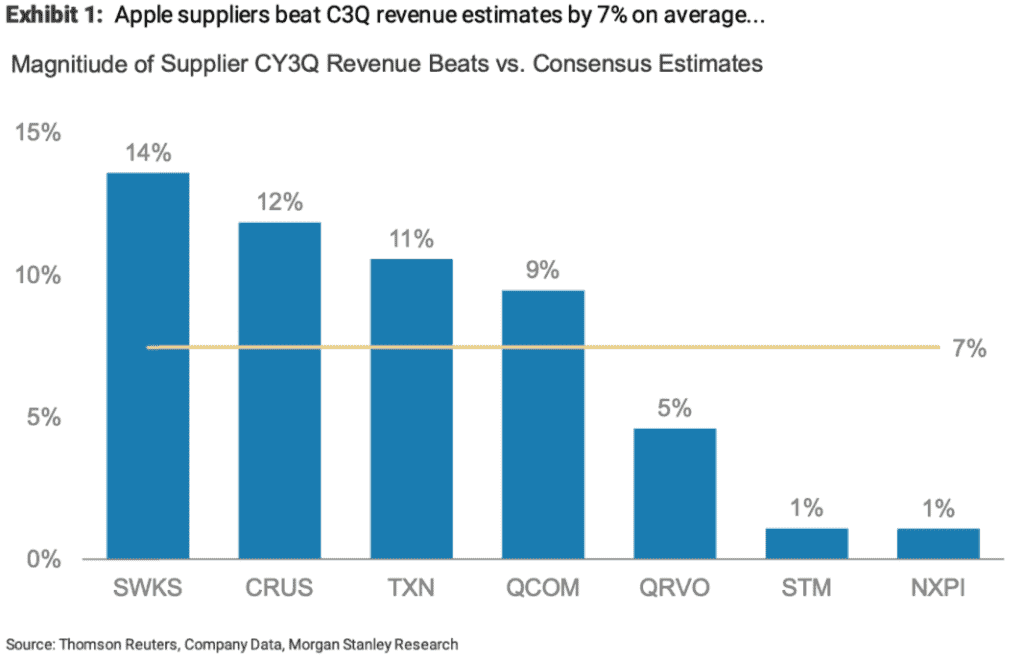

According to reports from Morgan Stanley, the iPhone 12 series is doing very well in the market. Information from the supply chain indicates that demand for iPhone 12 and iPhone 12 Pro is far stronger than expectations. Analyst Katy Huberty said, “Apple’s US suppliers in the past week’s revenue and profits were stronger than expected, which shows that iPhone 12 demand is strong”. Seven of Apple’s semiconductor suppliers, including Qualcomm, STMicroelectronics, and Texas Instruments, have all announced recent earnings. Their quarterly revenue growth exceeds market expectations by about 7%.

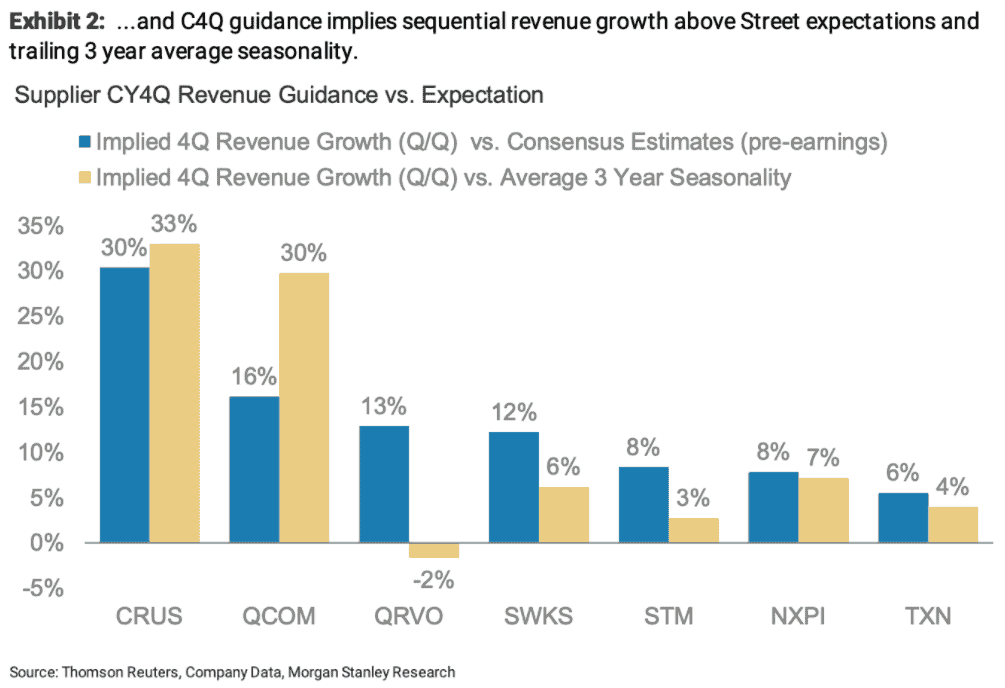

In addition, the quarterly revenue index released by the supplier is also higher than the average market expectation. This means that after three years of seasonal and flat growth, it finally ushered in a day of quarterly revenue growth of 12% year-on-year.

Huberty points out that the delayed release of the iPhone 12 mini and iPhone 12 Pro Max is also verifying this seasonal change. However, the supplier’s performance also indicates that the demand for the new iPhone truly exceeds expectations. For example, Qualcomm said that this revenue is higher than seasonal growth. Cirrus Logic said its revenue is far higher than its internal estimate of 12%.

The data also coincides with the increase in iPhone sales in December. Furthermore, there is a high demand for iPhones that are yet to hit the market. In China, JD.com reports that it has 1.47 million pre-orders for the iPhone 12 mini and iPhone 12 Pro Max.

Apple 12 series delivery cycle is high

Huberty believes that the delivery cycle of the iPhone 12 Pro is now at 25 days. This is the same as the situation last week and this is the longest cycle in the series. This causes the speculations that the demand for iPhones is high. Suppliers are struggling to meet up with the high demand and this is the reason for the long cycle. Considering the demand data and the long delivery cycle, analysts believe that the consensus forecast of 220 million iPhone shipments for the 2020 calendar year may not be accurate.

Huberty’s Apple target price is still $136 based on an enterprise value sales multiple of 5.9 times the Apple product business and an EV/sales multiple of 10.5 times the Apple service business. As a result, the EV/sales multiple in 2021 is 6.7 times, and the target P/E ratio for the year is 33.3 times. However, Apple’s stock market is still stable. As of yesterday, its closing price remains at $118.83.