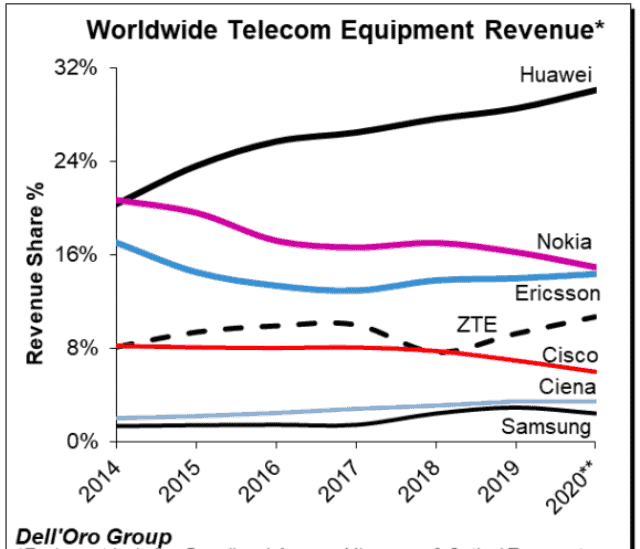

Chinese telecommunications equipment suppliers Huawei and ZTE have achieved an increase in their share in the global market. This growth is mainly driven by China, where the 5G network is actively deployed.

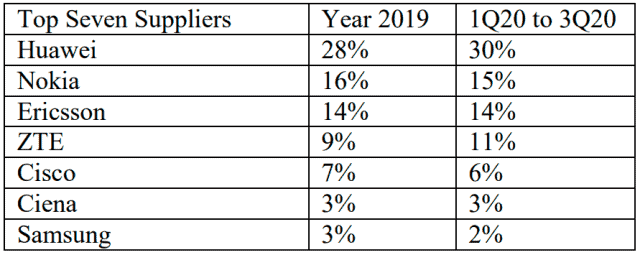

Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena and Samsung are the largest telecom equipment suppliers in the world. In the third quarter of this year, Huawei took first place and 30% of the global market. A year earlier, the company held 28%. ZTE also posted 2 percentage points growth from 9% in the third quarter of 2019 to 11% in the third quarter of this year.

Analysts note that the companies are actively supplying their equipment to Chinese mobile operators. China became one of the first countries to offer commercial 5G networks. Operators are working hard to increase the speed of 5G.

Over the same period, the shares of other major telecom equipment suppliers declined, according to a TelecomLead report. Nokia’s market share has decreased from 16 to 15%, Samsung now holds only 2% of the market, Cisco’s share has decreased to 6%.

Ericsson demonstrates stability: as in the previous year, the company occupies 14% of the market.

Huawei and Honor will occupy 4% and 2% of the smartphone market next year

A new forecast by research firm TrendForce says that independent company Honor, which no longer has anything to do with Huawei, will only be able to occupy 2% of the global smartphone market next year.

Of course, the sale of Honor will hit Huawei very hard, which is barely afloat under the pressure of US sanctions and their aftermath. If this year analysts give the company only 14% of the global smartphone market, then next year, according to the forecast, the company’s share will drop to 4%. With such results, the company will have to fight for a place in the top ten leaders, since they will definitely not be able to get into the top five.

US sanctions imposed on Huawei are limiting the company’s ability to procure required components; affecting Huawei’s ability to manufacture and market new smartphones. The sanctions were the main reason behind Huawei’s decision to sell its Honor brand.

Another Chinese company Xiaomi, according to the forecast, will significantly strengthen its position next year. TrendForce analysts make a modest forecast for Xiaomi’s share to increase from 12% to 14%. However, Xiaomi itself is much more optimistic and intends to sell from 240 to 300 million smartphones. Also, the company wants to get ahead of Apple and possibly compete for the top spot with Samsung.