A few days ago, the Semiconductor Industry Association (SIA) released the 2020 version of the Factbook. The report shows the strength and prospects of the US semiconductor industry with more details. There are a couple of major players in the global semiconductor industry. The U.S., South Korea, Japan, Taiwan and parts of Europe all have a major voice in this market. We can not also ignore the rapid growth and development of the Chinese semiconductor market. However, the U.S. is clearly dominating the global semiconductor market. This is why certain pronouncements from the U.S. government affect other companies.

For instance, TSMC can not produce Huawei’s chips because the U.S. government says so. Why? This is because TSMC uses some U.S. technologies in the production process. If the U.S. takes away these technologies, TSMC, a Taiwanese company will face troubles. Let us now take a look at the five major aspects where the U.S. dominates

1. Global Share

In the 1980s, the global market share of the US semiconductor industry suffered a significant decline due to the impact of Japan. However, by 1997, the United States regained its leadership with more than 50% of the global market share. Well, since that time, the U.S. is not losing grip on this position. Today (2021), the total global market share of US semiconductor companies is 46%, the highest in the world. The second highest is South Korea with a total market share of 21%.

The European continent is not so keen on the semiconductor market. Thus, despite its huge size with 44 countries, it collectively has just 9% and this is even including Japan. While Taiwan manages 8% of the global semiconductor market share, China has 7%. Sales of US-based semiconductor companies will grow from $71.1 billion in 2001 to $ 257.5 billion in 2021. This is a significant increase and a compound annual growth rate of 6.65%.

2. Manufacturing process

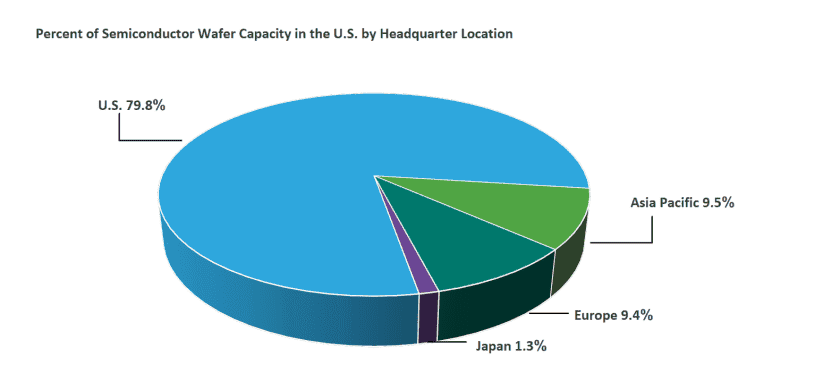

Most of the semiconductor manufacturing in the United States is completed by American companies. The data shows that in 2021, 79.8% of the semiconductor wafer manufacturing capacity in the United States will come from companies headquartered in the United States. Semiconductor companies with headquarters in the Asia-Pacific region account for 9.5% of U.S. domestic production capacity, as shown in the chart below:

Among them, US-based semiconductor companies have localized 43% of front-end manufacturing. However, the total global share of US semiconductor manufacturing has declined by more than 10% in the past eight years.

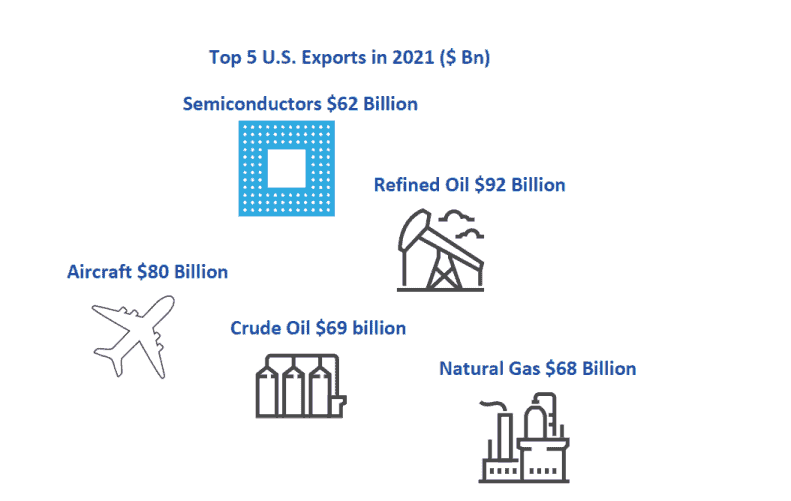

3. Export

U.S. semiconductor industry exports will total $62 billion in 2021. It is the fifth-largest U.S. export after refined oil, aircraft, crude oil, and natural gas. Of all electronics exports, semiconductors account for the largest share of U.S. exports. So long as the U.S. continue to have such major export, it will control the industry. Once you are not on good terms with the U.S., it will simply block its export and isolate you.

4. Research and development and expenditure

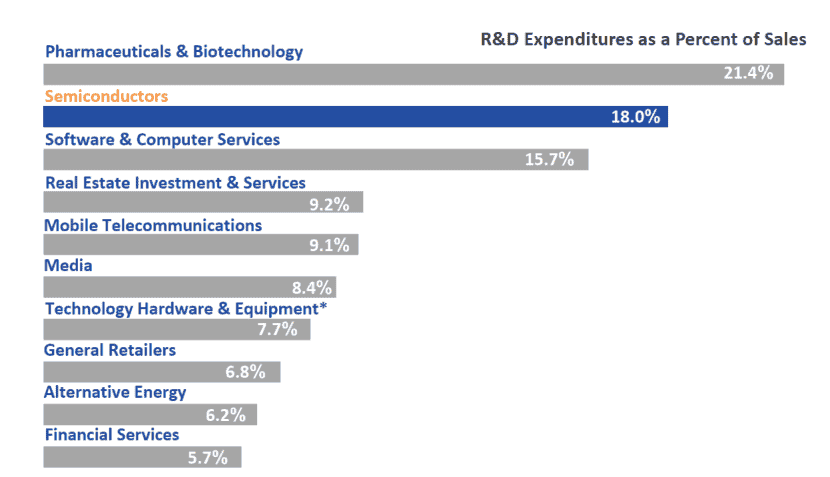

In 2021, U.S. semiconductor companies, including fabless, will spend $90.6 billion in R&D and capital spending. Among them, the total investment in research and development is $50.2 billion, with a compound annual growth rate of about 5.9% in the past two decades. Total investment per employee, as measured by total investment in research and development, new plant and equipment, grew to a record $206,000. The U.S. semiconductor industry is second only to the pharmaceutical and biotech industries in terms of R&D spending as a percentage of sales (18%), which is well ahead of China at 7.6% and Taiwan at 11%.

5. Employment and productivity

According to the SIA report, the number of talents directly involved in the semiconductor industry in the United States is 277,000. However, for every semiconductor person, 5.7 other jobs can be pulled. It means that the semiconductor industry creates 1.6 million jobs in the U.S.

Chinese semiconductor market is growing rapidly

Yole, a well-known semiconductor analyst firm, released its latest analysis of the global packaging market last year. It also provides insights into the growth rate of emerging and mature markets, capacity, capital expenditure and supply chain.

Gabriela Pereira, semiconductor, memory and computing technology and market analyst and packaging team member at Yole, said: “2021 is an important year for the advanced packaging industry, with ASE continuing to dominate the market, followed by Amkor. Intel maintains third place followed by Changjiang Electronics Technology and TSMC. In addition, the year-on-year revenue growth in 2021 is higher than that in 2020. Also, the fastest-growing Outsourced Semiconductor Assembly and Test (OSATs) are mainly from mainland China.”

The global advanced packaging market will also have total revenue of $32.1 billion in 2021. Furthermore, it is expected to grow at a CAGR of 10% by 2027, with total revenue of $57.2 billion. Megatrends including 5G, automotive infotainment/advance driver assistance systems, artificial intelligence, data center and wearable applications continue to drive the development of advanced packaging.

OSATs are increasing their revenue

The analysis points out that 2021 is an important year for advance packaging. Furthermore, the top three OSATs have increased their revenue by 20% year-on-year this year.

Stefan Chitoraga, a technology and market analyst specializing in packaging and assembly at Yole, said: “The major OSATs reported revenue growth of 15% to 26% year-over-year in Q4 2021 and 1% to 15% quarter-on-quarter. Rising costs and increased consumer interest in thinner and lighter electronic devices have led OSATs to see value opportunities in advanced packaging.”

Leading OSATs are operating at full packaging capacity and many product lines are still facing capacity constraints. This will continue until 2022. In addition, IDM’s packaging outsourcing continues to accelerate, especially for more advanced products. Their investments are more focused on front-end manufacturing expansion. All in all, OSAT is slowing the expansion of its wire-bonding capacity.

Yole’s quarterly market monitoring report for advanced packaging also lists companies with the largest revenue growth within the OSAT ecosystem in mainland China. Payton Technology, Suzhou Jingfang Semiconductor, Qizhong Technology, China Resources Microelectronics and Yongsi Electronics are leading the way. The government has been investing heavily as it looks to grow and strengthen regional semiconductor development and supply. The top three semiconductor packaging and testing companies in mainland China are among the top ten globally. They account for 85% of the top ten OSAT revenue in China in 2021.