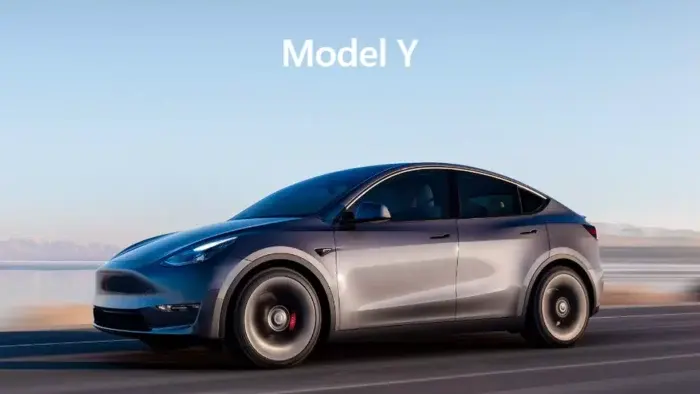

Tesla has recently announced significant price cuts for its Model Y across several European countries. These price cuts are coming after a similar price cut in China. According to the Investor Business Daily, Tesla has lowered the price of Model Y in Germany, France, the Netherlands and Norway.

Germany

Tesla’s German official website has confirmed the following price reductions

- The Model Y Standard Range+ was reduced by 1,900 euros to 42,900 euros, marking a decrease of 4.2% to 9.1%.

- The Model Y Long Range and Performance variants saw price cuts of 5,000 euros. This brings its prices to 49,900 euros and 55,990 euros, respectively.

- Tesla Model Y rear-wheel drive version price drops from 44,890 euros to 42,990 euros

- Tesla Model Y high-performance version drops from 60,990 euros to 55,990 euros

France, the Netherlands, and Norway

- In France, the Model Y prices were reduced by 5.7% to 6.7%.

- The price cuts in the Netherlands ranged from 4.3% to 7.7%.

- Norway saw reductions of 5.6% to 7.1%.

Tesla issued a notice on January 11 that due to a lack of required parts, the Berlin factory will almost completely suspend production from January 29. However, the company said that all is under control now and the factory will resume production on February 12.

As a factor for comparison, let us briefly take a look at the price cuts in China. After the price cuts, the new Model 3 and Model Y ushered in the lowest prices in the history of the Chinese market. The company cut 6,500 (839 euros) to 15,500 yuan (1999 euros) from these models. After the discounts, the starting price of the Model 3 is now 245,900 yuan (31,724 euros). However, the starting price of the Model Y rear-wheel drive version is 258,900 yuan (33,401 euros). Despite the price cuts, the Chinese models are still about 10,000 euros cheaper than the European models.

Why the price cuts

These price adjustments come in the wake of Tesla’s efforts to remain competitive in the electric vehicle (EV) market. This is particularly true after the end of EV incentives in various European countries. The company’s decision to lower prices is also influenced by the need to stimulate sales in the region. In Europe, EV demand has faced challenges due to changing subsidy programs and other market dynamics.

The price cuts are expected to make Tesla’s Model Y more accessible to consumers in these European markets, potentially boosting the company’s sales and market share. However, concerns have been raised about the impact of these price reductions on Tesla’s profit margins, especially amid ongoing supply chain disruptions and production challenges.

The average sale price per car fell by over $5,000 from the previous year. Analysts estimate that the average Tesla sold for $46,850 in the last quarter, down from $52,100 a year earlier. While these price cuts have juiced demand for Tesla’s electric vehicles, they have come at a steep cost.

Implication for the price cuts

Tesla’s recent price cuts for its Model Y in several European countries have significant implications for the company and the electric vehicle (EV) market. The price reductions are expected to make Tesla’s Model Y more affordable and accessible to consumers in these markets. It could also potentially boost the company’s sales and market share. This move is also expected to increase pressure on other EV brands to follow suit, leading to a potential “price war” in the industry. Please note that a “price war” is a good thing for consumers because different brands will be competing for the best prices. This means that consumers will get the products at lower rates.

Nevertheless, amid the supply chain and production issues, there are concerns about the impact of the price cuts on Tesla. The company’s decision to lower prices is also influenced by the need to stimulate sales in the region. However, this also means that its profit margin will plunge.

Recall that price reductions across the model lineup led to a decline in Tesla’s first-quarter net income, falling by 24% from a year ago. The company’s first-quarter operating margin also fell from 19.2% in the first quarter of the previous year to 11.4%. Also, Tesla’s core margins tumbled to 19% in Q1 and 18.1% in Q2, indicating a steady erosion of profit margins. The aggressive pricing strategy, including steep price cuts and discounts, has led to a decline.

Despite the price cuts, Tesla’s stock has shown resilience, with the company’s shares experiencing fluctuations in response to the news. The broader implications of these price adjustments on Tesla’s financial performance and market position will likely be closely monitored in the coming months.

Final Words

Tesla’s decision to lower the price of the Model Y in several European countries reflects the company’s strategic response to evolving market conditions and competitive pressures in the EV sector. The extent to which these price cuts will influence consumer demand and Tesla’s overall business performance remains a topic of interest for industry observers and investors. While these price reductions are expected to boost sales and market share, they also raise concerns about profit margins and the potential for a price war in the industry. The impact of these price adjustments on Tesla’s financial performance and market position will be closely watched in the coming months.

Author Bio

Efe Udin is a seasoned tech writer with over seven years of experience. He covers a wide range of topics in the tech industry from industry politics to mobile phone performance. From mobile phones to tablets, Efe has also kept a keen eye on the latest advancements and trends. He provides insightful analysis and reviews to inform and educate readers. Efe is very passionate about tech and covers interesting stories as well as offers solutions where possible.