JPMorgan Chase, an American multinational investment bank sued Tesla on Monday, accusing it of failing to pay the warrant transactions in accordance with the contract. The investment bank is demanding compensation of more than $162 million. According to the indictment, Tesla sold warrants to JPMorgan Chase in 2014. These warrants expired in June and July 2021. Initially, the “exercise price” agreed by the two companies was $560.6388. If Tesla’s stock price is higher than the exercise price when it expires, JPMorgan Chase stated that Musk’s company should basically hand over the difference between these prices.

Elon Musk tweeted on August 7, 2018, to threaten to take Tesla private, which was tantamount to a major corporate transaction that gave the bank the right to adjust the exercise price of the warrants. The bank later lowered the exercise price. The price thus maintains the same fair market price as before the announcement. After 17 days, Tesla abandoned the privatization transaction, and JPMorgan Chase adjusted the exercise price again to reflect the rise in stock prices.

However, Tesla’s stock price rose nearly 10 times when the warrant expired. JPMorgan Chase said that according to the contract, Tesla must deliver stock or cash. The lawsuit states that the adjustments made by JP Morgan Chase were appropriate and required by the contract. However, Tesla refused to settle at the contract exercise price and paid the amount owed to JP Morgan Chase in full, blatantly breaching its contractual obligations. Therefore, Tesla must immediately pay more than $162 million due to JPMorgan Chase.

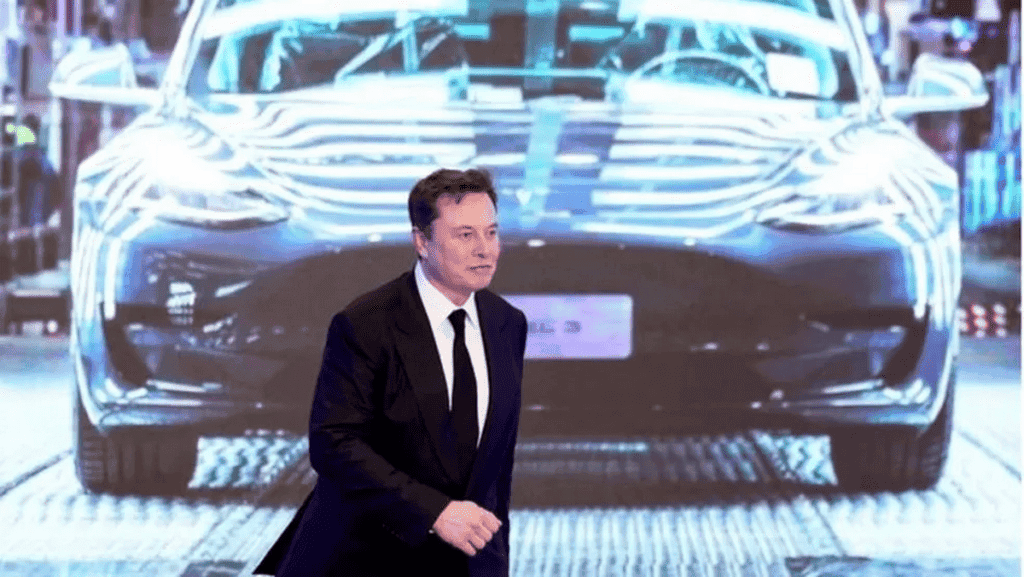

Elon Musk sold $7 billion worth of Tesla shares last week

A recent document from the US Securities and Exchange Commission (SEC) shows that on Friday, Elon Musk sold 1.2 million Tesla shares again. He takes home over $1.2 million from the sales. This part of the stock is held by Musk’s trust fund. Affected by this, Tesla fell more than 15% this week, the largest weekly decline since March 2020. Furthermore, its market value evaporates by $189.5 billion last week. On Friday, Tesla shares closed at $1033.42 per share. Since the beginning of this year, Tesla’s stock price has risen by more than 46%.

This is the latest in a series of stock transactions that Musk has conducted this week. The SEC’s previous documents show that Musk’s trust fund sold 4.434 million shares on November 9. The value of these shares is approximately $5 billion.

On November 11, Musk sold 639,737 shares worth approximately $680 million through multiple transactions. In addition to the 1.2 million shares sold on November 12, Musk sold a total of about 6.36 million Tesla shares last week, with a total value of nearly $7 billion.

As of November 10, after Musk sold $5 billion in Tesla shares, he was still Tesla’s largest single shareholder, holding approximately 15.5%. In contrast, Amazon founder Jeff Bezos holds approximately 14% of Amazon’s shares, while Mark Zuckerberg owns approximately 14% of Facebook’s parent company, Meta.