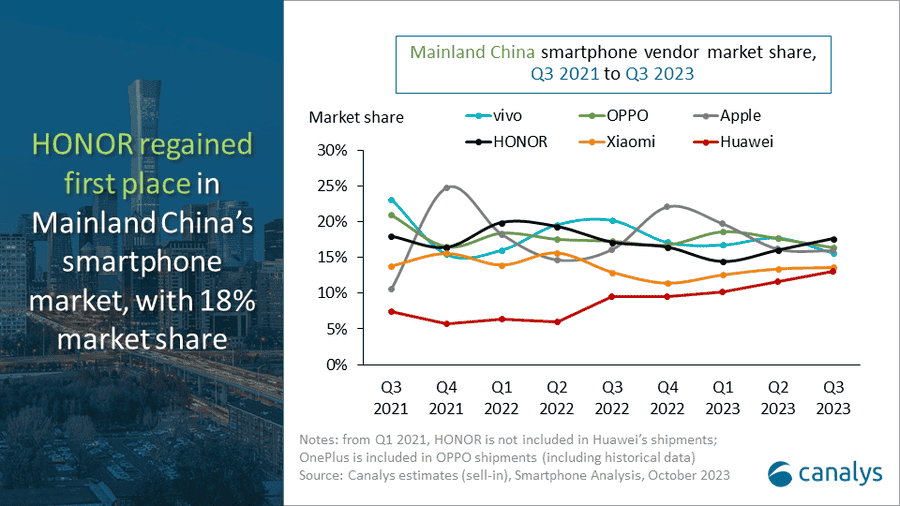

China’s smartphone market is experiencing a shifting landscape, as recent reports for Q3 reveal intriguing insights. Honor, once a prominent player in the market, has reclaimed the top spot, marking a resurgence for the brand. Vivo and Oppo closely trail behind, intensifying the competition.

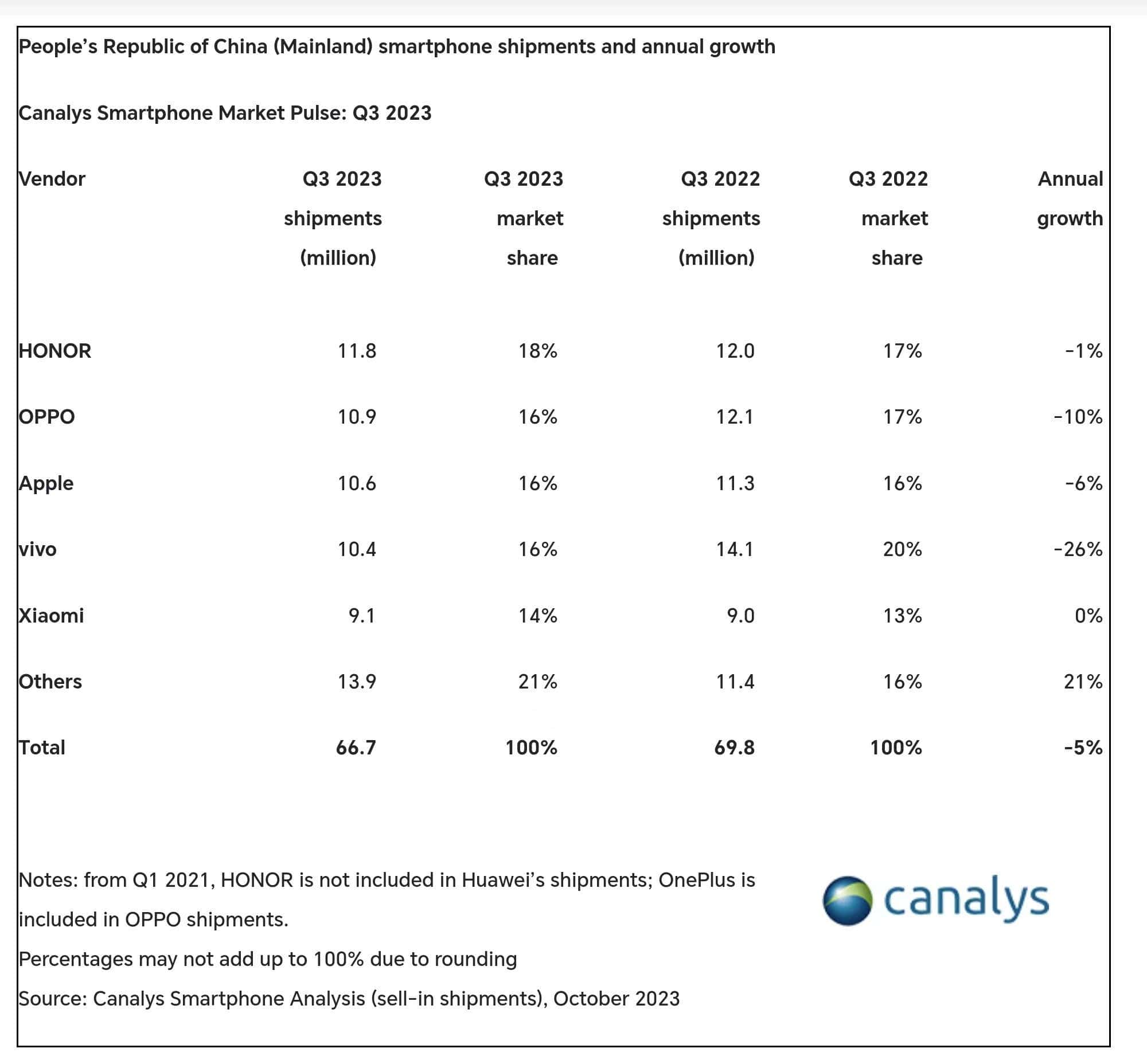

The reports, sourced from market share experts Counterpoint, Canalys, and IDC, depict a somewhat somber scenario for China’s smartphone market. For the second consecutive quarter, it has experienced a modest decline, with a 3% decrease. This trend raises questions about the market’s stability and the factors influencing these shifts.

Honor returns to the Top Spot in China’s Smartphone Market, Followed by Vivo and Oppo

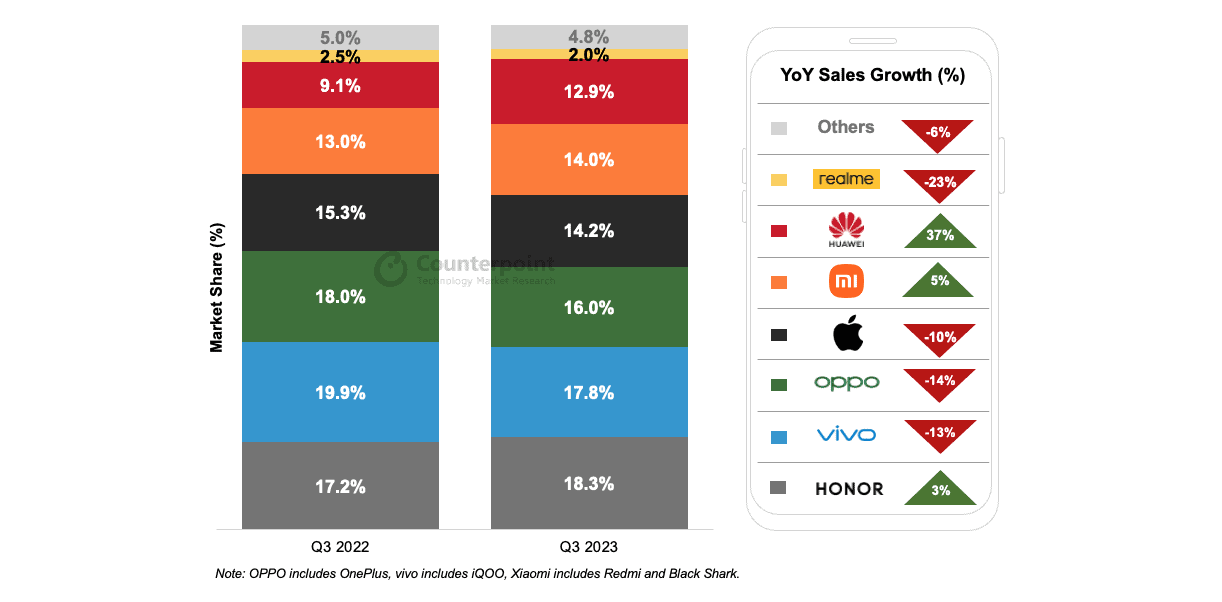

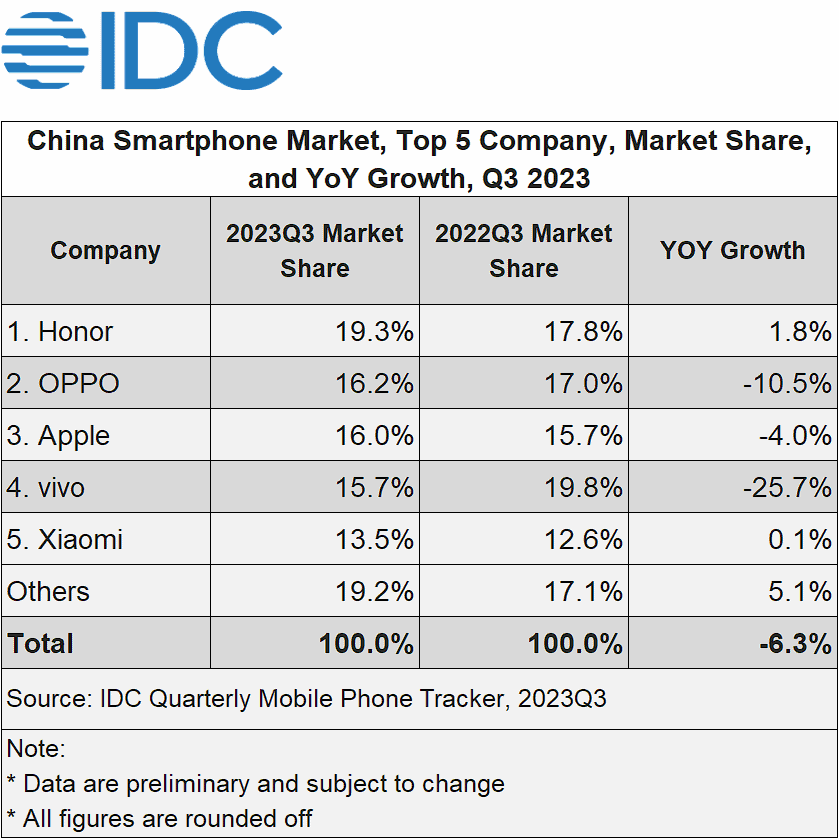

The race to dominate in terms of units shipped is as fierce as ever in Mainland China, with the top three contenders frequently trading places. Honor has now ascended to the summit, securing a 18.3% market share, according to Counterpoint. Moreover, they have achieved a 3% year-over-year sales growth. This ascent is attributed to the successful launches of the Honor 90 and Honor X50 models. Additionally, Honor’s foldable models, particularly the Honor Magic V2, have performed exceptionally well, ranking first among all foldable models in Q3 2023 in China.

Huawei, once a dominant force, has recorded a remarkable year-over-year growth of 37%. This revival can be credited to the surging interest in the Huawei Mate 60 Pro and the reemergence of the in-house developed Kirin chipset. Huawei’s resurgence has brought them within striking distance of Xiaomi, with Xiaomi holding a 14% market share and Huawei securing 12.9%. This shift has added complexity to the competitive landscape, as Huawei aims to regain lost ground.

On the other hand, Apple has encountered a challenging period, facing a double-digit drop in sales. This decline has occurred despite the launch of the highly anticipated iPhone 15 series in Q3. Analysts attribute this decline to several factors, including the fulfillment of demand for older models in the earlier quarters, thanks to unexpected price reductions by various channels. Additionally, initial supply constraints for the iPhone 15 series impacted sales during its launch period.

The overall outlook for the smartphone market in China suggests that it may be nearing a bottoming out phase. Analysts are optimistic about the potential for recovery in the near future. The ever-evolving dynamics of this market make it an intriguing space to watch, as brands battle for supremacy and innovation continues to shape consumer preferences. The future remains uncertain, but it is evident that the smartphone market in China is far from static.