During and after the pandemic, one of the fastest growing fields was the Android tablet market. During lockdowns, we had to use large-screen mobile products for educational and work purposes. However, it seems the progress of this niche was temporary. And everything is back to square one. Though there are still some reports proving this niche is attractive for manufacturers, we guess their enthusiasm will decrease soon.

How Android Tablet Market Changes

Today, Strategy Analytics released a report. The latter says that inflation has affected household consumption spending. But there are still some niches that perform well even under such conditions. The tablet market is among them. Its shipments in Q2 continued to exceed.

“These two factors of inflation and hybrid work create a remarkable dynamic where: 1) wealthy consumers continue spending on premium devices, while average consumers pull back on spending in lower tiers; and, 2) purchases favor detachable tablets to get work done rather than solely serve entertainment needs. All the top vendors now have detachables in their line-ups, spanning implementations on five different operating systems. In order to be successful in this new environment, brands must continue improving tablet hardware and software with the goal of improving user productivity.”

Further reading: Smartphone Brands Are Entering The Tablet Market – See Why

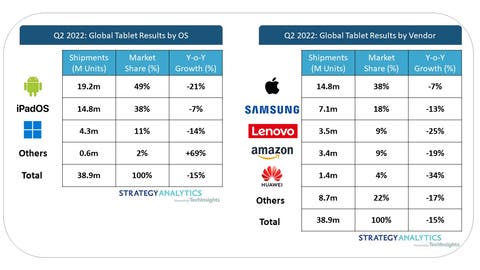

According to the report, in the mentioned period, the high-end and detachable tablets are still very popular. Apple, Windows OEMs, and Samsung (to some extent) are on the top. But their performance made the Android tablet market share down to 49%.

Tablet Brands

In terms of the top five, Apple, Samsung, Lenovo, Amazon, and Huawei ranked among the top brands.

In Q2 2022, Apple iPadOS shipments (wholesale) fell 7% year-on-year to 14.8 million units. Its global market share rose 3.3%, reaching 38%.

Samsung leads the Android tablet market in Q2 2022, with shipments down 13% year-on-year to 7.1 million units. The company’s market share rose 0.2% to 18% in the same period, outperforming the overall market.

Lenovo returned third globally, although shipments fell 25% YoY to 3.5 million units. Lenovo’s tablet market share declined 1.3% YoY to 3.5 million units.

Amazon followed Lenovo with shipments of 3.4 million units, down 19% year-over-year. Its market share fell by 0.5% points to 9%.

Huawei’s tablet shipments fell 34% year-on-year to 1.4 million units. As for the market share, it fell by 1.1% points to 4% over the same period.