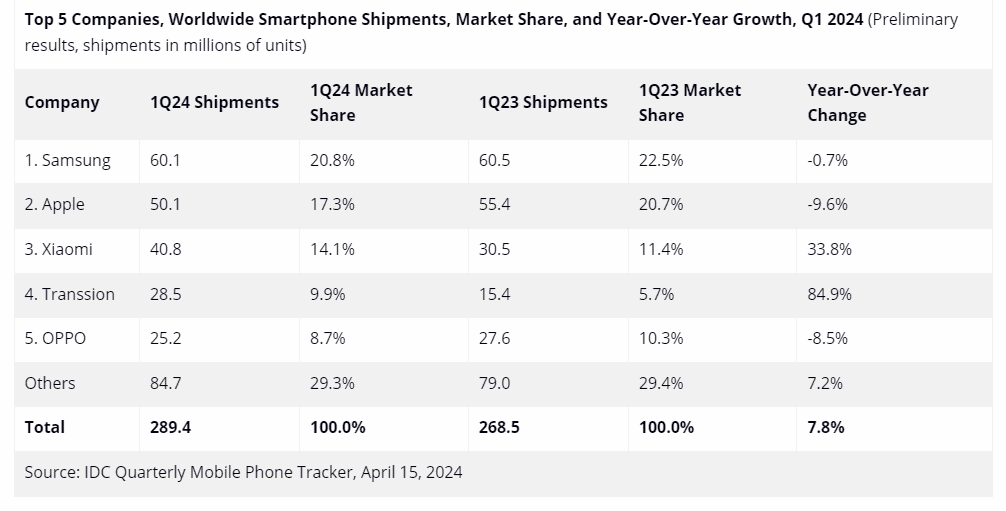

The first quarter of 2024 (Q1 24) witnessed a robust resurgence in the global smartphone market, defying economic headwinds in various regions. According to the IDC Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments surged 7.8% year-over-year, reaching a total of 289.4 million units. This marks the third consecutive quarter of growth, signifying a remarkable recovery from previous market turbulence.

The Global Smartphone Market: A Rebound Fueled by Innovation and Shifting Dynamics

A Shifting Landscape: Brand Performance and Market Share

Samsung emerged as the market leader in Q1 2024, shipping 60.1 million units and capturing a market share of 20.8%. While experiencing a slight decrease in shipments compared to Q1 2023, Samsung strengthened its market position. Apple, retaining the second spot, shipped 50.1 million units, securing a 17.3% market share. However, they faced a 9.6% decline in shipments compared to the same quarter last year.

Xiaomi presented a compelling story with a remarkable 33.8% increase in shipments from Q1 2023. Reaching 40.8 million units and claiming a 14.1% market share. This impressive growth propelled them to the third position in the market.

Transsion, a brand focusing on emerging markets, witnessed a phenomenal surge of 84.9% in shipments compared to Q1 2023. This translated to 28.5 million units shipped and secured them the fourth position with a 9.9% market share. OPPO, on the other hand, faced a decline of 8.5% in shipments compared to Q1 2023. Settling for the fifth position with 25.2 million units shipped and an 8.7% market share.

The “Others” category, encompassing a multitude of smaller brands, collectively shipped 84.7 million units, constituting a significant 29.3% of the market share in Q1 2024.

Market Recovery and Future Outlook

Ryan Reith, IDC’s group vice president, highlights the ongoing market recovery, particularly with leading brands like Samsung reclaiming the top spot. He acknowledges the dominance of Apple and Samsung in the high-end segment but emphasizes the potential disruption from resurgent players like HUAWEI in China and Xiaomi, Transsion, OPPO/OnePlus, and vivo. As the market strengthens, these brands’ advancements could force established leaders to explore new avenues for expansion. Reith anticipates that major players will solidify their positions as the recovery progresses, potentially posing challenges for smaller brands struggling to gain a foothold.

Key Trends and Insights: A Post-Recovery Landscape

Nabila Popal, research director at IDC’s Worldwide Tracker team, sheds light on two significant trends shaping the market. Firstly, consumers are increasingly opting for premium devices with extended lifespans, leading to a rise in device value and average selling prices (ASPs). Secondly, the power dynamic among the top 5 companies is undergoing a significant shift. As the market emerges from recovery, this trend is expected to persist, prompting market players to adapt their strategies to this evolving landscape. Popal emphasizes the need for players to navigate the challenges and opportunities presented by this post-recovery environment.

Beyond the Numbers: A Market Reshaped

Popal further emphasizes the transformation the smartphone market has undergone in the past two years. Xiaomi’s vigorous rebound from previous declines and Transsion’s strong global expansion solidify this change. While Samsung experienced a slight decline in shipments, their position remains relatively stable compared to recent quarters, suggesting potential for future growth. These dynamics showcase a competitive and evolving market where established players face increasing pressure from innovative upstarts.

Looking ahead, the global smartphone market is poised for continued growth, fueled by consumer demand for premium devices, technological advancements, and strategic shifts by key players. The ability to adapt and cater to evolving consumer preferences will be crucial for success in this dynamic landscape.