On June 19, Strategy Analytics came in with an interesting article. The latter is based on its report ‘Low-cost 4G Smartphones: Market Dynamics and Opportunities’. Also, it was combined with the latest industry developments, the current 2G/3G dropout trend analysis, and 4G user migration opportunities.

According to the Strategy Analytics’ latest wireless market forecast announced earlier this year, 2G and 3G users accounted for 46% of the total number of global mobile users. But they contributed only 27% of the total global mobile revenue. By 2023, the proportion of this income will drop to 10%.

Africa Still Uses 2G

However, Africa can be regarded as a special case. In this region, the ARPU value of each country is less than $2. So the subsidy to promote user migration has limited operational space.

Also Read: 2G Phones Still Sell More Than 5G Devices In China

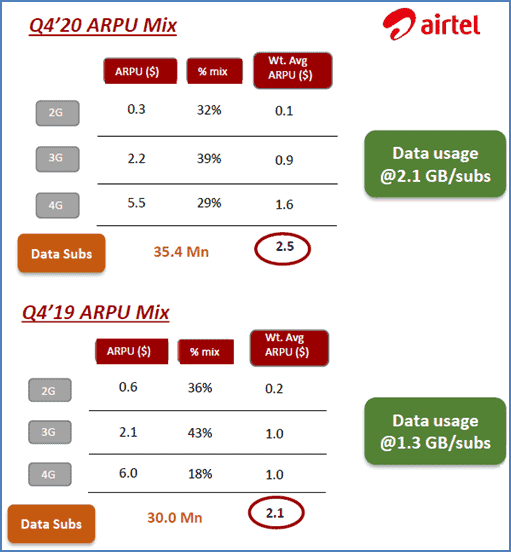

Anyway, Africa and other developing regions have also made good progress in promoting 4G services. For example, Africa’s Airtel’s 4G network expansion and ‘large packages’ have promoted users’ migration to 4G. In terms of average data usage and data ARPU values, all aspects have been greatly improved. In the past year, 3/4 of the revenue growth came from data. In March 2020, the proportion of 4G data users increased from 18% last year to 29%. 4G revenue accounted for Airtel data revenue was more than 60%.

Gizchina News of the week

Many Operators Are Switching To 4G And Higher

More and more operators have announced 2G/3G de-networking plans. In this regard, some countries in North America and Asia-Pacific are at the forefront of the global 2G/3G de-networking process. But besides them, other countries are working on 4G migration as well. For example, the Indian market has accelerated to 4G. India Airtel has closed its 3G network in phases; FoneZiggo closed 3G in the Netherlands in February; Telia and Telenor’s Danish joint venture TT-Netvaerket will phase out 3G from April 2021; Vodafone’s CTO also talked about closing 3G Europe by 2022 at a recent Vodafone business analyst meeting.

Strategy Analytics believes that the withdrawal of 2G usually requires a long time to prepare, especially when it comes to the migration of 2G IoT services. In this case, operators may focus on shutting down the 2G smartphone business and only reserve a 2G thin network to provide services for 2G Residue Link users. In Africa, we also need to pay attention to the importance of the 2G USSD function for mobile payment services. This is an important source of income for some operators.