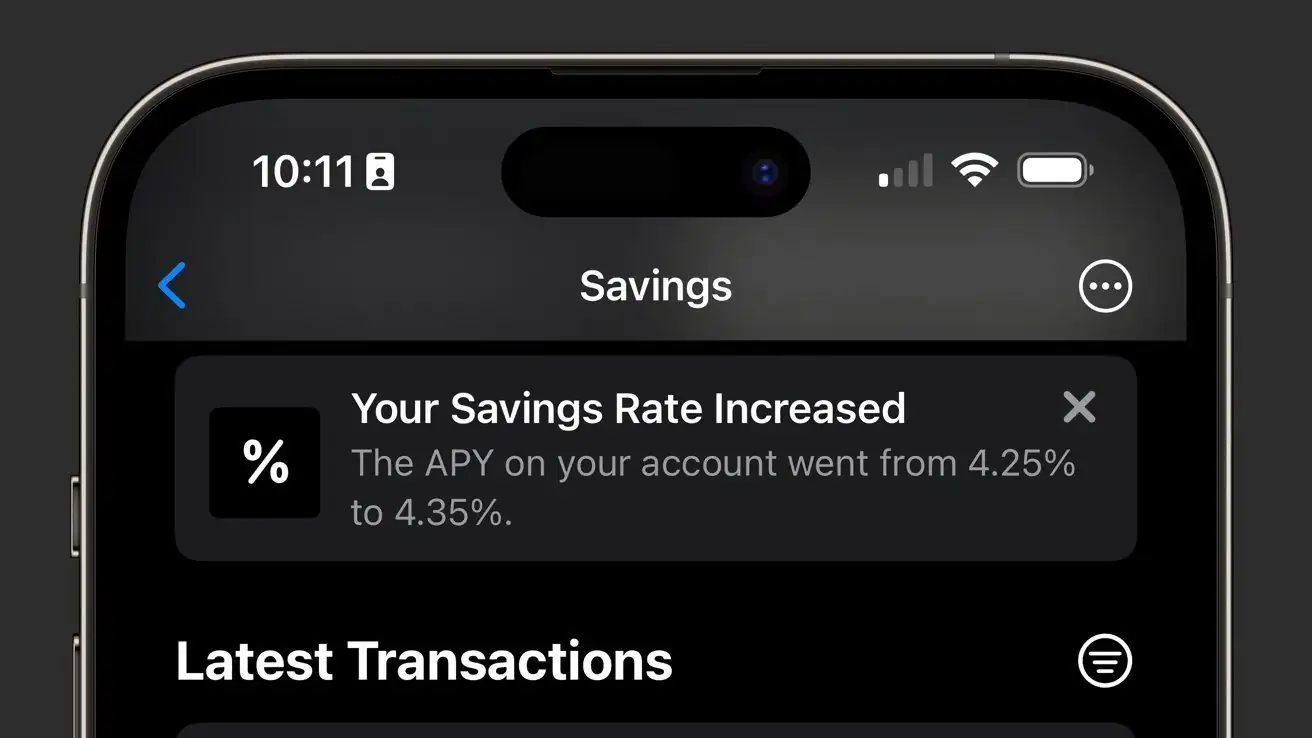

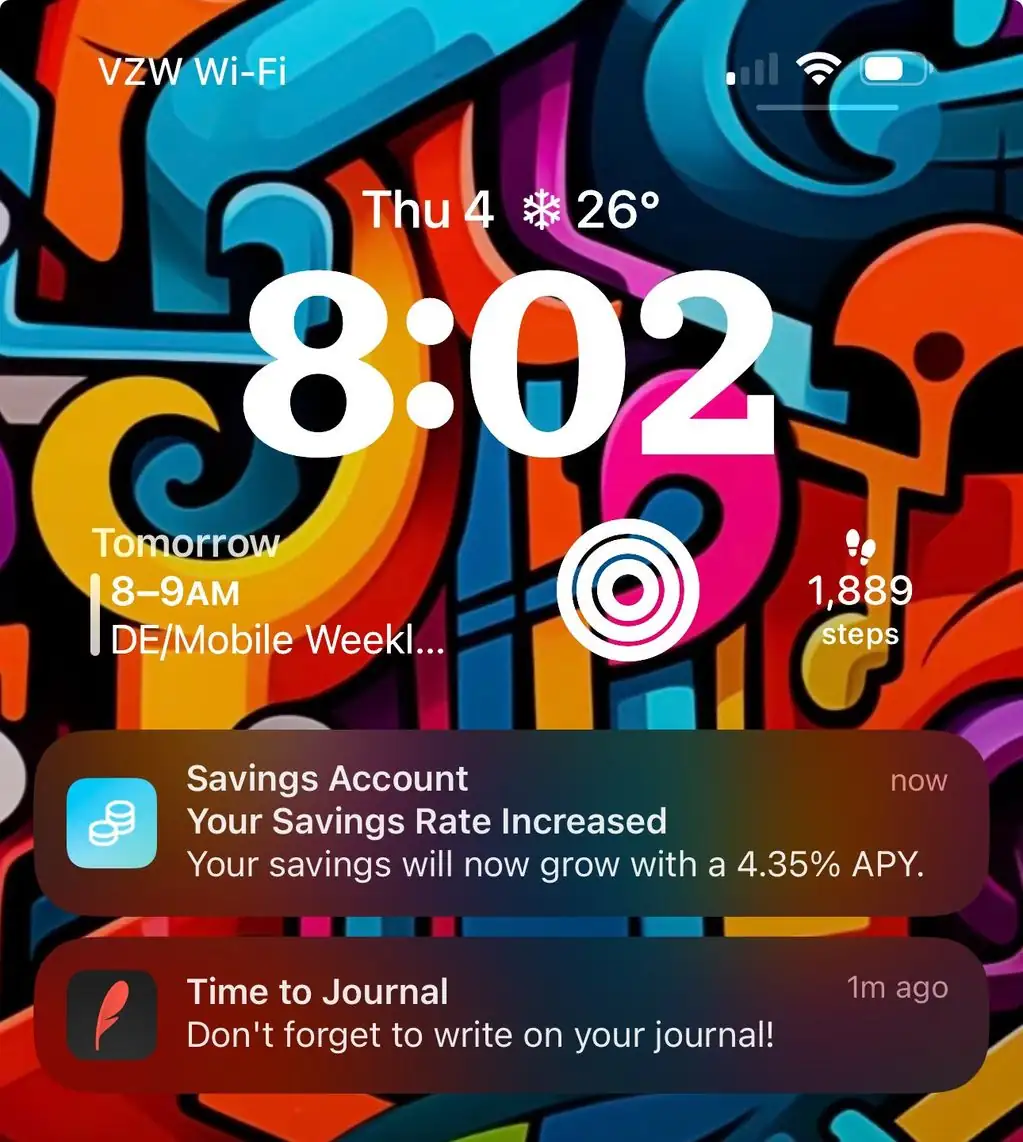

Apple has once again increased the annual percentage yield (APY) on its Apple Card savings account, this time to 4.35%. This marks the second consecutive increase in as many months, with the rate having been raised from 4.15% to 4.25% just last month. The move comes in the wake of multiple interest rate hikes by the Federal Reserve. According to the company, all the hikes by the Federal Reserve have not been reflected in the Apple Card Savings rate until now. Apple notified the US Apple Card Savings Account today that the annual interest rate on the savings account has increased.

Apple Card Savings Account

The Apple Card Savings Account is jointly launched by Apple and Goldman Sachs. It is currently only available in the United States. However, Apple and Goldman Sachs are currently discussing a “breakup” plan, and Apple is currently looking for a new partner. The Apple Card Savings account is a high-yield savings account offered to Apple Card holders, allowing them to grow their Daily Cash rewards while saving for the future. The account offers a competitive interest rate, with the APY having been 4.15% and recently increased to 4.35%.

Users can easily set up and manage their Savings account directly from the Apple Card in the Wallet app on their iPhone. All future Daily Cash earned is automatically deposited into the account. The account has no minimum deposits or balance requirements, and it charges no monthly fees. The maximum balance allowed for a Savings account is $250,000, and users can transfer money to and from the account. Users can also link this account to an external bank account.

Apple Card users can open a high-yield Savings Account through the iPhone Wallet app and start earning interest on their Daily Cash balance. Users can also earn interest on personal funds deposited into a savings account through a linked bank account or from their Apple Cash balance. Though the APR is 4.35%, it is well better than the industry average. Nevertheless, it trails other high-yield savings accounts, such as the 4.50% APR offered by Goldman Sachs through its in-house Marcus savings account.

Competitive Landscape

Apple introduced the Apple Card Savings account in April, offering a 4.15% APY to Apple Card holders. The account is provided by Goldman Sachs Bank USA and is exclusively available to Apple Card holders. The savings account has no monthly fees or minimum balance requirements, making it an attractive option for those already integrated into the Apple ecosystem.

The recent increase to 4.35% makes the Apple Card Savings account a more competitive option compared to other high-yield savings accounts in the market. For instance, Synchrony offers a 4.75% APY, while Capital One was at 4.50% at the time of the last check.

The Apple Card Savings account provides convenience for Apple Card holders. However, customers need to weigh the interest rate against other available options. Several high-yield savings accounts are currently offering rates of 5.15% APY or more, with the top nationwide rate at 5.40% APY. Therefore, it may be beneficial for individuals to consider alternative high-yield savings accounts to maximize their interest earnings.

Final Words

Apple’s decision to raise the APY on its savings account to 4.35% reflects a response to the broader interest rate environment. This makes the savings account option more competitive. However, users are advised to compare it with other available options. This is to ensure they are maximizing their savings potential.

Author Bio

Efe Udin is a seasoned tech writer with over seven years of experience. He covers a wide range of topics in the tech industry from industry politics to mobile phone performance. From mobile phones to tablets, Efe has also kept a keen eye on the latest advancements and trends. He provides insightful analysis and reviews to inform and educate readers. Efe is very passionate about tech and covers interesting stories as well as offers solutions where possible.