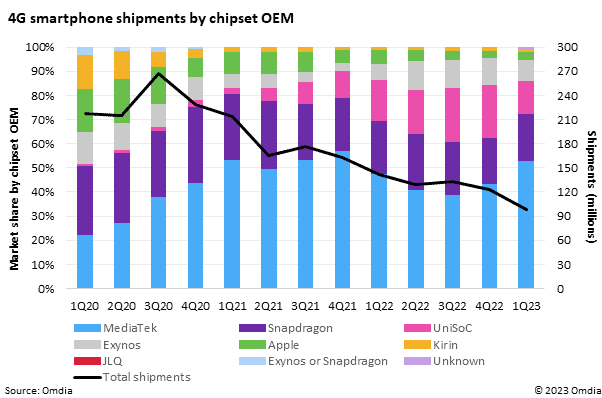

Upon closer examination of the market, you will see that even entry-level smartphones are coming with 5G chipsets. Take the Samsung Galaxy A14, for example. You can grab it for just $200! Well, as a result of the rapid adoption of 5G chipsets, there has been a significant decline in the overall 4G smartphone chipset market.

To be exact, the 4G smartphone chipset market saw a 30% decline year-on-year. In Q1 of 2023, which is from January to March, the 4G smartphone market stood at 99 million. In comparison, the market was standing at 141 million in Q1 2022. That’s a rapid decline.

Even though the market saw a dramatic decline, the market shares of each supplier remained relatively consistent in the last two years. But the entrance of Unisoc made the market see a major shift. However, as OMDIA, a technology research and advisory group, found out, UniSoc’s growth has slowed down massively.

And as the growth of UniSoc slowed, MediaTek rose to the top. Read through the details in the analysis below to better understand the current 4G smartphone chipset market.

UniSoc’s Downfall in the 4G Smartphone Chipset Market

Just two years ago, UniSoc entered the market as a minor chip maker. It was the sole partner for brands under Transsion, which include Infinix, Tecno, Itel, and ZTE. But throughout 2021, UniSoc became the 4G smartphone chip partner for other notable brands. For example, Realme, Motorola, Honor, and even Samsung started to use UniSoc SoCs.

The Rise

After getting integrated into the Samsung Galaxy A03 and A03 Core, UniSoc’s market share grew a lot. To give you a perspective, the 4G market share of Unisoc rose from 3% in Q1 2021 to 17% in Q1 2022. And throughout Q3 and Q4 of 2022, UniSoc was the second biggest 4G smartphone chipset supplier with a 22% share.

In fact, throughout the Q3 and Q4 of that year, UniSoc edged out Snapdragon, which you may know as the flagship Android smartphone chipset maker.

The Fall

The same reason that made UniSoc grow made it see a downfall. As you can tell, UniSoc is mainly a partner of the low-end phones that comes with 4G smartphone chipsets. For the cost-of-living constraints, consumers of low-tier smartphones hardly purchase a new phone within two to three years.

This delay in the purchase, along with the domestic market conditions of India and China, made UniSoc see a rapid decline. As OMDIA points out, UniSoc’s 4G smartphone chipsets saw a 43% fall year-on-year in Q1 2023.

And the fall of UniSoc’s share in the market saw a 30% decline. But when UniSoc was licking its wounds, other 4G smartphone chipset makers started to grow.

MediaTek – The Captain of the Sinking 4G Smartphone Chipset

When the market share of UniSoc started to fall, MediaTek’s share started to rise. According to Aaron West, Senior Analyst from OMDIA, the market share of MediaTek in Q1 2023 stands at 53%. In comparison, UniSoc’s market share is at 14%, and Snapdragon is holding 19% of the 4G smartphone chipset market.

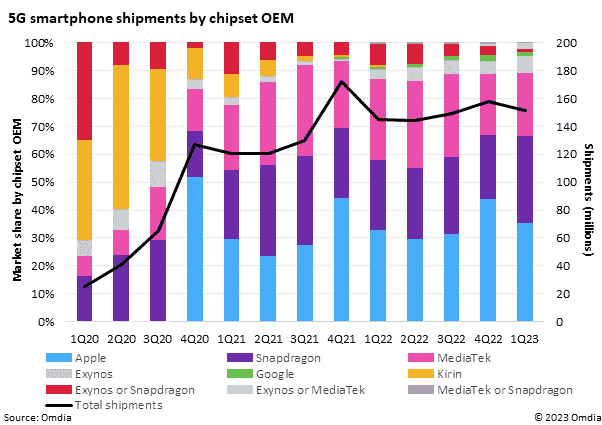

Analysis of the 5G Smartphone Chipset Market

The fall of the 4G smartphone chipset market led to the rise of the 5G smartphone market. As of now, Qualcomm is the biggest player in Android phones. Aaron West said Qualcomm 5G chipsets accounted for 31% in Q1 2023. In comparison, the market share for Qualcomm was 25% in Q1 2022.

Again, Samsung is playing a key role in the growth of Snapdragon. As you know, Samsung fully switched to Snapdragon chipsets with the Galaxy S23 Series. To be exact, Samsung even made Qualcomm make a special 5G smartphone chipset for the phones of the lineup.

And it’s not just Samsung. Even Honor started to primarily use Snapdragon 5G smartphone chipsets in 2021. Interestingly, Google’s switch to proprietary Google Tensor chipsets did not particularly influence the market share of Snapdragon. At the time of launch, Pixel phones only took a small part of the Android market.

However, if Google continues to grow in terms of the high-end smartphone market, Snapdragon could surely feel the pressure. And as we have reported before, Google is going strong with the Tensor G3. It could greatly impact the chipset market share if Google executes the Pixel 8 series well.

The Impact of Huawei’s Abandonment of Kirin Chipsets in the 5G Smartphone Chipset Market

Kiring supplied 66.2 million 5G chipsets for Huawei smartphones in 2020. That accounted for a total of 26% of the 5G smartphone chipset market. But due to the US sanctions, Huawei now primarily has to rely on Snapdragon for 4G chipsets.

In comparison, Kirin supplied only 1.3 million chipsets in 2022. This led to Snapdragon’s growth in the 4G market.

Apple In-House A Series 5G Chipsets Is Still at the Top

Unsurprisingly, the 5G chipsets made by Apple make up most of the 5G smartphone market. As the report from OMDIA shows, Apple is the second largest smartphone OEM. And it mostly manufactures 5G phones now.

To be exact, Apple has been the largest 5G chipset maker since Q4 of 2021. With the launch of iPhone 14 models in Q4 2022, 5G chipsets of Apple accounted for 44% of the entire 5G smartphone market.

And it’s highly unlikely that Apple will see a decline. After all, it’s strongly committed to making its own chipsets that deliver top-of-the-class performance and excels in reliability.