Recently, CounterPoint released its latest report concerning the Indian smartphone market. It turns out the shipment of the mobile phone in India grew 11 percent year over year and reached 169 million units in 2021. What’s interesting, in the last month of the past year, the sales dropped by 8 percent year over year because of supply issues. Do you imagine what results India could show if there was no chip shortage problem?

In this regard, Senior Research Analyst Prachir Singh said, “The Indian smartphone market witnessed high consumer demand in 2021, making it the best-performing year. This feat came in a year that witnessed supply constraints due to a multitude of reasons – a second and more virulent COVID-19 wave, global component shortages, and price hikes due to these shortages. The high replacement demand fuelled by increasing smartphone affordability in the mid and high-price tiers due to promotions and discounts, as well as better financing options, led to an 11% YoY growth in 2021. The demand outstripped the supply in the last two quarters of 2021. During Q4 2021, the smartphone market declined 8% YoY. We expect the supply situation to get better going forward and reach normalcy by the end of Q1 2022.”

Other than that, the overall mobile handset market grew 7 percent year over year in 2021. Samsung is the absolute leader with a market share of 17 percent. Interestingly, the feature phone shipments reached 86 million. Thus, the growth curve remained almost flat. But here is another leader, itel. It took 24 percent of the market. Not surprisingly, this brand has been leading this segment for two consecutive years. It is followed by Lava, Samsung, and Jio.

Commenting on the competitive landscape and pricing, Research Analyst Shilpi Jain said, “India’s smartphone market retail ASP (average selling price) grew 14% YoY in 2021 to reach its highest ever at $227. The price hikes in the budget segment due to component price rise, increasing focus of OEMs on the premium segment, and increased demand for mid-range and premium smartphones due to increasing uses and availability of financing options contributed to the increasing ASP. This resulted in the Indian smartphone market revenue crossing $38 billion in 2021, registering a growth of 27% YoY.”

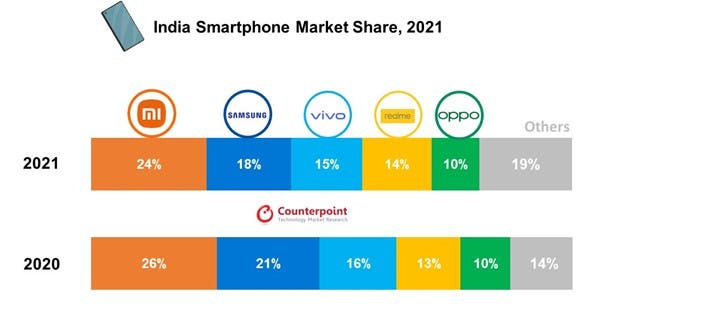

Top Brands In Indian Smartphone Market In 2021

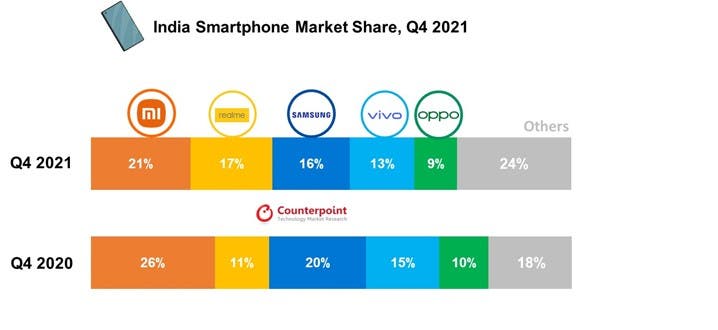

On the top position, we still can see the Chinese Xiaomi. The latter grew 2 percent year over year. Again, because of chips and other components shortage, Xiaomi couldn’t grow more. However, in the premium smartphones niche (>INR 30,000, ~$400), Xiaomi’s growth reached 258% in 2021. In this segment, the Xiaomi Mi 11x series has no equals.

Samsung is still in second place. It grew 8 percent year over year. Due to some noteworthy reasons, such as supply chain disruptions and the absence of the new Note series, customers were mainly looking for low-end Samsung phones. This hugely affected the company’s reputation and sales. But in the 5G smartphones segment, Samsung led the list in Q4 2021. The Korean company also led the INR 20,000-INR 45,000 (~$267-$600) segment with a 28% share. And finally, its folding screen smartphone sales grew 388 percent year over year in 2021.

Vivo ranked third. Unlike Samsung which only topped the list in the fourth quarter only, VIVO has become the best 5G smartphone brand in 2021 with a 19% share. Its growth rate in the Indian smartphone market is 2 percent year over year. It’s correlated with a strong performance of its Y series and V.

Realme is the fourth. Moreover, among the top five brands in the Indian smartphone market, it was the fastest-growing in 2021 with a 20 percent rate. In the fourth quarter, it also took second place. This is unprecedented for Realme. However, there is a “trick” to how Realme could outrun many of its competitors. In the peak period of chip shortage, it switched to ‘Unisoc’. Of course, this is not the only factor helping the company in getting a bigger market share. We mean it also released the much-popular premium ‘GT series’ and generated high demand for its C series and Narzo series. Other than that, Realme is working hard to enter the 5G smartphones field priced above INR 15000 (~$200) as well as the ultra-premium segment.

The latest brand in the top five Indian smartphone brands is OPPO. It had 6 percent YoY growth. Now, this company is offering more mid-range and top-end models rather than low-end smartphones. In the premium smartphones niche, it was the fastest-growing brand in 2021.

Lastly, though Apple was considered to be one of the fastest-growing brands in 2021 with 108% YoY growth, it still can’t outrun Xiaomi and Samsung. Although in the premium segment (>INR 30,000, ~$400), its market share reached 44 percent.