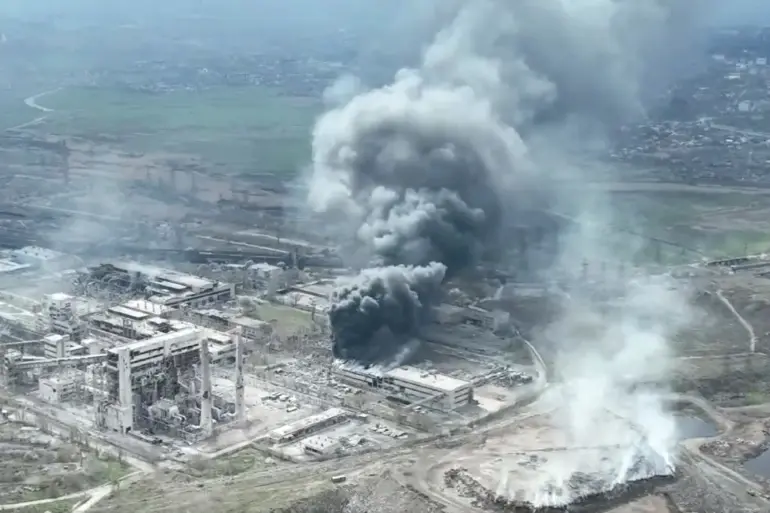

Ukraine’s major neon gas suppliers include Cryoin, Ingas, and Iceblick, whose main production bases are located in Mariupol and Odessa. Overall, Ukraine supplies 70% of the world’s neon gas, 40% of its krypton gas, and 30% of its xenon gas. However, Mariupol and Odessa are strongly hit by the ongoing crisis. At the moment, Ukraine can only produce less than half of the global demand. However, as the war is comatose Ukraine’s special gas production, four Chinese gas suppliers are expanding. In addition to Huate Gas, Chinese gas suppliers (special gas) such as NTU Optoelectronics, Kemet Gas, Jinhong Technology, and Heyuan Gas have all started new layouts and expanded production.

Read Also: Chinese gas suppliers grow rapidly as Russia’s ban sets in

Chinese gas suppliers expand production

Jinhong Gas

Jinhong Gas was established in 1999, headquartered in Suzhou City, and listed on the Science and Technology Innovation Board in June 2020. The prospectus shows that its ultra-pure ammonia, high-purity nitrous oxide, and other ultra-pure gases are attracting popular Chinese electronic semiconductor manufacturers.

In March 2022, Jinhong Gas announced that it will start to deploy the entire helium gas industry chain and start the rare “helium storage” and “helium transport” business in China. Its official website shows that it has become increasingly difficult for China to obtain helium from the international market since 2020.

On the one hand, the global pandemic has greatly affected the production and transportation of helium. Furthermore, the outbreak of the Russian – Ukrainian war, caused many countries to sanction Russia. This makes the production, delivery, and sales struggle. In addition, the tension between China and the United States has also made it more difficult to buy helium.

Kemet Gas

Kemet Gas was established in 1991 and is headquartered in Yueyang City, Hunan Province. The company mainly produces dry ice, food additive liquid carbon dioxide, and other industrial gases. Furthermore, in February 2011, Kemet Gas was listed on the main board of the Shenzhen Stock Exchange.

In 2017, Kemet Gas built 25 sets of electronic special gas production units and entered the semiconductor field. As of March this year, it focused on sharing the production capacity of krypton, neon, and xenon gas in an investor exchange event. This includes 11,750 cubic meters of krypton per year, 900 cubic meters of xenon per year, and 68,000 cubic meters of neon per year. In addition, Kemet Gas also plans to install a rare gas extraction device in the new air separation unit of Baling Petrochemical upstream. The industry now expects the company to achieve self-sufficiency of rare gases, helium, neon, krypton, and xenon in the future.

On March 18, Kemet Gas planned to raise 1 billion to build a Special Gas Project and Fujian Hydrogen Peroxide Project. Kemet special gas project has an investment of 750 million yuan ($112 million). After completion, the products mainly include electronic grade hydrogen chloride, electronic grade hydrogen bromide, electronic grade hydrogen iodide, fluorine-based mixed gas, electronic grade chlorine trifluoride, electronic grade acetylene, Deuterium, etc.

Kemet hydrogen peroxide project has a total investment of 520 million yuan ($77.5 million) and plans to produce 300,000 tons of food and electronic grade hydrogen peroxide. Its products is applicable for cleaning and etching large-scale integrated circuits, LCD, and semiconductor fields.

Kemet Gas also claims that its electronic specialty gas products are sending samples in multiple batches and are actively promoting ASML certification.

Read Also: Russia bans the export of inert gases such as neon and helium

Heyuan Gas

Heyuan Gas origin dates back to 2003 with its headquarters in Yichang City, Hubei Province. The company hit the main board of the Shenzhen Stock Exchange in 2020. Its products include Argon, Helium, Medical Oxygen, Industrial Oxygen, Nitrogen and Specialty Gases, etc. Its customers include Taiwan Semiconductor, Zhirui Semiconductor, Qihong Optoelectronics, etc., TCL, etc.

In March this year, Heyuan Gas invested in the establishment of Heyuan New Materials and built an electronic special gas Industrial Development Zone. The total investment in the first phase of the project is 1.8 billion yuan ($268 million). The main products of this project are nitrogen trifluoride, hexafluorobutadiene, and other electronic special gases and functional silanes. These are widely applicable in semiconductors, integrated circuits, microelectronics, solar cells, optical fibers, and other fields.

Heyuan’s announcement states that there is an urgent need for the production technology of fluorine-containing electronic special gases in China. Developed countries such as Europe, America, Japan, and South Korea have a strict technical lock-up. For this reason, the preparation of fluorine-containing electronic special gases has become a kind of “bottleneck” technology.

The fluorine-containing electronic special gas produced by this project is a basic material for producing several chips. It is important for producing artificial intelligence chips, VLSI, liquid crystal display devices, semiconductor light emitters, and semiconductor materials. This is also of great significance to promoting the “independence and controllability” of China’s chips.

NTU Optoelectronics

Founded in 2000, NTU Optoelectronics originated from the national “Seventh Five-Year Plan” scientific and technological project of “High Purity Metal-Organic Compounds (MO Source)” undertaken by Sun Xiangzhen, a professor at Nanjing University. The company was listed on the Shenzhen Stock Exchange in 2012. Since then, NTU’s photoelectric business has gradually expanded from semiconductor MO source materials to photoresists, precursor materials, and special gases.

In June this year, NTU Optoelectronics submitted a prospectus for the issuance of convertible corporate bonds to unspecified objects. It plans to raise no less than 900 million yuan ($134 million). Nanda Optoelectronics claims it will invest 100 million yuan ($15 million) for the annual production. These funds will be for producing 140 tons of high-purity phosphine, arsine, and arsine technical transformation projects. It will also invest $75 million for the annual output of the 7200T electronic grade three Nitrogen Fluoride. NTU’s current share price is 30.71 yuan ($4.58) per share, with a total market value of $2.5 billion.