India is the second largest mobile phone market in the world, behind just China. Thus, it is a very important market for many mobile phone brands. For many consecutive years, Xiaomi was the No. 1 mobile phone brand in India. However, it now looks like the company is beginning to lose its grip on the Indian market. The latest research report from Counterpoint via its Monthly India Smartphone Tracker shows that shipments in India remained flat last year, at 152 million units. The market only started to rebound in the second half of 2023 after a slow start in the first half. According to Counterpoint, the slow start of 2023 was due to “ongoing macroeconomic turbulence leading to low demand and an inventory build-up.” However, with 5G upgrades and massif festive sales, the second half was better.

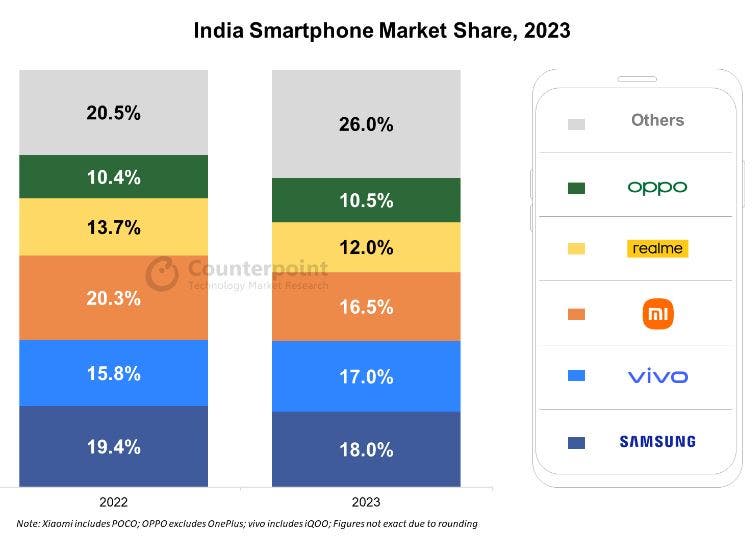

In terms of brands, the top five mobile phone brands in India are Samsung, Vivo, Xiaomi, Realme and Oppo. Samsung tops the list with a share of 18% in 2023, reaching the top spot for the first time since 2017. Vivo ranks second with a 17% share in 2023 and leads the entry-level high-end market with a 33% share. Xiaomi slipped to third place in 2023 but led with an 18.3% share in the fourth quarter of 2023. Xiaomi has been on top of the Indian mobile phone market since 2017. Samsung only took the top spot in the fourth quarter of 2022 and retained the position last year.

Although Apple is nowhere to be found in the top five brands in India, the company made more money. Apple’s shipments exceeded the 10 million mark, helping the company to top the list of natural annual revenue for the first time.

Counterpoint Expert Comments

Looking at the Indian mobile phone market dynamics, Counterpoint Senior Research Analyst Shilpi Jain said,

“Driven by the premium segment’s growth and 5G upgrades, India’s smartphone market grew 25% YoY in Q4 2023 after declining for a year. The elongated festive season further aided this growth, as the availability of steep discounts, easy financing schemes and lucrative promotions boosted demand. For many OEMs, the key focus during the year was on taking 5G to the lower segment driven by a shift in consumer preferences. 5G smartphone shipment share crossed 52% in 2023, growing 66% YoY. The last quarter (October-December) exited the market with healthy inventory levels compared to last year, setting the right tone for growth for next year. We believe the market will grow by 5% YoY next year driven by premiumization, diffusion of 5G in lower price bands and better macroeconomic conditions.”

About the competitive landscape and analyses on the brand level, Research Analyst Shubham Singh said

“Samsung led the market in 2023 with an 18% share driven by a strong performance of the A series, aggressive marketing in offline, and focussed approach in the premium segment. vivo ranked second with a 17% share and led the affordable premium segment in 2023 driven by CMF (Colour, Material, Finish)-focused V29 series in offline and T series in online. Xiaomi slipped to the third spot in 2023 but captured the top spot in Q4 2023 driven by its strategy to launch 5G phones in the affordable segment, offline expansion and a leaner portfolio.”

Flagship market

The flagship market (or premium segment) is for devices that cost over INR 30,000 (~ $360). The report reveals that more people are now buying flagship phones in India. This market saw a 64% growth year-on-year with users preferring to buy higher-priced phones.

Apple made more money in India because all its devices were flagships and it was able to sell 10 million premium phones. Also, the company placed much emphasis on the Indian market. Counterpoint reported that there was a “robust demand for both its latest and older iPhones.” Furthermore, Apple opened its retail stores in India and had regular promotions. This contributed to an increase in its offline shipments.

Other brands that did quite well

Though not in the top five, in addition to Apple, other mobile phone brands did quite well in India last year. One of them is OnePlus. The Chinese manufacturer grew by 33% year-on-year with a better product portfolio and also decent flagship segment. Transsion Holdings also did quite well with a 31% year-on-year increase driven by a hybrid channel strategy. The company also focused on the flagship segment with its Infinix brand. It also had special strategies like releasing a mobile phone with 8GB RAM and an OLED display for only $120. The likes of Google, Lava and Motorola also recorded growth in the Indian mobile phone last year. Google recorded a whopping 111% increase in shipments while Lava and Motorola recorded 36% and 13% respectively.

Final Words

The dynamics of the Indian mobile phone market, as revealed by the latest research report from Counterpoint, underscore a shifting landscape where traditional leaders like Xiaomi face new challenges from competitors like Samsung and Vivo. While Xiaomi has historically dominated the market, Samsung’s resurgence and Vivo’s aggressive approach have reshaped the top rankings.

The surge in demand for premium smartphones, indicated by the significant growth in the flagship market, highlights evolving consumer preferences and purchasing power. Apple’s strategic focus on the Indian market, coupled with its emphasis on premium devices and retail expansion, resulted in impressive revenue gains, despite not being among the top five brands in terms of shipments.

Moreover, the success stories of OnePlus, Transsion Holdings, Google, Lava, and Motorola reflect the diverse strategies and innovations driving growth in India’s mobile phone market. From product portfolio enhancements to hybrid channel strategies and value-driven offerings, these brands have capitalized on emerging trends and consumer demands to expand their market presence.

As India’s smartphone market continues to evolve, with 5G upgrades and a resurgence in demand bolstering growth, brands must adapt and innovate to stay competitive. The increased competition and changing consumer behaviours present both challenges and opportunities for manufacturers, emphasizing the importance of agility, differentiation, and customer-centricity in navigating the dynamic Indian market landscape.