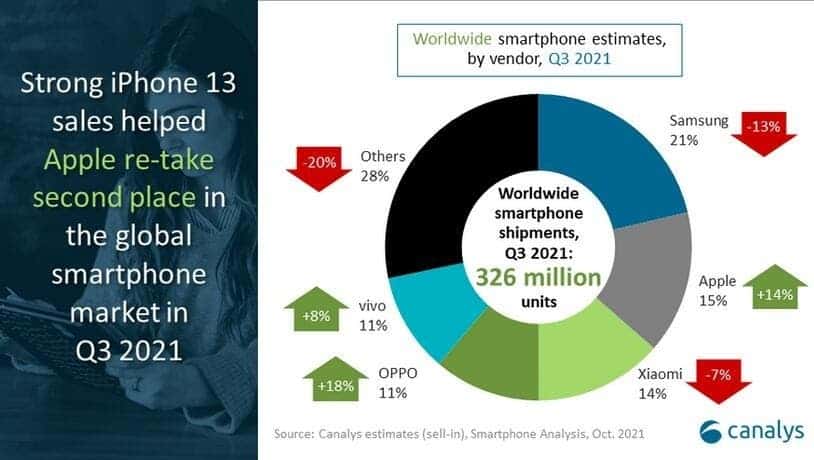

The global smartphone market is very competitive and major smartphone brands are on high alert. Popular market research firm, Canalys recently released the statistics on the global smartphone market for the third quarter of this year. The report shows that due to the shortage of chips, the global smartphone shipment in Q3 2021 will be 320 million units. This is a 6% decrease relative to the previous quarter. However, Samsung is still far ahead with shipments of 69.4 million units. The South Korean manufacturer accounts for 21% of the market share.

Apple ranks second with shipments of 49.2 million units, an increase of 14%. In the third position, we have Xiaomi with shipments of 44 million units and a 14% market share. The gap between Xiaomi and Apple in the global market is not very big.

Canalys Research Analyst Le Xuan Chiew said: “iPhone 13 has a good start. The pre-orders are high. Unlike last year, Apple can make full use of the power of its retail stores to promote sales. For iPhone users who have used it for 2 to 3 years, they will want to upgrade. They have better cameras, battery life, and of course 5G.”

iPhone 13 series has a huge impact

However, it is important to note that the iPhone 13 series brought very fierce growth momentum for Apple. Apple has notified the iPhone supply chain to increase its shipment target in the first half of 2022 by 30%. This will increase the total annual iPhone shipments to over 300 million units for the first time. In fact, due to chip shortages, Apple had to discontinue the production of iPads and older iPhones to create space for the iPhone 13 series.

In the first half of this year, Apple’s shipment target is 130 million units. This value will increase to 170 million units after an increase of 30% next year. Thanks to the substantial increase in sales expectations, Apple’s stock price has risen all the way recently, and it has reached a market value of $294 million, a new record high.

In fourth and fifth positions, we have Oppo and Vivo with 11% market share each. These companies have been quite consistent over the years. However, it appears that they are not doing enough to push Xiaomi in the global market. In China, however, their performance is much better. With Huawei out of the global and Chinese smartphone market, there is now opportunities for the likes of Xiaomi, Oppo and Vivo. These companies are making good use of Huawei’s exit and are climbing up the ladder in the global smartphone market