According to a recent Canalys report, there are some changes in the top five rankings for smartphone manufacturers. The report looks at the second quarter of this year. According to Canalys, the major change is that Xiaomi’s market share is 17%. However, the interesting part is that it now ranks second in the world, ahead of Apple. This is an unprecedented achievement for Xiaomi, and it is gratifying. Lei Jun also stated in the open letter that for the first time “we stand at this height, we will face a fierce and anxious tug-of-war in the future”.

Xiaomi’s CEO is confident that the company can secure the second position globally. However, what are the major drivers to Xiaomi’s rise to the second position? There are many reasons why Xiaomi won second place in the world. The most obvious reason is the exit of Huawei from the global smartphone market. Xiaomi took advantage of this, especially in Europe.

The market situation shows that Huawei’s withdrawal gives other Chinese mobile phones room for growth. Oppo, Vivo, Xiaomi, and other brands are seeking prudent strategies to enter the mid-end and high-end market segments. Their target is to use good 5G smartphones to penetrate the European market. Of course, there is no hiding the fact that Samsung and Apple are still leaders in the European 5G market.

Smartphone shipment will rebound in 2021

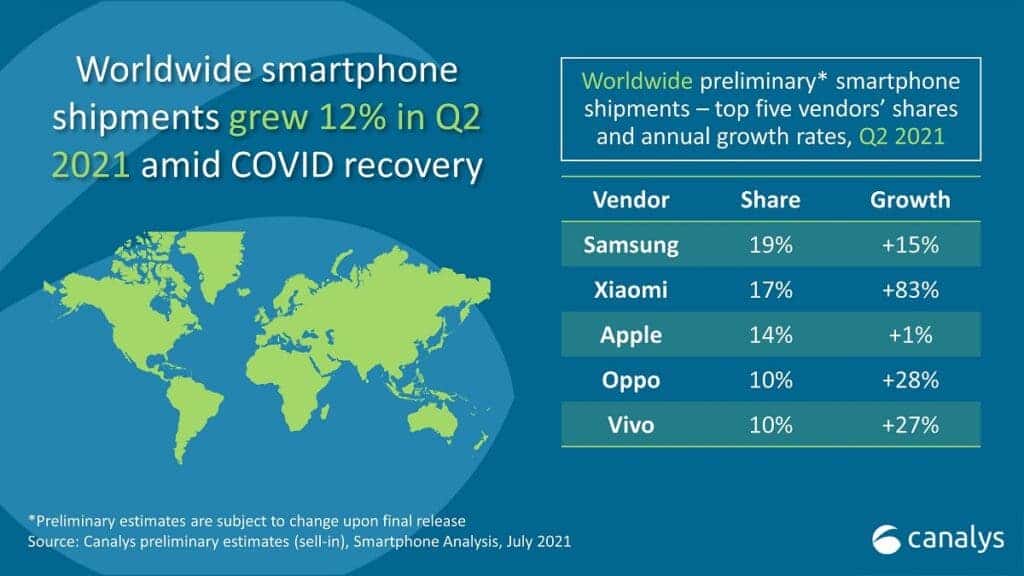

Canalys’ previous report on the global smartphone market shows that the global smartphone market will grow by 12% in 2021. In terms of shipment, there will be about 1.4 billion smartphones this year. The report pointed out that compared with 2020, smartphone shipments have achieved a strong recovery. Last year, smartphone shipments fell by 7% due to the severe restrictions on the market.

As Canalys Research Manager Ben Stanton says, “The smartphone industry’s resilience is quite incredible. Smartphones are vital for keeping people connected and entertained. And they’re just as important inside the home as outside. In some parts of the world, people have been unable to spend money on holidays and days out in recent months. So many have spent their disposable income on a new smartphone instead. There is strong momentum behind 5G handsets. They accounted for 37% of global smartphone shipments in Q1. Also, they should account for 43% for the full year (610 million units). This will be driven by intense price competition between vendors, with many sacrificing other features, such as display or power, to accommodate 5G in the cheapest device possible. By the end of the year, 32% of all 5G devices shipped will have cost less than US$300. It is time for mass adoption.”