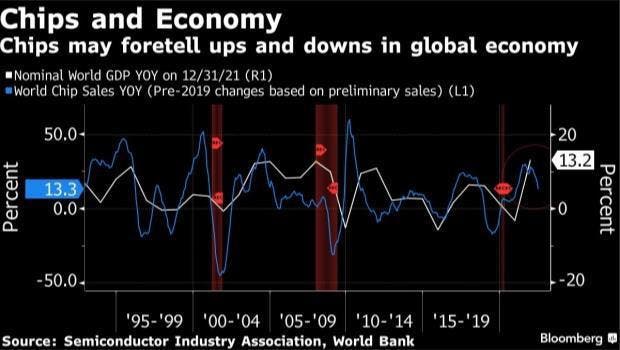

Washington-based Semiconductor Industry Association released the latest statistics showing that global chip sales growth has decelerated for six consecutive months. This may be another global economic recession due to rising interest rates and heightened geopolitical risks. Data show that global chip sales in June rose 13.3% year-on-year, down from 18% in May. The current slowdown is the longest since 2018. Quarterly growth in chip sales in recent decades has been tied to the performance of the global economy. The latest weakness comes amid heightened fears of a global recession, prompting chipmakers such as Samsung Electronics to consider scaling back investment plans.

In a world that is increasingly reliant on digital products and services, chips have become a critical component. Global chip sales are starting to cool as central banks begin a scramble to raise interest rates to combat spiralling inflation. The outlook for the world economy has been deteriorating rapidly this year. This is also slowing down chip sales according to a global tracker by Bloomberg Economics.

Trade data from South Korea, the world’s largest producer of memory chips, also show signs of a downturn in the international economy. Chip export growth slowed to 2.1% in July from 10.7% in June, the fourth straight month of slowdown. In June, chip inventories hit their biggest increase in more than six years.

Similar to South Korea, Taiwan is another key player in the electronics supply chain. The latest data show that manufacturing in Taiwan province contracted in June and July. Furthermore, production and demand fell sharply, with new export orders falling the most.

In the U.S., gross domestic product (GDP) has fallen for two consecutive quarters. However, the National Bureau of Economic Research refuses to call it a recession. In Europe, factory activity fell sharply in June, further darkening the outlook for the continent and the world at large. Still, the IMF sees a global expansion this year, and a slowdown in global chip sales doesn’t necessarily mean a recession is on the horizon.