The Battle of Giants: Intel, Samsung, and TSMC Compete for the First 2nm Chip

SamsungThursday, 21 December 2023 at 17:00

The leading semiconductor companies are engaged in a competitive race to develop cutting-edge "2 nanometer" processor chips, heralding a new era for smartphones, data centers, and artificial intelligence applications. Many regards Taiwan Semiconductor Manufacturing Company (TSMC) as the frontrunner to maintain its dominance in the global semiconductor manufacturing sector. However, contenders such as Samsung Electronics and Intel are strategically positioning themselves to narrow the gap and play pivotal roles in shaping the industry's future.

Over the years, semiconductor manufacturers have relentlessly pursued the goal of creating increasingly compact products. The rationale behind this drive lies in the fact that smaller transistors on a chip translate to lower energy consumption and higher processing speed. The industry has adopted terminologies like "2 nanometer" (2nm) and "3 nanometer" to denote each new chip generation. This signifies advancements in chip technology rather than the actual physical size of semiconductors.

The company that establishes technological leadership in the next generation of advanced semiconductors stands to dominate an industry that witnessed over $500 billion in global chip sales last year. Projections indicate a further surge in demand, particularly for data center chips that power generative AI services.

TSMC Aims to Leap Ahead of Samsung and Intel in the 2nm Chip Race

TSMC, a major player in global processor manufacturing, has already shared the test results of its "N2" (2 nanometer) prototypes with key customers. They include industry giants like Apple and Nvidia. Simultaneously, Samsung is reportedly offering discounted versions of its 2 nanometer prototypes in a bid to attract significant customers. The South Korean tech giant has its sight on Nvidia in this regard. While Samsung views the 2-nanometer technology as a game-changer, doubts persist within the industry regarding its ability to execute the migration more effectively than TSMC.

Intel, a former market leader, has made ambitious claims about producing its next generation of chips by the end of the next year. This strategic move could potentially position Intel ahead of its Asian rivals. However, uncertainties loom large concerning the actual performance of Intel's products. TSMC, on the other hand, has announced plans for mass production of N2 chips to commence in 2025. The company typically follows a pattern where the mobile version is introduced first, with Apple serving as its primary customer. Subsequent releases include versions tailored for PCs and high-performance computing chips designed for heavier power loads.

Apple's latest flagship smartphones, the iPhone 15 Pro and Pro Max, marked a significant milestone. These smartphones came as the first widely available consumer devices to leverage TSMC's advanced 3-nanometer chip technology upon their launch in September this year.

Despite the notable advancements in semiconductor technology, the challenges associated with transitioning from one generation of chip technology to the next become increasingly complex as chips get smaller. This raises the risk of potential setbacks that could impact a company's market standing. TSMC, however, has expressed confidence, assuring that its N2 technology development is progressing well and is on track for volume production in 2025. The company aims for its technology to be the most advanced in both density and energy efficiency within the industry.

Samsung Aims to Narrow the Gap in Terms of Market Share with TSMC with 2nm Chip

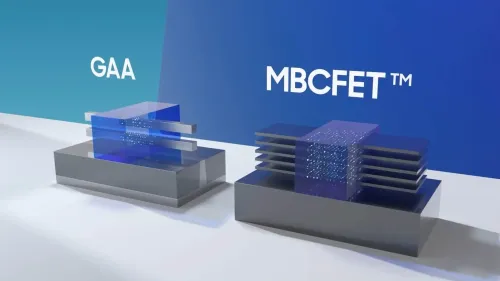

Samsung, which commands a 25% share of the global advanced foundry market compared to TSMC's 66%, perceives an opportunity to close the gap. The conglomerate initiated mass production of its 3 nanometer chips last year. The chip featured a new transistor architecture known as "Gate-All-Around" (GAA). US chip designer Qualcomm is reportedly planning to incorporate Samsung's "SF2" chip in its next-generation high-end smartphone processors. This marks a strategic shift after Qualcomm transferred most of its flagship mobile chips from Samsung's 4-nanometer process to TSMC's equivalent.

However, industry analysts caution that while Samsung was the first to bring its 3-nanometer chips to market. It has grappled with challenges related to the "yield rate." The yield rate measures the proportion of chips produced that meet the quality standards for shipment to customers. According to sources, the yield rate for Samsung's simplest 3-nanometer chip stands at just 60%, falling below customer expectations. Concerns are raised about the potential decline in yield rates for more complex chips, equivalent to Apple's A17 Pro or Nvidia's graphic processing units.

Samsung's Challenges in the 2nm Chip Industry

"Dylan Patel, chief analyst at research firm SemiAnalysis, expressed skepticism about Samsung's ambitious strides in semiconductor technology. Patel remarked, 'Samsung tries to do these quantum leaps. They can claim all they want, but they still have not released a proper 3-nanometer chip.' This skepticism underscores the challenges Samsung faces in delivering on its promises and achieving technological milestones. As competitors vie for supremacy in the semiconductor industry, the effectiveness of each company's execution in transitioning to advanced chip technologies remains a critical factor in determining market leadership."

Samsung faces challenges because its smartphone and chip design units compete for customers interested in logic chips. Professor Lee Jong-hwan from Sangmyung University in Seoul notes concerns about potential leaks due to Samsung's structure. On the other hand, former market leader Intel is showcasing its upcoming "18A" node at tech conferences. It is offering free test production to chip design firms and planning production in late 2024. TSMC's CEO, CC Wei, remains confident, stating their 3-nanometer variant is comparable to Intel's 18A in power, performance, and density.

Samsung and Intel aim to reduce reliance on TSMC for commercial reasons or concerns about a potential Chinese threat. AMD's CEO mentioned considering other manufacturing options for greater flexibility. Leslie Wu, CEO of RHCC consulting firm, highlights major customers seeking 2-nanometer technology prefer spreading chip production across various foundries. This is due to the risks of relying solely on TSMC. Mark Li, an Asia semiconductor analyst at Bernstein, questions the significance of geopolitical factors compared to TSMC's advantages in cost, efficiency, and trust. The evolving semiconductor landscape continues to witness intense competition, with each player vying for technological supremacy and market dominance.

Popular News

Latest News

Loading