The chip shortage issue is of global concern and it’s affecting the production of some devices. As of now, there is no solution in sight. We may have to live with chip shortages throughout next year. Tesla told employees that supply chain issues are now affecting its solar panel business. In the past year, there have been many talks about the supply chain issues affecting Tesla’s automotive business. However, no one knows the impact of chip shortages on the solar panel business. According to Electrek, an e-mail sent by Tesla to employees in the solar business last week told them to postpone some installations.

The email partly reads

“We confirmed with the supply chain team that some current supply constraints will affect the capacity of photovoltaic retrofit installation”.

Tesla expects that installations this quarter will be affected by 3 ~ 4MW (megawatts). The company also claims that some solar panel installations may need to be rescheduled at the end of next month. Earlier this year, Tesla launched a new and larger solar panel with a capacity of 420W. Tesla also made several major adjustments to its solar business, such as discontinuing its subscription business. The company currently provides its complete solar and energy products -“Tesla Energy Ecosystem” to third-party installers.

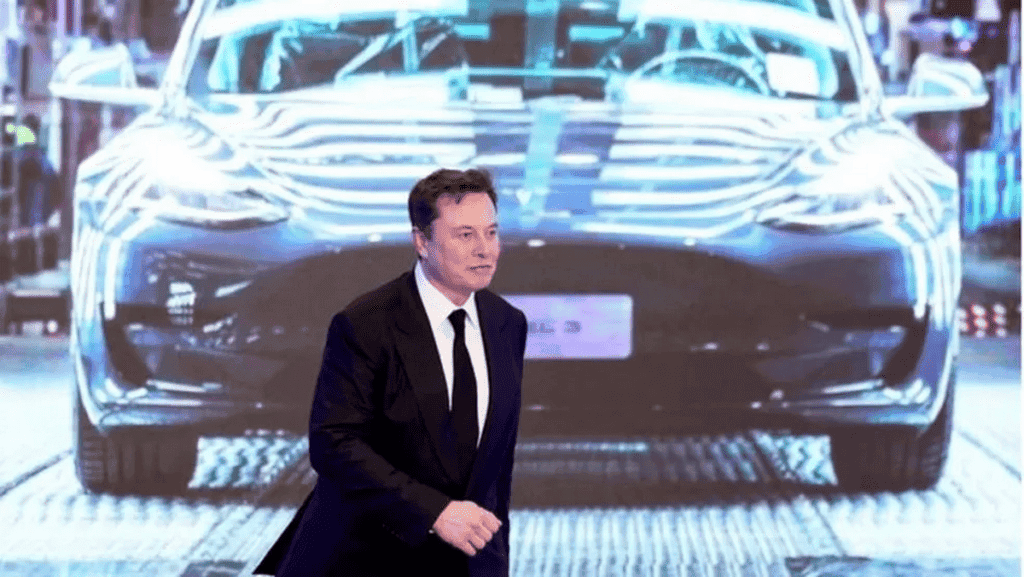

Elon Musk sold $7 billion worth of Tesla shares last week

A recent document from the US Securities and Exchange Commission (SEC) shows that on Friday, Elon Musk sold 1.2 million Tesla shares again. He takes home over $1.2 million from the sales. This part of the stock is held by Musk’s trust fund. Affected by this, Tesla fell more than 15% this week, the largest weekly decline since March 2020. Furthermore, its market value evaporates by $189.5 billion last week. On Friday, Tesla shares closed at $1033.42 per share. Since the beginning of this year, Tesla’s stock price has risen by more than 46%.

This is the latest in a series of stock transactions that Musk has conducted this week. The SEC’s previous documents show that Musk’s trust fund sold 4.434 million shares on November 9. The value of these shares is approximately $5 billion.

On November 11, Musk sold 639,737 shares worth approximately $680 million through multiple transactions. In addition to the 1.2 million shares sold on November 12, Musk sold a total of about 6.36 million Tesla shares last week, with a total value of nearly $7 billion.

As of November 10, after Musk sold $5 billion in Tesla shares, he was still Tesla’s largest single shareholder, holding approximately 15.5%. In contrast, Amazon founder Jeff Bezos holds approximately 14% of Amazon’s shares, while Mark Zuckerberg owns approximately 14% of Facebook’s parent company, Meta.