China's Rare Earths Dominance: Limits Export of Gallium and Germanium

TechFriday, 22 December 2023 at 05:58

China's dominance in the rare earths market has come into sharp focus recently, as the country has limited the export of gallium and germanium, two essential materials for various high-end technologies and applications. This move has raised concerns about the potential impact on global supply chains and the consequences of such restrictions on other countries' industries.

A few days ago, China banned the export of relevant technologies. These technologies are used to separate and extract rare earth elements. According to Reuters, this ban by China is "...a further step towards protecting its dominance in several strategic metals."

China is a major player in the rare earth element market, otherwise, it will not introduce the ban. The Asian nation is the world's highest processor and miner of rare earth elements. Whether it is in terms of current mining activities or reserves, no other continent put together comes close to China.

The country has been systematically banning its rare earths from leaving China. Recall that on December 1st, it imposed a ban on different types of graphite. A few days later, it also imposed export permits for gallium and germanium. All these elements are chipmaking elements and this will affect chip production worldwide.

China's Dominance in Rare Earths

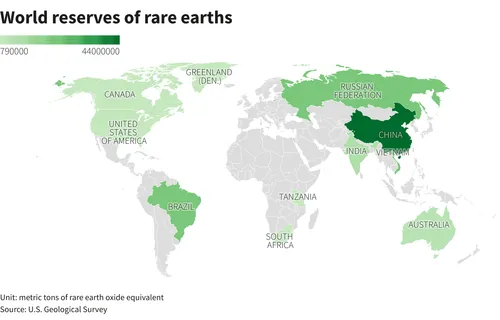

China is the world's largest producer of rare earths, accounting for 70% of global mine production in 2022. According to the United States Geological Survey (USGS), after China at 70%, the U.S., Australia, Myanmar and Thailand follow.

Source: USGS

The country's dominance in the rare earth supply chain extends to processing, where China is home to at least 85% of the world's capacity to process rare earth ores into materials. This strong position has allowed China to exert significant influence over the global rare earths market. Also, China currently has 89% of the world's neodymium and praseodymium, the key metals for EV magnets. However, consultancy Benchmark Mineral Intelligence forecasts that this value will dip to 75% in 2028. Even at 75%, it is still pretty high.

Reuters also reveals that most of the United States' rare earths come from China. Between 2014 to 2017, the U.S. was 80% dependent on China for rare earths. However, between 2018 and 2021, this value reduced to 74% which is still pretty high.

USGS data also reveals that China has about 44 million tonnes of rare earth oxide (ROE) equivalent in reserves. This accounts for 34% of the world total. Vietnam, Russia and Brazil are estimated to have just over 20 million tonnes each. India has 6.9 million, Australia has 4.2 million and the United States has 2.3 million tonnes.

Export Restrictions and National Security

China's decision to limit the export of gallium and germanium is a response to the U.S. Chips Act and other policies that the country perceives as threats to its national security. The export limitations on gallium and germanium are retaliatory, targeting industries and players that China feels have been attacked by the U.S. This move highlights the growing tensions between the two countries and the potential for further escalation in their economic and technological rivalry.

Impact on Global Supply Chains

The export restrictions on gallium and germanium could have significant implications for global supply chains, as these materials are crucial for various industries, including high-end solar cells, microchips for quantum computing, telecommunications, electric vehicles, defence, and more. The potential for China to limit rare earth or magnet exports is higher than before but still considered low and unlikely by some analysts.

Alternatives and Reducing Reliance on China

Western countries have been ramping up support to boost domestic production of critical minerals, including rare earths. Australia, Canada, the European Union, and the United States have set out policies and support packages to reduce their dependence on Chinese production. However, it is essential to consider that rare earths are difficult to separate from surrounding materials, and processing generates toxic waste. Therefore, alternative sources and production methods must be developed to reduce reliance on China's dominance in the rare earths market.

MP Materials (MP.N) of the United States mines rare earths in California and sends some of them to China for processing. MP set up a separation unit this year and made 50 metric tonnes of neodymium-praseodymium oxide in the third quarter. Tesla (TSLA.O) is moving away from rare earths in future models to reduce environmental and supply issues.

Conclusion

Rare earths are rather abundant but in low concentrations. They are typically found combined with another element or with radioactive elements like uranium and thorium. Rare earth's chemical characteristics make them difficult to separate from surrounding elements. Also, the processing of these elements can leave behind harmful waste.

China's dominance in the rare earths market, particularly its control over gallium and germanium, has raised concerns about the potential impact on global supply chains and the consequences of export restrictions on other countries' industries. As tensions between China and the U.S. continue to escalate, the allies of these nations need to get ready. U.S. allies will likely not get any support from China and they will have to look for alternative sources and production methods.

Author Bio

Efe Udin is a seasoned tech writer with over seven years of experience. He covers a wide range of topics in the tech industry from industry politics to mobile phone performance. From mobile phones to tablets, Efe has also kept a keen eye on the latest advancements and trends. He provides insightful analysis and reviews to inform and educate readers. Efe is very passionate about tech and covers interesting stories as well as offers solutions where possible.

Loading