Study Reveals Dissatisfaction Among American Smartphone Users

PhonesThursday, 05 September 2024 at 03:10

The American smartphone market is the world's third largest. This market has seen a ton of innovation. Brands like Apple and Samsung are offering something new with each generation of phones. Despite that, it is experiencing a shift in consumer sentiment. Of course, there has been fierce competition from the Chinese manufacturers.

These companies release new features and functionalities year after year. Even with all these, a study finds that less and less Americans are satisfied with their smartphones.

32% of Americans Are More Likely to Switch Smartphone Brands

Despite their central role in daily life, Americans are less satisfied with their smartphones than with other industries. That includes banks, insurance companies, and internet providers. Several factors contribute to this dissatisfaction.

Wondering why? The high cost of premium smartphones has led to a perception of limited value for money. These smartphones often exceed $1,000. Short product life cycles and frequent new model releases can make devices outdated fast. For example, some phones start to miss out on features and software support just a year after release.

Additionally, power-hungry features like 5G and high refresh rates can strain battery life. A weak battery can lead to poor performance. That can make the phone feel sluggish. Durability, privacy concerns, software bugs, and inconsistent updates further contribute to user dissatisfaction.

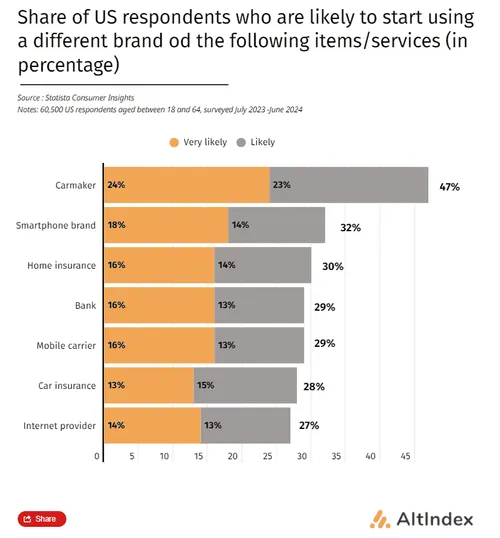

A survey by Statista Consumers Insights reveals the extent of this problem. 32% of American smartphone users plan to switch brands. Among them, 18% say that they are very likely to switch.

Image source: Altindex

What's rather interesting is that Americans are less satisfied with their smartphones than with banks, insurance companies, or internet providers. At least, that's what the Statista survey reveals. Only carmakers had higher levels of dissatisfaction in America. In that segment, 47% of respondents said that they are likely to switch.

Would This Impact the Phone Sales?

Despite growing dissatisfaction, smartphone sales in the US are not expected to be significantly impacted. Statista forecasts a 1.9% decline in revenue, amounting to $1.2 billion, in 2024.

Total spending on smartphones is predicted to reach $60.8 billion this year, down from $62 billion in 2023. The global smartphone market is also experiencing a similar trend. Over the next five years, annual sales revenue is expected to grow by only 4%, reaching $63.5 billion by 2029.

Popular News

Latest News

Loading