After Tesla spent US$1.5 billion to invest in Bitcoin in January this year, the price of Bitcoin soared from US$38,903. According to CoinMarketCap’s record on February 19, the value of each Bitcoin price has reached US$55,000. More interestingly, the market value has exceeded the US$1 trillion threshold for the first time.

Another source, CoinGecko’s data shows that there are currently 18.53 million bitcoins issued globally, and bitcoin will reach a limit of 21 million in 2040.

CNBC quoted Jim Reid, a strategy researcher at Deutsche Bank, who pointed out that as companies or institutions begin to get involved in Bitcoin, the scale of Bitcoin has become large enough to establish its own demand.

At least, 9 listed companies around the world have purchased Bitcoin as assets. In addition to Tesla, the business analysis platform MicroStrategy holds 71,079 Bitcoins worth more than US$4 billion; the cryptocurrency bank Galaxy Digital Holdings has 16,402; Grayscale Investments holds 656,166; CoinShares has 69,730; Ruffer Investment Company has 45,000; and 3iQ has 22,590.

Not only the aforementioned emerging industries or investment banks, but even the Bank of New York Mellon, established in 1784, announced in mid-February that it would provide financing services for cryptocurrencies including Bitcoin. Gradually recognized by large institutions, Tesla plans to allow consumers to buy cars with Bitcoin in the future.

Although there are still many financial organizations who are skeptical of it and believe that its prospects are unclear, it is undeniable that this cryptocurrency, which is embraced by investors and is highly growing, cannot be ignored.

Is Bitcoin Reliable?

However, Tesla also warned that the value of digital assets may continue to be highly volatile, which brings risks and uncertainties. In addition, it is an emerging trend and it is impossible to predict the acceptance of investors, consumers or companies. The lack of physical form, and the reliance on various establishment and transaction verification technologies, or the decentralized nature, may be maliciously attacked or face technical obsolescence problems. This may cause financial damage to the company.

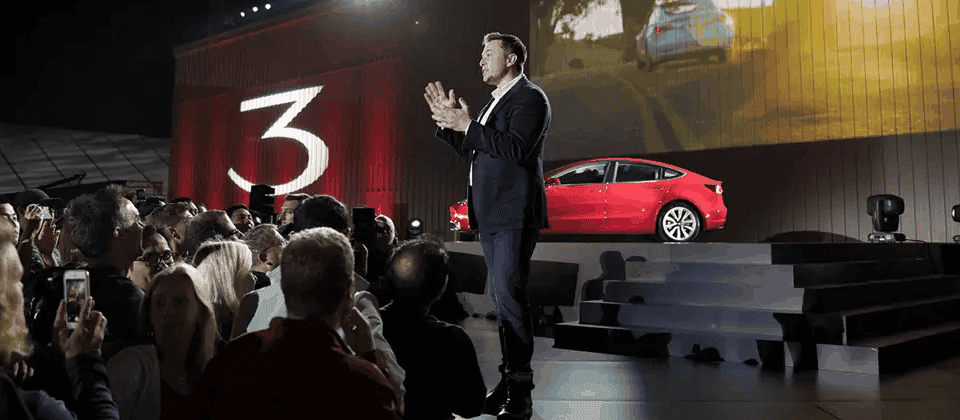

Tesla founder and CEO Elon Musk has never hesitated to publicly support cryptocurrencies. He added the hashtag #bitcoin to his Twitter profile at the end of January. It caused Bitcoin to rise by 15.5%. A Dogecoin, established in 2013, was also fueled by Musk. It rose from about $0.003 in November last year to $0.82 this week, an increase of 2723%.