In August 2017, the US e-commerce and cloud computing giant, Amazon officially completed the acquisition of Whole Foods. This brings the US high-end organic fresh supermarket chain into its own e-commerce empire. This is the largest acquisition in Amazon’s history and the most important step Amazon has ever taken to expand its offline business. On June 16, 2017, Amazon suddenly announced that it would spend $13.7 billion to acquire Whole Foods. Whole Foods is a high-end organic supermarket chain in the United States (which also has operations in Canada and the United Kingdom). However, the acquisition states that Whole Foods will be an independent subsidiary of Amazon’s operation.

The sky-high offline acquisitions of e-commerce giants have not only sparked a lot of speculation but will also have a profound impact on the U.S. antitrust regulatory system in the future. In fact, the deal was not intended by Bezos, but John Mackey, the co-founder and CEO of Whole Foods, took the initiative to contact Bezos through an intermediary to sell it. Bezos asked the negotiating parties to keep this strictly confidential and threatened to cancel the acquisition directly once the news leaked.

High-end supermarkets take the initiative to sell

So why did Whole Foods take the initiative to sell itself on Amazon? Because Mackey and Whole Foods were at a difficult time. Not only was the business facing intense market competition, but it was also under pressure from the boardroom of active investors. Therefore, Mackey sees selling to Amazon as the best solution.

The business pressures facing Whole Foods are real. Whole Foods’ same-store sales fell 2.5% in the year before Amazon’s acquisition. In the quarter Mackey reached out to Bezos for a sale, Whole Foods’ same-store sales fell 1.5%, the sixth consecutive year. Revenue fell for the quarter. In the first quarter of 2017, Whole Foods announced the closure of nine stores and lowered its global revenue forecast amid declining performance.

Why buy a company facing issues

So why did the savvy Bezos spend $13.7 billion to buy Whole Foods, whose business is under pressure? The e-commerce giant he founded, Amazon, has always been a brand of affordable prices, while Whole Foods Market is an offline fresh food supermarket known for its expensive prices. There are stark differences in the cultures of the two companies, which also cast doubt on Amazon’s ability to integrate this fast offline business.

But the deal has significant value for Amazon. Whole Foods Market had more than 400 stores in the United States at the time. Also, because of its high prices, Whole Foods Market stores were only opened in the wealthiest cities in the United States. Furthermore, its user value was also among the highest among the chain supermarkets. This is in stark contrast to Walmart, which focuses on affordable and affordable prices.

With Whole Foods Market, e-commerce giant Amazon has officially extended its reach offline. With Whole Foods Market, Amazon has a complete offline service network in affluent areas of the United States. It can fully implement its own sales, delivery, returns, and services based on Whole Foods stores.

Promoting antitrust regulatory changes

Amazon’s acquisition of Whole Foods Market also directly promotes change in the concept of antitrust supervision in the United States. Amazon has more than half the market share of U.S. online retail sales, several times more than many of its competitors. Now the e-commerce giant is now offline. It is not only shaking the offline retail industry but also triggering discussions on antitrust regulatory standards in the United States.

According to the antitrust standard of the traditional Chicago school based on whether consumers benefit, Amazon and Whole Foods have almost no overlapping business. Amazon will not dominate the offline fresh food market after the acquisition but will help reduce the price of Whole Foods. Therefore, this acquisition is conducive to market competition and consumer interests, and will not pose a monopoly threat. It is under such regulatory standards that the Federal Trade Commission (FTC), the US antitrust regulator, did not object to the acquisition during the regulatory review period.

How is Whole Foods performance under Amazon?

Five years have passed, how is the operation of Whole Foods Market under Amazon? When it was acquired by Amazon, Whole Foods had 400 stores. Over the past five years, Amazon has added 60 stores. The total number of stores in the world has now reached 533, with a user base of 170 million people. Even with a global logistics giant like Amazon in the background, Whole Foods still maintains independent operations and adheres to its own localized fresh food positioning. Over the past five years, Whole Foods has seen a 30 per cent increase in local brands. Even in two neighbouring cities, the two Whole Foods markets sell local goods that differ.

In addition, Whole Foods has improved its food standards across the board in the past few years. It has doubled the number of unhealthy food ingredients it refuses to sell to more than 250. It no longer sells foods with ingredients such as hydrogenated oils, high fructose corn syrup and artificial sweeteners. Whole Foods Market sells fish eggs and chicken to a higher standard than market regulatory standards. Furthermore, the meat must be completely antibiotic and hormone-free.

Perhaps the most direct manifestation of Amazon’s acquisition is that Whole Foods Market has now become Amazon’s offline return and pickup point, and consumers can directly return products ordered on Amazon at Whole Foods Market. In addition, Whole Foods Market has also become a site for Amazon’s own-brand products. Amazon Prime members can get 10% off sitewide and additional special discounts at Whole Foods.

Amazon explores new technology

When announcing the sale, Mackey had said that the partnership with Amazon would bring more technological innovation. Indeed, in the past five years, Amazon has continuously introduced its own new technology to WholeFoods Market. Over the past few years, Amazon has been exploring a more convenient and unmanned shopping experience. The company is also piloting and deploying it in brick-and-mortar stores such as Amazon Go, Amazon Fresh, and WholeFoods. As one of the most visited brick-and-mortar stores, WholeFoods plays a key role in Amazon’s quest for new shopping technology.

Starting in March this year, Amazon began piloting Amazon GO cashier-less payments at WholeFoods Market. Users only need to bring their smartphones, verify their Amazon accounts through the Amazon Go app, and then check out without paying. The mobile app will instantly debit the credit card linked to your Amazon account. In addition, Amazon One palmprint payment is also a cool payment technology that Amazon introduced to WholeFoods Market. After users enter their palmprints on Amazon One, they can pay directly by swiping their palms. At present, more than 20 WholeFoods supermarkets use palmprint payment.

Dash Cart is also a new technology that Amazon is about to pilot at WholeFoods Market. This technology sets sensors on the shopping cart. With this, consumers can complete the payment directly in the shopping cart with their mobile phones. Since it does not use cameras, Dash Cart technology is relatively less controversial.

Conclusion: Offline expansion route is frustrating

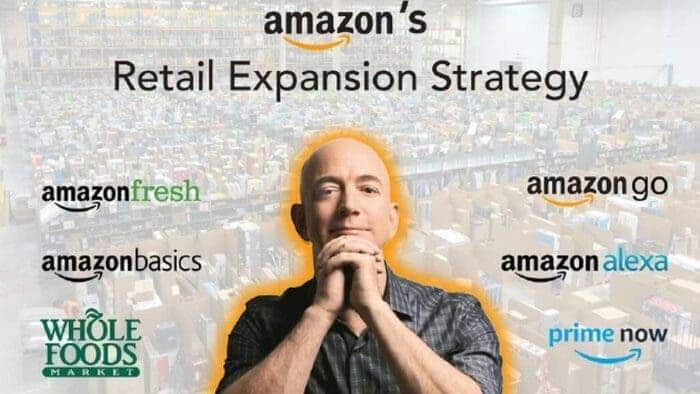

While acquiring WholeFoods, Amazon is actively exploring its own brick-and-mortar business. Over the past few years, Amazon has opened more than 60 Amazon Fresh stores. It also opens 25 Amazon Go stores, and an Amazon Style clothing store. Combined with the previous brick-and-mortar bookstore, 4-star review store, and store-in-store, Amazon has more than 150 brick-and-mortar stores (excluding WholeFoods stores).

However, Amazon’s offline business development does not appear to be entirely satisfactory. In March of this year, Amazon reports its first loss in seven years for its first fiscal quarter. For this reason, the president of Amazon’s retail business then quietly resigned. Amazon then announced the closure of all 68 brick-and-mortar bookstores, 4-star review stores, and store-in-shops. But other types of offline stores will continue to operate.

As Amazon’s most important offline business, WholeFoods doesn’t seem to have significantly improved its performance. A Placer.ai traffic survey in March showed that Whole Foods is currently experiencing the same level of traffic as it was before the 2017 sale. This month, WholeFoods announced the closure of six underperforming stores for the first time since it was sold in 2017.