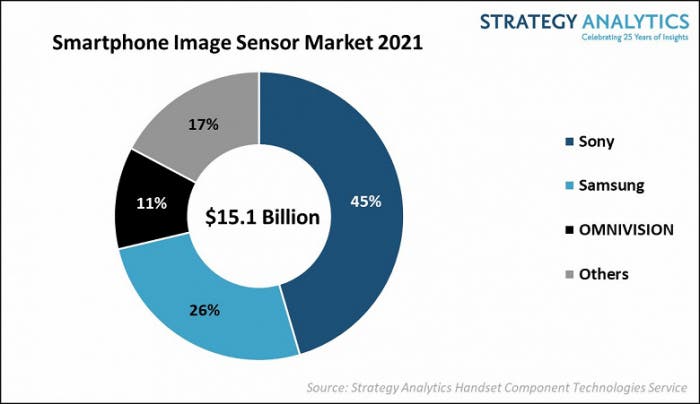

Along with the increase in the number of cameras in smartphones, the image sensor market is also growing. According to analysts at Strategy Analytics, at the end of 2021, the image sensor segment grew by 3% and reached $15.1 billion.

The global smartphone Image sensor market in 2021 secured a total revenue of $15.1 billion; according to the Strategy Analytics Handset Component Technologies service report.

In fact, this market was divided among themselves by three companies, which accounted for 83% in terms of money. It is quite predictable that Sony is in the lead here, which controls 45% of the image sensor market. Samsung System LSI managed to get 26% of the profit from the sale of sensors. In third place was OmniVision with an 11% profit share in the image sensor segment. The remaining 17% came from other manufacturers, but they do not affect the balance of power in the market.

The image sensor market

Strategy Analytics finds that the smartphone image sensor market witnessed a revenue growth of more than 3 percent year-over-year in 2021. Sony Semiconductor Solutions topped with 45 percent revenue share followed by Samsung System LSI and OMNIVISION in 2021. The top three vendors captured nearly 83 percent revenue share in the global smartphone image sensor market in 2021. In terms of smartphone multi-camera application, Image sensors for Depth and Macro application reached 30 percent share; while those for Ultrawide application exceeded 15 percent share.

Jeffrey Mathews, Senior Analyst at Strategy Analytics says, “Smartphone OEMs continued to embrace the multicamera applications as well as the adoption of high-resolution CIS across device tiers. Sony expanded the supply of custom CIS products across leading premium smartphones while Samsung and Omnivision saw demand for high-resolution CIS products. We note image sensor vendors are introducing new CIS products featuring high-resolution specifications for smartphone ultrawide camera application.”

Analysts also concluded that the growth of the market is due to the increase in the number of sensors in smartphones. Moreover, manufacturers are most actively buying useless stub modules for macro photography and depth analysis. These sensors accounted for 30% of the total volume of all supplied sensors. As for wide-angle sensors, their share was just over 15%.

Stephen Entwistle, Vice President of the Strategic Technologies Practice at Strategy Analytics commented, “Large format and high-resolution image sensors will be a key area of growth as OEMs aim to apply superior camera capabilities within smartphones. However, demand continues to be influenced by the CIS inventory as well as the supply shortages for smartphone components.”