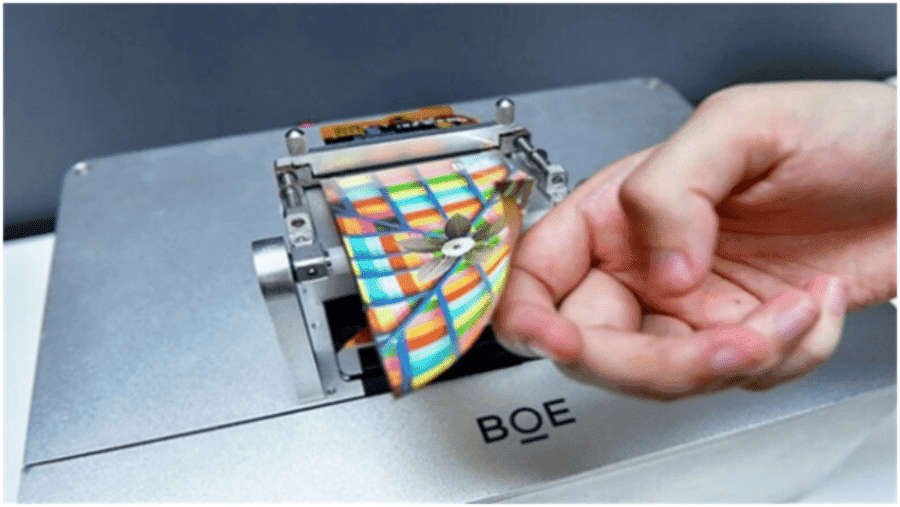

Chen Yanshun, chairman of BOE, said that the company has been actively expanding the production capacity of OLED panels for smartphones. According to him, the company has a goal of shipping more than 100 million units in 2022. Chen Yanshun claims that BOE will ship nearly 60 million OLED panels in 2021. It will have a global market share of 17%, making it the world’s second-largest OLED manufacturer.

BOE expects that its two OLED panel production lines in western China will be fully operational by the end of 2022. In addition, the third production line in central China is currently testing products. According to reports, Samsung Electronics plans to purchase 3.5 million OLED panels for smartphones from BOE in 2022, and another 3 million from CSOT.

In addition, BOE will supply Apple with 31 million OLED panels for the iPhone in 2022. However, Samsung Display will supply 140 million and LG Display will supply 55 million. According to industry sources, CSOT is evaluating the feasibility of investing in the construction of a dedicated production line for OLED panels for iPhones, and a decision is expected to be made in the second half of 2022.

According to the report, China’s smartphone suppliers mostly use OLED panels from Chinese manufacturers. BOE has provided OLED panels for the Magic 3 and Magic V smartphones launched by Honor. The company is also the exclusive supplier of the Honor Magic 4 and Magic 4 Pro. Huaxing Optoelectronics provides OLED panels for Xiaomi 12, 12 Pro and 12X.

Furthermore, Visionox has partnered with several Chinese smartphone vendors, including Honor, Xiaomi, Oppo, ZTE, Huami and Nubia. Global smartphone demand in 2022 will be lower than in 2021. Nevertheless, the demand for OLED panels will remain strong as they are used in mid-range and high-end models, said Gao Wenbao, vice president of BOE.

Samsung withdraws from the LCD market

Several Chinese panel manufacturers have surpassed Samsung and LG to become the main LCD panel manufacturers in recent years. Korean companies are no longer able to compete. Samsung will stop the production of LCD panels half a year ahead of schedule. Samsung originally planned to stop the production of LCD panels by the end of 2020. However, the LCD panel market started to increase prices in the past year or so. This made Samsung’s LCD factory continue to operate for another two years. However, the company originally plans to exit the market at the end of 2022. Nevertheless, the LCD panel market has changed since the end of last year. The price has been falling significantly and it is now on a free fall. By January this year, the average price of a 32 -inch panel was only $ 38, a 64% drop relative to January last year.