Earlier today, Counterpoint Research released an interesting report concerning Xiaomi’s performance in the first quarter of 2022. According to the market research company, Xiaomi users crossed the 500-million mark. Thus, it is on the same line with such players as Samsung and Apple.

A large Xiaomi user base will allow the company to design more products, give chance for better monetizing the brand, and sell more IoT products.

Further reading: Xiaomi Sold Over 190 Million Smartphones In 2021, Ranking First In Many Markets

However, it’s more interesting to take a look at the company’s performance in various niches and understand how this brand could take its recognition to a new level. If you remember, 10-11 years ago, Xiaomi has been considered to be a budget smartphone maker. Plus, it could monetize the brand in select markets only, such as China. Now, this China-based firsts-tier smartphone maker has found the key to success in many other regions, such as India. In those markets, Xiaomi not only sells smartphones but also offers various services (fintech, e-commerce, etc.) and IoT products.

Xiaomi Users and Markets

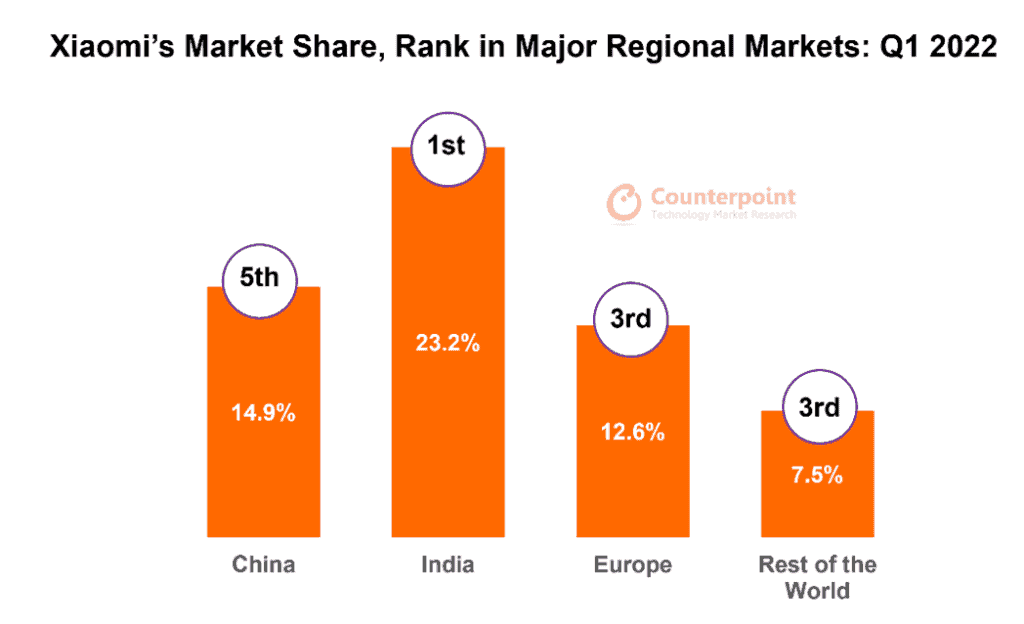

Huawei has been trying to capture a larger market share in the US and other similar markets. Xiaomi decided not to follow Huawei’s steps and focused on other regions. When saying this, we mean Europe, Africa, and many South Asian countries. Among them, India has played an important role. It is among the top three biggest OEMs in Q1 2022.

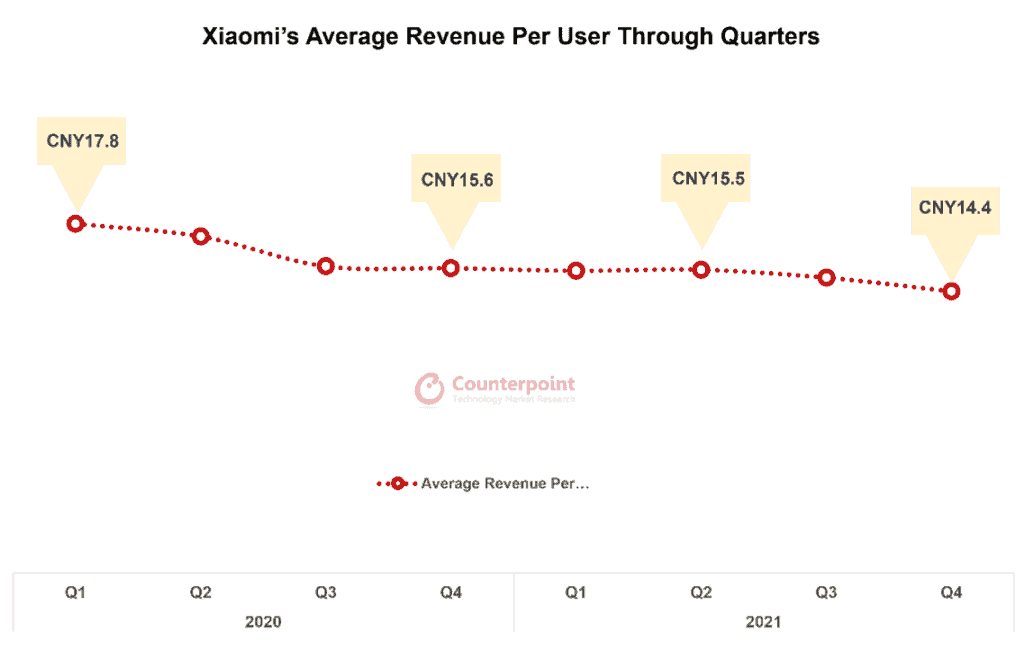

As for a detailed introduction, Xiaomi’s “internet service” reached RMB 28.2 billion ($4.16 billion) in 2021. At the same time, in the report, we can see that Monthly Active Xiaomi users (MIUI users) reached 508.9 million in December 2021. These two have been showing stable growth during the past few years. But the average revenue per user (ARPU) continues to decline.

For instance, Xiaomi’s ARPU in China is much higher. Moreover, in the premium smartphone niche, ARPU is much higher than that for lower-end smartphones. However, there is a logic behind this. Xiaomi has been focusing on the Chinese flagship smartphone market more rather than other regions. So if the company continues running the same strategy, China’s premium smartphone users could further help Xiaomi subsidize overseas sales channels.

As for numbers, Xiaomi has reported that over 80% of its internet service revenue comes from China. Ads are the main source of revenue. However, in other markets, where Google has a dominant role, Xiaomi can’t make any competition. So in all those non-Chinese markets, Xiaomi should develop a new approach to monetization. Counterpoint thinks that the “company might try fintech, e-commerce and other services that could leverage its MIUI in combination with its other consumer IoT products.”

Xiaomi IoT Ecosystem

We know that besides smartphones, Xiaomi runs multiple sub-brands that design various IoT products for it. Moreover, in many markets, Xiaomi has no rivals. For instance, in India, Xiaomi was the biggest OEM in 2021 with a shipment share of 24.1%. But there are some segments, where Xiaomi’s performance is relatively weak. Say, smartwatch and TWS shipments dropped a lot.

Anyway, in this region, Xiaomi runs a value-for-money strategy. Honestly, it helps the company to easily win customers’ hearts. In this sense, we have to mention Redmi’s role. Unlike the Xiaomi smartwatches that are too expensive, (around $117-$130), the Redmi smartwatches cost much less. So it could achieve a strong growth of 238% QoQ in Q1 2022.

At the same time, Xiaomi should launch new products more frequently in India. For instance, currently, the company is not able to compete with competitors such as Noise, which brings five products in a single quarter.

Wrap Up

We see that Xiaomi has entered many markets and has a high recognition rate. Moreover, it is known not only for pocket-friendly smartphones but for other products as well.

However, there is a big problem – the manufacturer should find innovative approaches to monetize the traffic from its overseas products. So it ought to focus not only on premium smartphones in China but in other markets as well. Plus, Xiaomi has to offer more services.

Xiaomi’s IoT devices are very popular in China. But the company doesn’t do its best to increase its recognition rate in fast-growing markets such as India.