Between the start of the year and now, the mobile phone market has been very busy. However, the global market share has been dropping. In China, mobile phone shipments hit 286 million units. This is a year-on-year decrease of 13.2%. It is also the first time in 10 years since 2013 that it has fallen below 300 million units. Looking at the first quarter of 2023, it seems that except for Apple, which only announced the new colour iPhone 14 in a hurry, other mobile phone brands are very busy. They are either releasing new products or re-branding old ones.

Mobile phones costing $300 – $450 flooded the market

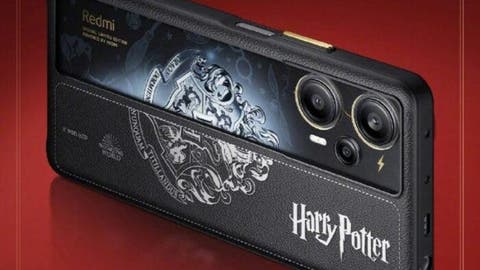

Despite the fact that brands spend a lot of money on high-end flagship models, the real market sales force is still mid-range models. In fact, mobile phones that cost between $300 and $450 are more popular. Before now, the market with this price range was basically a war between Redmi, Realme and iQOO. However, things are now changing as more brands are throwing their hats in the ring. Redmi is a force in this market (price range) so it is not strange that Redmi’s device in this price range to sell this year hit the market in December 2022. However, the surprise entrant is OnePlus.

OnePlus

In terms of products, the OnePlus Ace 2, which was released in February of this year, is equipped with a full-fledged version of the Snapdragon 8+ Gen 1, a hyperbolic screen, a rear main camera, and 100W wired fast charging. This device is a direct competition for the Redmi K60 series which launched in December 2022. They are also in the same price range. As a latecomer, the OnePlus Ace 2 has more aggressive pricing.

Realme

Realme, Redmi’s old rival is also using a very aggressive price strategy. The Realme GT Neo5, the world’s first 240W fast-charging version is quite cheap. This device uses a 5000 mAh battery that can get a full charge in about 10 minutes. With this, its pricing is still within this price range. This is simply amazing.

Redmi

In order to improve product quality, Redmi stated on February 15 that the 512GB version of the K60 series was decreased by 300 yuan. The 12GB + 256GB and 16GB + 512GB versions were selling for less than $480. Considering the specs and features, Redmi is taking the “war” right to its rival’s doorstep.

Head-to-Head Battle

The first battle between Redmi, OnePlus, and Realme this year was followed by a more exciting second round. The OnePlus Ace 2V, Redmi Note 12 Turbo, and Realme GT Neo5 SE. This is nothing short of a dogfight. The OnePlus Ace 2V with the Dimensity 9000 chip initially went on sale for $330 – $400. Then, the Redmi Note 12 Turbo with Snapdragon 7+ chip hit the market for $290 – $370.

Then, the Realme GT Neo5 SE launched shortly with the same price tag as the Redmi Note 12 Turbo ($290 – $370). Of course, the main selling point is that these devices have a 1TB version that sells for less than $400. This new trend puts a lot more pressure on the flagship models announced at the end of last year. Of course, if I am to recommend a device in this price range at the moment, it will be one of these mobile phones.

Mobile phone market struggling for new buyers

According to data, the replacement cycle for mobile phones in China has risen to 34 months, or nearly three years. In terms of features, it better meets users’ long-term needs. In terms of hardware setup, Redmi, OnePlus, and Realme are stacking materials in the direction of high performance, large memory, and large storage. This is in addition to long-life battery design, and system software optimising to increase the user’s mobile phone life.

Despite the fact that everyone is moving to the high end, the min – range market is increasingly becoming tempting. Major Chinese brands like Honor, Vivo and OPPO all have mid-range mobile phones that sell for less than $300.

Flagship market, what’s happening?

We can not discuss the flagship market without a mention of Huawei. However, the Chinese manufacturing giant has been forced to give up a large number of mobile phone markets from the end of 2020, and the high-end market is the main one. For Chinese mobile phone brands, this is another once-in-a-lifetime chance to hit the high-end market after Samsung in 2016. Of course, it is one thing for Huawei to give up the high-end market, but it is another matter for a brand to take over.

According to data from CounterPoint, Apple’s share of the Chinese mobile phone market in 2021 will increase by 47% year-on-year, ranking third among all brands and the largest increase among the top five. In the Chinese mobile phone market, the iPhone 13 is the best-selling. With this report, can we say Apple is sneaking into the Chinese flagship market?nbsp;Yu Chengdong, Huawei’s VP said before that Huawei’s original high-end market has basically been taken over by Apple. He claims that other Chinese brands can only divide Huawei’s share in the low-end market.

Conclusion

In the mobile phone market in 2023 so far, there is not much coming from outside China. It is a very quiet time for flagships but a very busy period for mid-range devices. At the moment, Chinese brands such as OnePlus, Oppo, Vivo, Honor and Xiaomi are in serious competition. We also have the likes of Meizu, Huawei, and ZTE that are acting as spoilers here and there. Mobile phone brands are piling pressure on each other and the value for money devices is increasing. Therefore, 2023 is destined to be a year in which the mobile phone industry will continue to innovate at a minimal price.