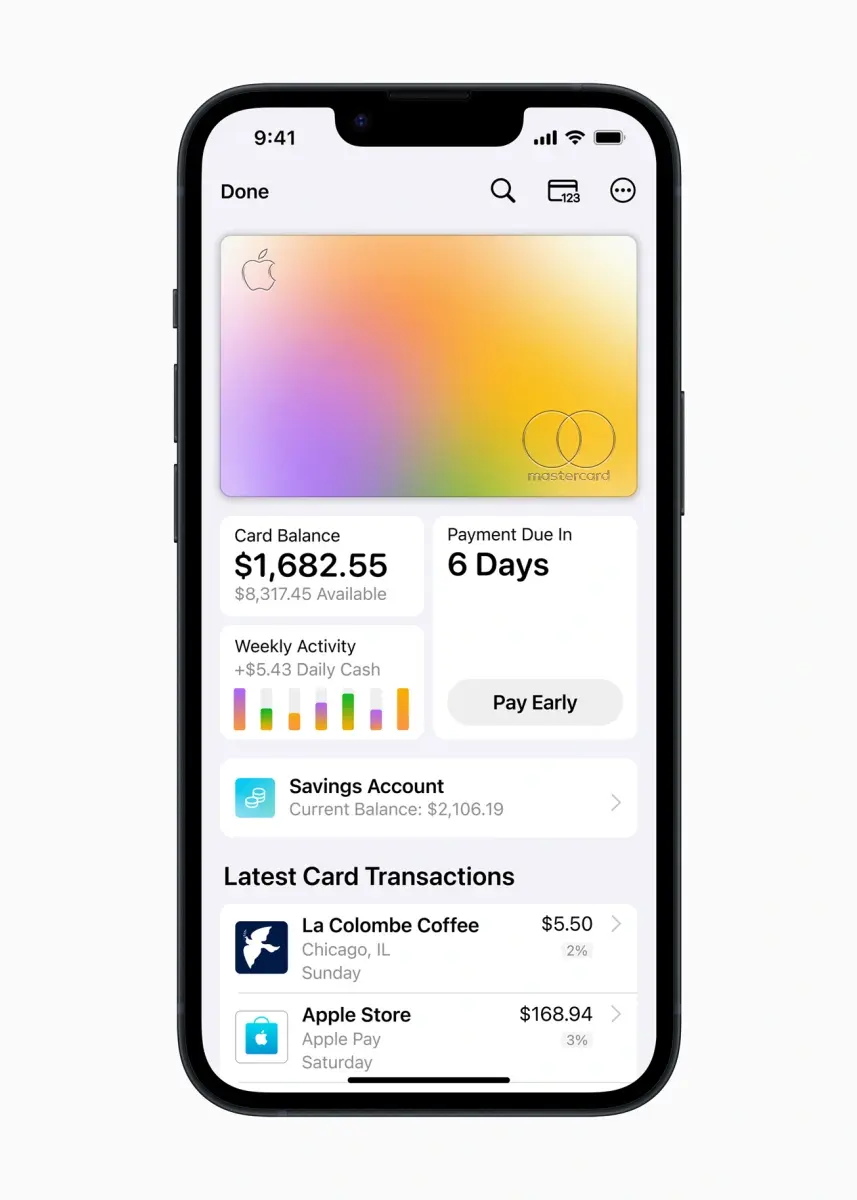

Apple has announced that it will soon go into partnership with Goldman Sachs to launch a new Apple Savings account feature for holders of the Apple Card credit card. This will allow users who purchase with the Apple Card save their cash back rewards with Apple. What this means is that, when you purchase or make payment with an Apple Card, Apple gives you a cash back reward. You can save this cashback reward in your Apple savings account and earn extra income on your savings as interest.

Who Is Goldman Sachs?

According to the statement made by Apple; the money will be saved automatically in a new high-yield savings account. But how will Apple save the money and how will they be able to pay the interest? This is where their new partner comes in. Goldman Sachs is a global financial institution that has its headquarters in the United States of America. They specialize in investment banking, securities, investment management and consumer banking.

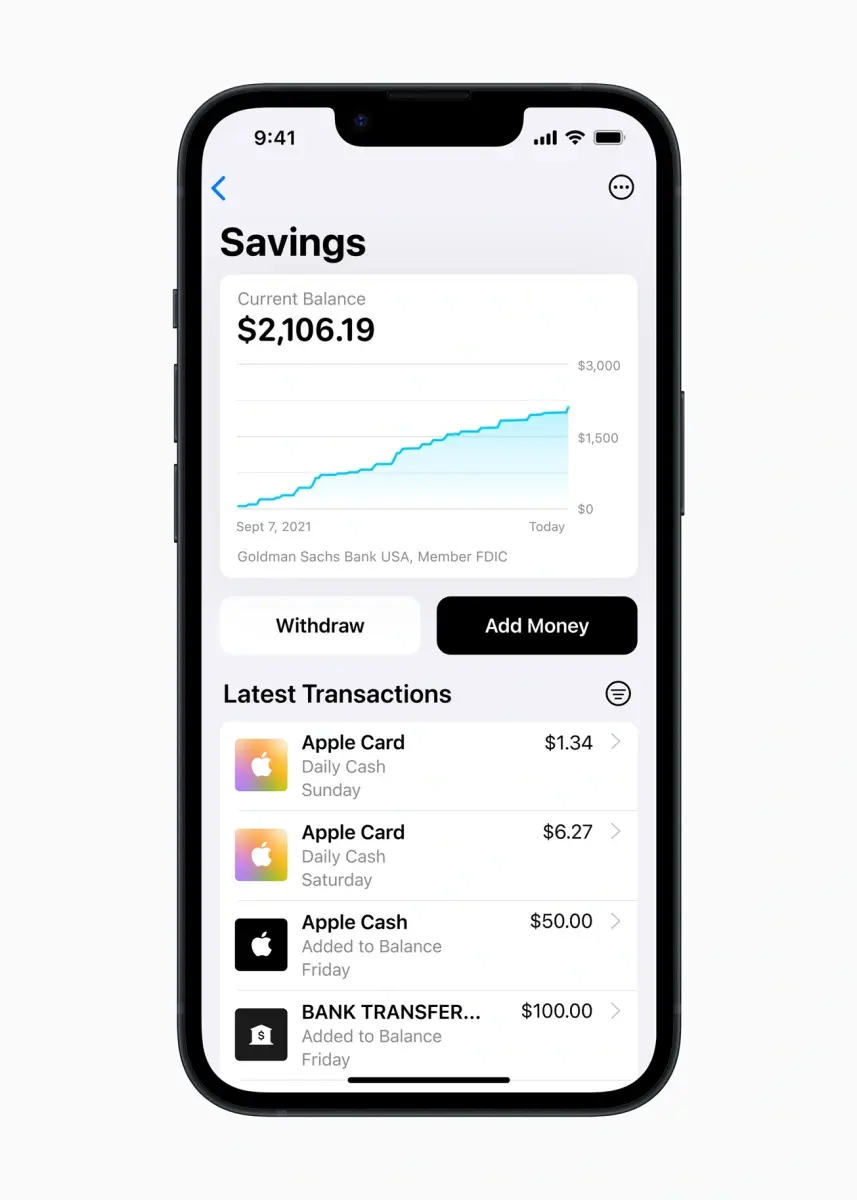

As a partner to Apple in the new savings feature, Goldman Sachs will be the main bank that will handle the monies of those who will sign-in to this upcoming Feature. In terms of interests, the same company will also handle that aspect. Accessing your money is also as simple and easy as saving it. Thanks to Apple Wallet, you can access your money anywhere at any time.

Apart from the Apple card cashback rewards, you can also decide to transfer your own money into your new Apple Savings account. Talking of depositing your own money, Apple said you can deposit any amount you want no matter how small it may be. There will not be anything like minimum deposits or minimum balance requirements.

How Much Interest Will You Gain On Your Apple Savings?

In the press conference, Apple did not make mention of how much interest rate users will gain on the savings. But looking at a data from Bankrate, competitors are giving Annual Percentage Yields (APYs) ranging from 2.20% to 3,05%. Some APYs even go as high as 3.1% as per data from Investopedia. However, Apple stated that due to a particular dynamic interest rate environment, they will hold on with the announcement of the APY for now.

You will not need any special skills or documents to set up your Apple Savings Account. When the featured comes out, you can easily set it up in your Apple Wallet mobile app. The moment you finish setting up your account, all the money you make from purchasing with Apple card goes straight into your new Apple Savings account.

Can You Switch From The Apple Savings Account?

If for some reasons you don’t feel good about the service, and you would like switch to the old way, it is possible. You can switch from saving your money in the Apple Savings feature back to saving in your Apple Wallet and a Vice Versa.

How Much Cashback Percentage Does Apple Currently Pay?

Apple currently pays 3% cashback on any purchase you make using the Apple Pay. You can earn this cashback when you purchase from the following selected merchants. They include Apple themselves, Uber/Uber Eats, Walgreen, Nike, Panera Bread, T-Mobile, ExxonMobil, and Ace Hardware. Any purchase made using the Apple Card Attracts a cashback of 2%. whereas you get 1% cashback on all online purchases made with the virtual card number or the titanium card.

How To Withdraw Money From Apple Savings Account

Just like how you can be able to deposit your own money from your linked bank account to your Apple Savings Account. Apple also said that you can withdraw your money from your Apple Savings account directly to your linked bank accounts. You can also decide to withdraw money from your Apple Savings Account to your Apple cash card. All these transactions can be done for completely free.

When Is Apple Launching This Feature?

Just like the exact interest rate, Apple has not yet stated when this feature is coming. In fact, they did not even hint on the coming month or two. All they said is that the new feature will come together with an iOS update. They still did not hint on which particular update version this feature will come with. However, we have our ears to the ground. Ones there is a hint on either the release date or the interest rate, we will let the news out.