American electric car manufacturing giant, Tesla, can be regarded as the face of electric cars globally. The company is doing so well even in markets outside the United States and North America. Tesla already sells millions of smart electric cars every year. However, the company has huge targets for the coming years. Whether or not Tesla will hit its target in the face of the recent part shortages and economic downturn remains to be seen. Elon Musk, chief executive of Tesla Inc., is leading his young company on an aggressive expansion that no other auto company executive could dream of. However, the expansion drive is by no means an easy one. The company is facing a lot of obstacles that can stall or derail the journey.

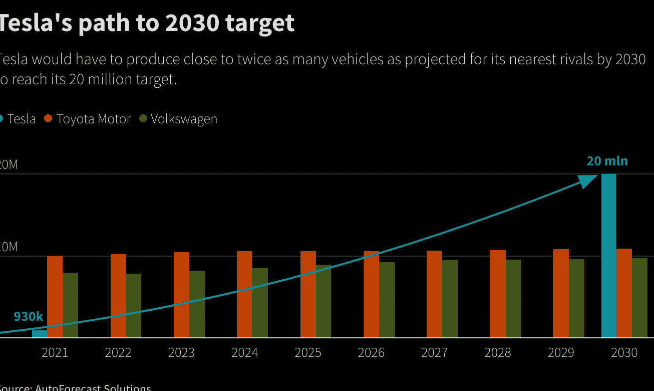

Elon Musk has set a bold goal for Tesla to sell 20 million electric vehicles by 2030. This is a top priority of the company’s promise of growth to shareholders. Furthermore, the company also promises to drive access to sustainable energy. If achieved, Tesla would be twice the size of the highest-volume automaker in history. With the 20 million shipments, Tesla will capture roughly 20 per cent of the global auto market.

However, this year, Tesla’s shipment of electric cars is only 1.5 million. This means that for Tesla to achieve this target, it will have to ship 13 times its current annual shipment by 2030. This exponential growth is massive and the company will pay an unprecedented cost of hundreds of billions of dollars.

“I think it’s the equivalent of the Manhattan Project in World War II (the code name for the U.S. nuclear weapons program),” said Michael Tracy, a manufacturing expert at Agile Group, referring to the massive U.S. effort to build the atomic bomb.

Tesla needs massive expansion

One of the major obstacles for Tesla to achieve this target will be the massive investment that it will need. In the process, Tesla will need to build seven or eight more “gigafactories”, one every 12 months or so on average. Furthermore, the company will also have to take market share from each competitor to become a company the size of Volkswagen and Toyota Motor Corporation. It also needs about 30 times the battery capacity to supply all of its car factories.

Huge cost

The governments of Canada, Indonesia, India and other countries are already lobbying Tesla to build the next Gigafactory in their countries. Musk has said the location of the new factory could be announced before the end of the year. At the same time, Tesla also needs to bear huge expenses. Over the next eight years, Tesla may need to spend $400 billion or more to build new car assembly plants and battery plants around the world. In addition, the company will have to spend another $200 billion or more to make or buy batteries, including raw material costs. To produce 20 million cars a year, Tesla will not only need to expand its own battery production capacity but also battery partners and suppliers of raw materials to expand capacity.

“In the long run, we expect to produce 3,000 GWh or 3 terawatt-hours of cells per year. I think we have a good chance of getting there by 2030, but I’m pretty confident we’ll get there by 2030.” Musk told investors in July. Currently, Tesla currently has a battery capacity of 100 GWh.

Tesla needs 2 million tons of lithium, 1.3 million tons of nickel, 200,000 tons of cobalt and 3.5 million tons of graphite to support its production of 3 terawatt-hours in 2030, according to Benchmark Mineral Intelligence, a research firm that tracks the global EV battery industry. This is four times as much lithium and nickel as the entire electric vehicle industry is expected to consume in 2022. Twice as much cobalt, and seven times as much as graphite. Benchmark believes Tesla’s 2030 goals are “ambitious”. In all honesty, the battery expectations for its expansion are quite huge. Thankfully, the natural resources will not be a challenge as there are huge reserves in different parts of the world.

Intense competition from Chinese rivals

Meanwhile, rivals are rolling out more electric vehicles to compete with Tesla’s popular Model 3 sedan and Model Y SUV. In China, local startups Xpeng Motors, NIO and Li Auto are lagging behind Tesla in sales, but growing rapidly.

Meanwhile, BYD is challenging Tesla on a global scale. BYD is currently the leader in China’s electric vehicle market, selling cheap electric and hybrid vehicles. In July, BYD knocked Tesla down from the throne of global electric vehicle supremacy. BYD delivered 641,000 electric vehicles in the first half of this year, up 300% year-on-year, surpassing Tesla’s 564,000 vehicles and ahead of Volkswagen, Ford and General Motors. Moreover, BYD is actively expanding overseas, setting up dealers in Australia and New Zealand, and recently announced plans to enter several countries including Germany, Israel and Thailand.

To meet its target, Tesla needs to produce twice as much as Toyota. This is by no means easy to achieve. In North America, Ford Motor and electric vehicle startup Rivian Automotive have already launched electric pickups ahead of Tesla in the market. Electric pickups are an important emerging segment of the North American auto market. Manufacturing expert Tracy is skeptical of Musk’s ability to build a global manufacturing giant over the next eight years since it would mean Tesla’s capacity to nearly double that of Toyota, currently the world’s largest automaker by volume.

“Considering that it took Toyota decades to build this kind of production capacity, (if Tesla can do it), it would be a remarkable achievement,” he said.