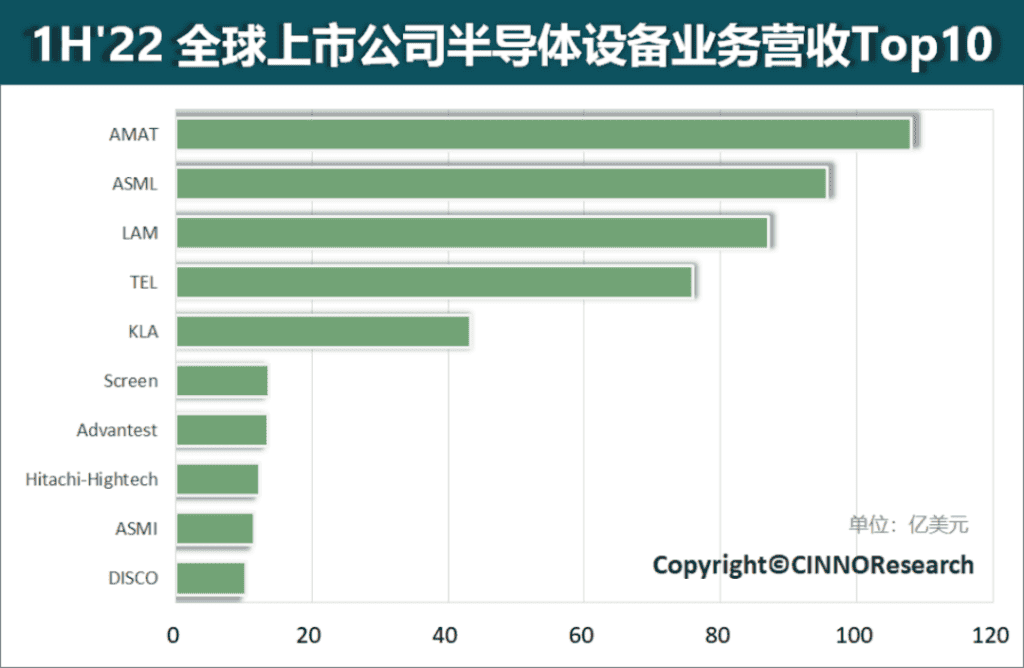

The global semiconductor market has been facing a tough time with chip shortages and other issues. The supply chain is struggling while the companies that buy the chips are cutting down their orders. However, this will not stop the production in the industry. A recent report from CINNO Research reveals the top 10 global semiconductor equipment companies by revenue. According to the report, in the first half of 2022, the total semiconductor business revenue hits $47.3 billion. This is an increase of 4.2% year on year and a month on month decrease of 7.6%. In the second quarter of 2022 alone, the total revenue hit $23.9 billion. This is for the top 10 global semiconductor equipment business revenue rankings. This revenue is also basically the same as the total revenue in Q1’22.

Interestingly, the top 10 global semiconductor manufacturers’ rating for the first quarter of 2022 is similar to the ranking for the first half of 2022. However, there is a slight change in the ranking. The ranking is for only companies in the global listing. Another interesting aspect of the list is that all the companies come from three countries. We have Japan, the U.S. and the Netherlands. While Japan clearly dominates the list with five slots, the U.S has three slots while the Netherlands has two slots.

Top global semiconductor manufacturers

The report shows that the American company, Applied Materials (AMAT) 1H’22 revenue exceed $10 billion dollars. The company ranks first in the top 10 global semiconductor manufacturers ranking. In the second position is the Dutch company, Advanced Semiconductor Materials Lithography (ASML). The company had to recover four positions to sit in the second position in H1 2022 ranking. An American company, Lam Research remains in the third position. This is the same position it occupies in the Q2 2022 ranking. Japanese company Tokyo Electron (TEL) sits in the fourth position in the first half of 2022. It drops from second place to fourth place in Q1’22 ranking to fourth. In terms of revenue, the top four semiconductor manufacturers have a revenue of over $7.6 billion. This is, of course, the semiconductor business revenue for the four companies in the first half of 2022.

Note: Exchange rate for this ranking

- 1 EUR = 1.20 USD

- 1 JPY = 0.009 USD in 2021

- 1 EUR = 1.04 USD

- 1 JPY = 0.007 USD in 2022.

Also, this revenue ranking is based on the revenue of the semiconductor business. It excludes the revenue of other businesses such as FPD and PCB.

1. Applied Materials (AMAT) – USA

This company is the world’s largest semiconductor company. Its business runs through almost the entire semiconductor process. Its products include thin film deposition (CVD, PVD, etc.), ion implantation, etching, and rapid heat treatment. It also has chemical mechanical planarization (CMP) as well as measurement and testing equipment. In the first half of 2022, its revenue soars by 1.0% year on year. However, in comparison with the previous month, there is a 4.8% decrease.

2. ASML – Netherlands

ASML is the world’s largest lithography machine equipment company. It is the only EUV lithography machine equipment brand in the world that can provide a 7nm advanced process. In the first half of 2022, its semiconductor business revenue fell 5.1% YoY and 22.2% MoM. Due to rapid shipment, its exact revenue will likely delay until 2023. However, the customer needs to complete the factory verification to confirm the revenue.

3. Lam – USA

Lam, or Lam Research is an American supplier of wafer fabrication equipment. It also offers its services to the semiconductor industry. The company mainly engages in etching equipment, thin film deposition equipment and cleaning equipment. In the first half of 2022, its business records a revenue increase. Year on year, it has an 8.8% increase while its month on month increase is 1.9%.

4. Tokyo Electron (TEL) – Japan

Tokyo Electron is Japan’s largest semiconductor equipment company. Its main business includes semiconductor and flat-panel display manufacturing equipment. The company’s products include coating and developing equipment, heat treatment equipment, and dry etching equipment. It also produces chemical vapor deposition equipment, wet cleaning equipment and testing equipment. In the first half of 2022, its business revenue fell 1.4% YoY and 12.1% MoM.

5. KLA – USA

KLA is an absolute leading company in semiconductor process inspection and measurement equipment. Its products also include defect inspection, film thickness measurement, CD measurement, registration accuracy measurement and other inspection equipment. In the first half of 2022, its business revenue increased by 32.3% year on year. However, its month on month increase is only 7.2%.

6. Screen Semiconductor – Japan

The main business of Screen includes semiconductors, flat panel displays and printed circuit board manufacturing equipment. However, its products include etching, glue development and cleaning equipment. In the first half of 2022, its business revenue increased by 10.6% year on year. However, it records an 11.4% month on month decline.

7. Advantest – Japan

The Japanese semiconductor companies mostly engage in semiconductor testing and mechatronics system testing systems. Its products include back-end testing machines and sorting machines. In the first half of 2022, its business revenue increased by 10.3% year on year. Month on month, it also records a 4.1% increase.

8. Hitachi HighTech – Japan

This company mainly engages in equipment such as electron microscopes, FPD equipment and medical analysis equipment, etc. Its products include deposition, etching, testing equipment, and packaging and placement equipment. In the first half of 2022, its business revenue increased by 12.7% year on year. Also, it has a 29.8% increase in revenue month on month.

9. ASM International (ASMI) – Netherlands

The main business includes deposition equipment for the semiconductor front end. Its products include thin film deposition and diffusion oxidation equipment. In the first half of 2022, its business revenue increased by 19.3% year on year. It also records a 4.0% month on month revenue increase.

10. Disco – Japan

This company is the world’s leading brand for wafer cutting equipment. It mainly engages in various types of precision cutting, grinding and polishing equipment. In the first half of 2022, its business revenue increased by 7.0% YoY and decreased by 16.1% MoM.