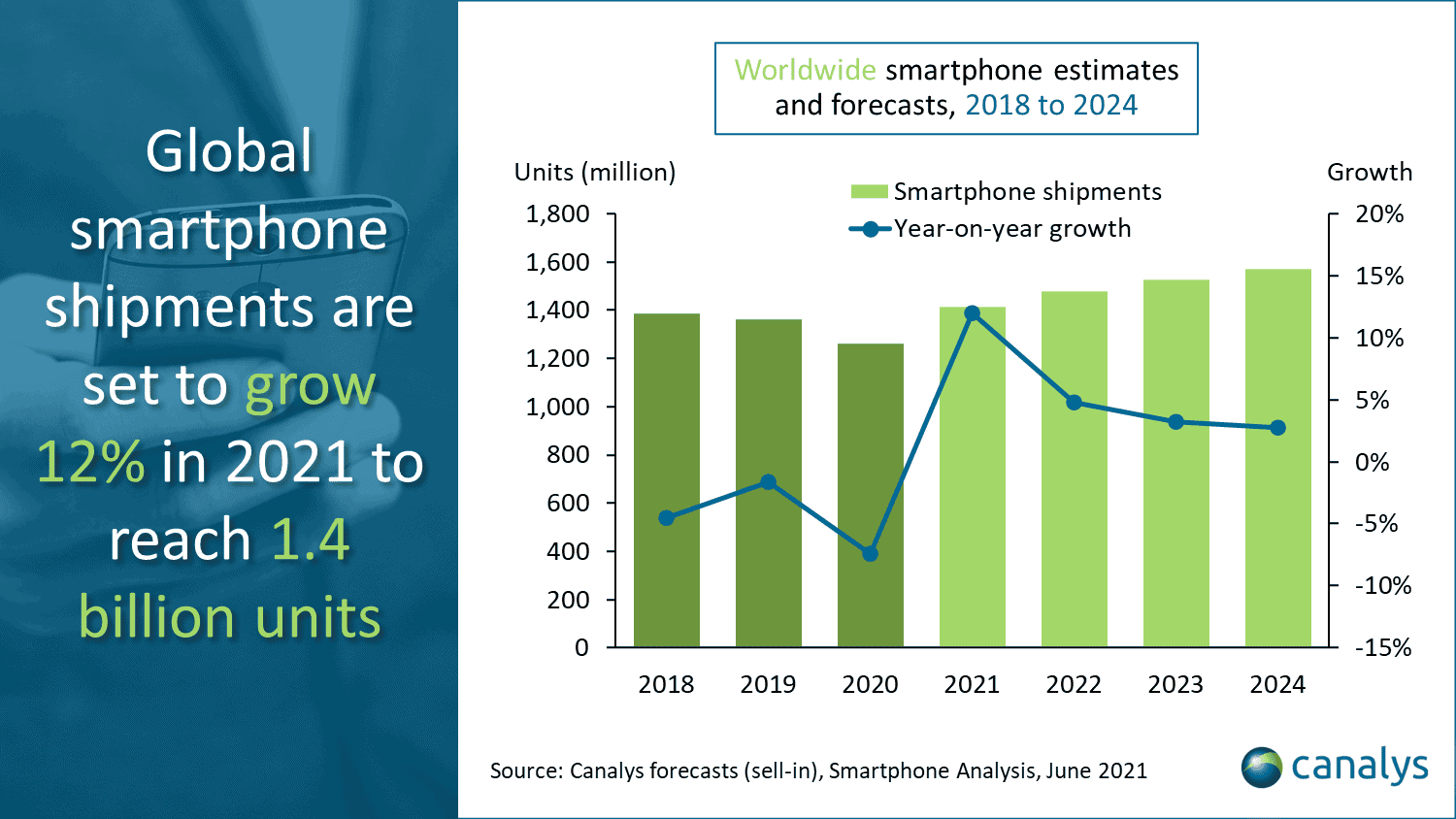

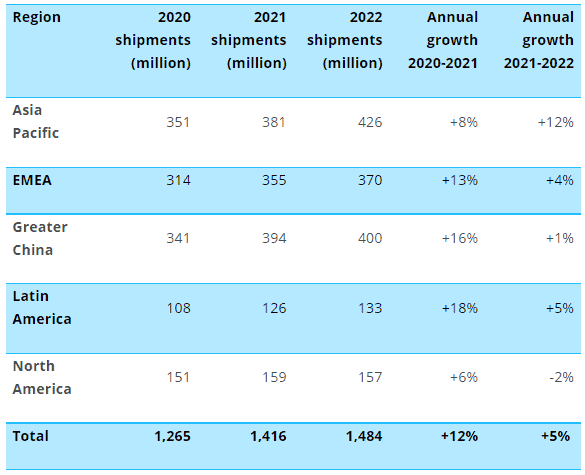

Since February 2020, all industry spheres tumbled into darkness. But at that time, no one could predict that we will feel the consequences on our skins for many years. Now, when the market is suffering of the chip shortage problem, we understand that COVID-19 will still exist in our lives for longer time than thought. But today, Canalys issued a report which shows the latest forecast data referring to the global smartphone market. According to the report, it will grow by 12% in 2021, and smartphone shipments will reach 1.4 billion units.

Smartphone Shipments Will Grow

The report pointed out that compared with 2020, smartphone shipments have achieved a strong recovery. Last year, smartphone shipments fell by 7% due to the severe restrictions on the market. The new coronavirus vaccine continues to reach various countries and the momentum of the new coronavirus epidemic weakens. But there have been predictions that the supply of parts and components will become a new bottleneck in the smartphone industry.

Gizchina News of the week

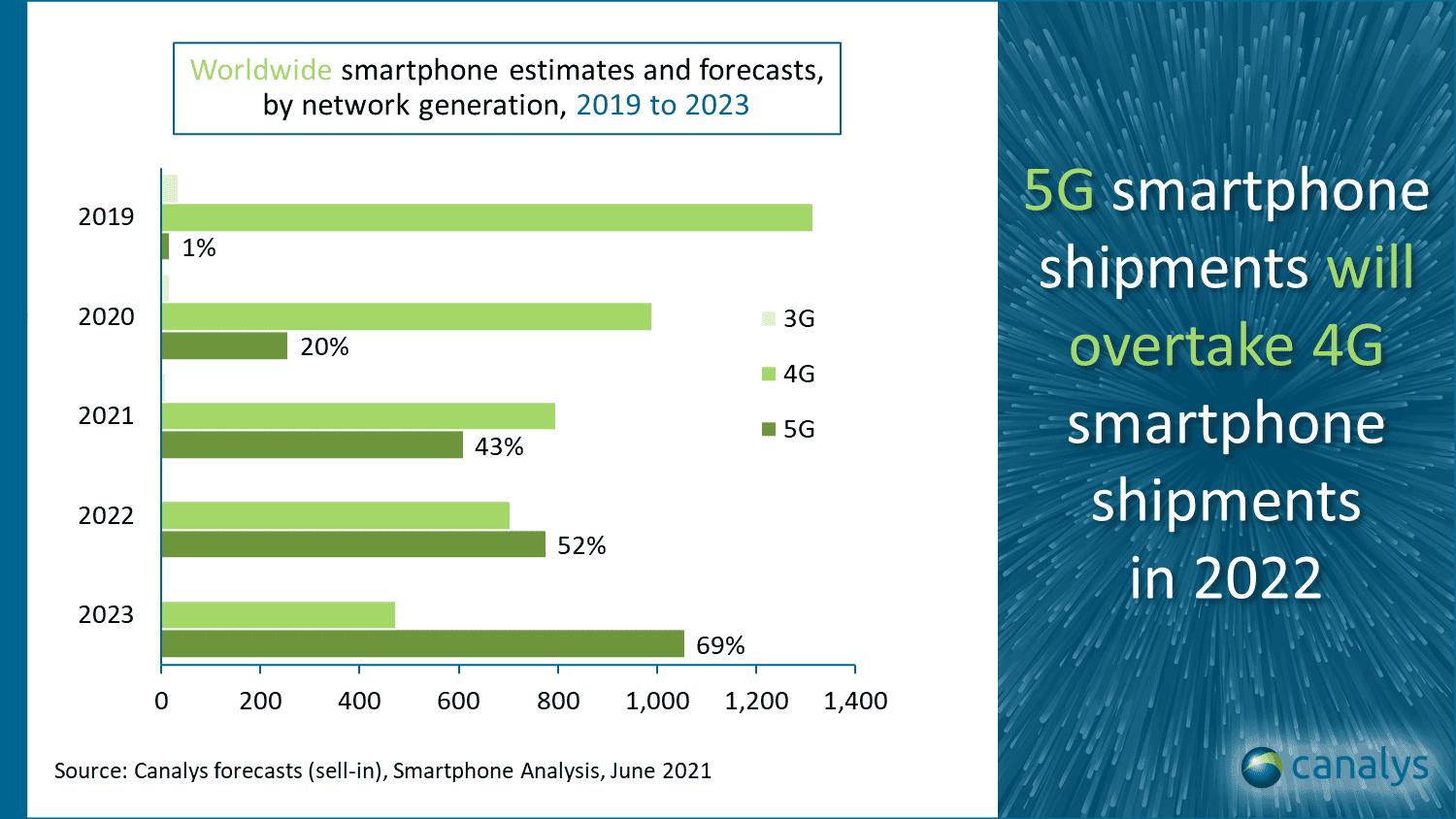

As Canalys Research Manager Ben Stanton says, “The smartphone industry’s resilience is quite incredible. Smartphones are vital for keeping people connected and entertained. And they’re just as important inside the home as outside. In some parts of the world, people have been unable to spend money on holidays and days out in recent months. So many have spent their disposable income on a new smartphone instead. There is strong momentum behind 5G handsets. They accounted for 37% of global smartphone shipments in Q1. Also, they should account for 43% for the full year (610 million units). This will be driven by intense price competition between vendors, with many sacrificing other features, such as display or power, to accommodate 5G in the cheapest device possible. By the end of the year, 32% of all 5G devices shipped will have cost less than US$300. It is time for mass adoption.”

New Opportunities

He also added that “Channels had to transform or die during the pandemic, and this forced innovation. Developed countries have seen an online surge, which has forced retailers to reassess their offline footprints. As a result, many stores will close this year. And for those that stay open, their purpose will be reimagined for customer support and order fulfilment, as customers increasingly use multiple channels during the purchase process. Innovations driven by COVID-19, such as unified stock and delivery to car, are helping shift retailers toward their consolidated omnichannel vision. And centralized procurement will also give the channel more negotiating power with smartphone brands and may cause some retailers to attempt to bypass distribution to build new direct relationships. The new normal for the smartphone industry is as ruthless and competitive as the old one.”