The idea of assembling iPhones entirely in the United States has once again surfaced following the Trump administration’s defense of “reciprocal tariffs.” The White House claims the country has the workforce and resources to manufacture iPhones domestically. However, analysts familiar with Apple’s operations argue that while American-made iPhones are not entirely impossible, such a move would be prohibitively expensive and logistically complex and

Apple currently produces more than 80% of its devices in China through contractors like Foxconn. Shifting even part of that vast production ecosystem to the U.S. would require significant time. It will also require large investments and policy stability—but there is no guarantee for any of these

Big cost jumps predicted for a U.S.-made iPhone

One of the primary concerns for American-made iPhones is cost. Labor expenses in the U.S. are far higher than in China, where Foxconn workers reportedly earned around $3.63 per hour during the iPhone 16 ramp-up. In contrast, the minimum wage in California is $16.50 per hour.

According to Bank of America Securities analyst Wamsi Mohan, this wage gap alone could raise iPhone 16 Pro prices by 25%, bringing the current $1,199 model up to around $1,500.

“While it may be possible to move final assembly to the U.S., moving the entire iPhone supply chain would be a much bigger undertaking and would likely take many years, if even possible,” Mohan wrote.

Wedbush analyst Dan Ives offered an even steeper estimate, pegging the cost of a fully U.S.-made iPhone at $3,500. He calculated that Apple would need to invest $30 billion over three years just to shift 10% of its supply chain to the U.S.

Tariffs and supply chain complexity add to the challenge

Beyond labor costs, Apple would face tariffs on most parts unless it could secure waivers. Components like the display, sourced from South Korea, and the processor, made by TSMC in Taiwan, are central to iPhone production. Apple’s dependence on global suppliers is a key factor in its pricing and supply strategy.

If Trump’s tariffs fully go into effect, a U.S.-made iPhone 16 Pro Max could increase in price by up to 91%, Mohan noted.

Skill shortages hinder U.S. production capacity

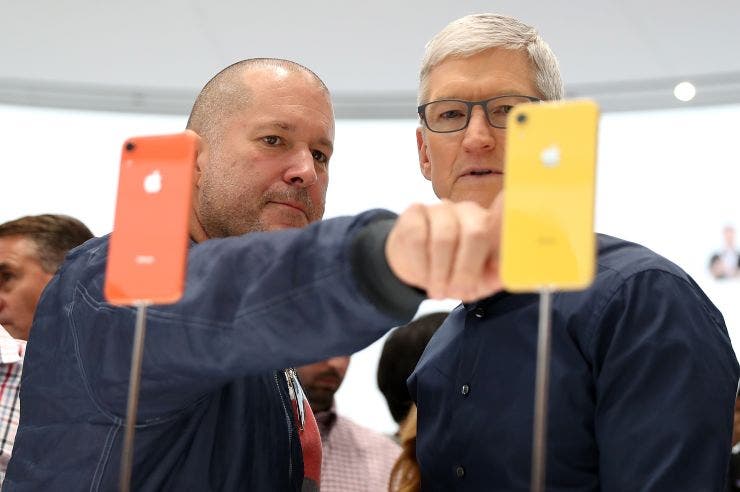

Even if cost were not a concern, Apple would still face structural limitations in the U.S. workforce. Apple CEO Tim Cook has previously pointed to a shortage of skilled labor—specifically, tooling engineers—as a significant barrier to domestic production.

“There aren’t enough tooling engineers in the U.S.,” Cook said in 2017. “The reason is because of the quantity of skill in one location, and the type of skill it is.” He added that a meeting of tooling engineers in China could fill “multiple football fields,” whereas in the U.S., it would be hard to fill even one.

Foxconn’s failed U.S. expansion casts a long shadow

Apple’s top supplier, Foxconn, attempted to establish a major manufacturing presence in Wisconsin following a 2017 announcement by Trump of a $10 billion investment. The plant was expected to create 13,000 jobs. Ultimately, it produced none of Apple’s core products, pivoting to face mask production during the pandemic. As of now, it only has about 1,454 jobs, and the facility is not even 100% ready.

Apple’s earlier expansion into Brazil also failed to fully localize iPhone production. Despite a $12 billion plant, it still had to import most components from Asia. In 2015, Brazilian-made iPhones cost nearly double those made in China.

Incremental domestic production is more realistic

While mass-producing iPhones in the U.S. may not be viable, analysts say Apple might pursue limited manufacturing runs for accessories or niche products. This strategy mirrors the company’s 2019 move to build the Mac Pro in Austin, Texas, after securing tariff exemptions.

“Given we now know that the Trump administration is willing to negotiate, we wouldn’t be surprised to see Apple commit to some small-volume production in the US (HomePod? AirTags?),” wrote Morgan Stanley analyst Erik Woodring.

Trump’s administration has praised Apple’s U.S. spending, including its $500 billion investment plan and the production of some AI server components in Houston. The Arizona plant by chipmaker TSMC, now making small batches of advanced semiconductors for Apple, represents one of the few successful examples of shifting key production steps to the U.S.

A patriotic iPhone, but at a high price

Despite pressure from Washington, experts remain skeptical about an all-American iPhone. “I don’t think that’s a thing,” said Needham’s Laura Martin. Jeff Fieldhack of Counterpoint Research added: “It’s just not a reality that on the time frame of imposing tariffs that this is going to shift manufacturing here. It’s pie in the sky.”

As the debate continues, Apple has chosen diplomacy over defiance. But unless the cost and skill barriers change dramatically, a red, white, and blue iPhone may remain a political dream rather than a retail product.