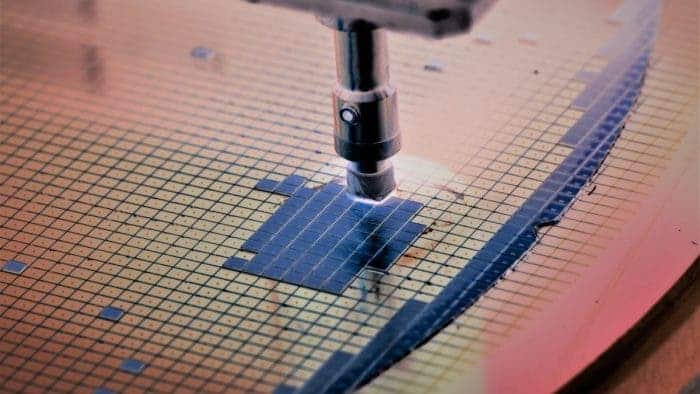

This year, the combined revenues of the three largest Taiwanese contract semiconductor manufacturers will grow by 17% to exceed $60 billion. This forecast is given by Digitimes Research experts.

Last year, TSMC, UMC and VIS earned $52.69 billion. In the fourth quarter of 2020 alone, these three manufacturers’ revenues hit a record $14.58 billion, up 4.4% year over year.

Growth is forecast to be 1.7% in the current quarter. This means that the listed companies will receive $14.83 billion. Analysts attribute the revenue growth to demand driven by measures to reduce the spread of coronavirus. Simply put, a massive shift to remote work and training. In addition, the increased demand for chips for automotive electronics and an increase in the average price of chips will be affected.

Capital investments of TSMC, UMC and VIS this year will total $28 billion, most of which will come from TSMC. According to Digitimes Research, the listed companies had a combined capex of $ 18.3 billion in 2020, reaching a record high.

Top 10 chip buyers – Apple leads, Huawei plunge, Xiaomi surge

A recent report from market research firm, Gartner, reveals the top 10 chip buyers in 2020. After returning to the number one position in 2019, Apple continued to maintain its lead, and its market share is now at 11.9%, further widening the gap with Samsung Electronics. However, Samsung is still in second place with a market share of 8.1%. In third place is Chinese manufacturer, Huawei with a market share of 4.1% while Chinese company, Lenovo is fourth with a market share of 4.1%.

After Lenovo, we have Dell and BBK Electronics (OnePlus, Oppo, Vivo, Realme, and iQOO brands) in fifth and sixth place respectively. These brands have a market share of 3.7% and 3.0% respectively. In the seventh position is an American company, HP with a 2.4% market share while popular Chinese manufacturer, Xiaomi, is in the eighth position with a 2.0% market share. Hon Hai (aka Foxconn) and Hewlett Packard Enterprise occupy ninth and tenth positions with market shares of 1.3% and 1.2% respectively.

In total, the manufacturers spent $449.8 billion on chips. This is a 7.3% increase from the $419.1 billion spent on the components in 2019. The top ten Original Equipment Manufacturers (OEM) increased their expenditure by about 10%. They collectively account for 42% of the total market, higher than 40.9% in 2019. The top ten chip buyers in 2020 remain the same as 2019.

Preliminary Ranking of Top 10 chip buyers

| 2020 Rank | 2019 Rank |

Company | 2020 Revenue |

2020 Market Share (%) | 2019 Revenue | 2019-2020 Growth (%) |

| 1 | 1 | Apple | 53,616 | 11.9 | 43,239 | 24.0 |

| 2 | 2 | Samsung Electronics | 36,416 | 8.1 | 30,247 | 20.4 |

| 3 | 3 | Huawei | 19,086 | 4.2 | 24,933 | -23.5 |

| 4 | 4 | Lenovo | 18,555 | 4.1 | 16,773 | 10.6 |

| 5 | 5 | Dell Technologies | 16,581 | 3.7 | 15,584 | 6.4 |

| 6 | 6 | BBK Electronics | 13,393 | 3.0 | 11,653 | 14.9 |

| 7 | 7 | HP Inc. | 10,992 | 2.4 | 10,729 | 2.4 |

| 8 | 8 | Xiaomi | 8,790 | 2.0 | 6,974 | 26.0 |

| 9 | 9 | Hon Hai Precision Industry | 5,730 | 1.3 | 5,816 | -1.5 |

| 10 | 10 | Hewlett Packard Enterprise | 5,570 | 1.2 | 5,561 | 0.2 |

| Others | 261,109 | 58.0 | 247,640 | 5.4 | ||

| Total | 449,838 | 100.0 | 419,148 | 7.3 |