Apple is one of the major brands that hold onto TSMC’s manufacturing capacity. The American brand is so important to TSMC that it even gets some preferential treatment. Due to chip shortages and other issues in the chip industry, many brands, even top brands cut down their chip orders. However, initial reports claim that these situations will not affect Apple and it will retain its orders. The reports also claim that Apple will be the only major customer of TSMC’s 3nm process this year. Nevertheless, it now seems like Apple is also feeling the heat, its orders with TSMC appear to have been reduced.

A popular Weibo tech blogger whose name roughly translates to @CellPhoneChipExpert and who gets first-hand news about the semiconductor industry claims that Apple has once again reduced the number of wafers put into production. According to his report, the decline this time is very large. It is as high as 120,000 pieces of N7, N5, N4 plus some N3 production lines.

Previous reports and leaks claim that Apple’s A17 for the iPhone 15 Pro / Pro Max this year will use TSMC’s N3 process. Also, the M2 Ultra / M3 may also use it. As for Apple’s recent iPhones, the A14 Bionic and A15 Bionic use TSMC N5 and N5P processes respectively. Both processes belong to the 5nm family. The A16 Bionic uses TSMC N4 which also belongs to the 5nm family. The M1 series is based on the N5 and N5P processes, and the M2 series of chips seem to use the N4 process. Of course, as for the N7 he mentioned, it is obviously the A13 chip used in the Studio Display monitor. The iPad 9 also uses this process but its current demand is not very high.

TSMC’s 3nm foundry quotation is as high as 20,000 US dollars

According to Digitimes, TSMC has completely defeated Samsung Electronics in the 7nm and 5/4nm battles. This is because Samsung’s 5/4nm and 3nm GAA foundry yields are too low. For this reason, many brands are aligning with TSMC. As things stand now, TSMC is way stronger than Samsung. TSMC’s 3nm will still be full of orders even if it continues to use the original FinFET technology.

According to reports, in addition to Apple and the delayed Intel, firms like Qualcomm, MediaTek, and Nvidia are said to have already reserved production capacity at TSMC for the years 2023 and 2024. This will obviously lead to a good increase in downstream costs. This expense is anticipated to be passed on to customers and end users through Apple’s iPhone 15 and other goods. The price increase will be quite noticeable. The market worries that many new products won’t be able to reach their prior targets in this era of low prices.

Gizchina News of the week

Major brands run to TSMC

Insiders in the semiconductor industry claim that since the start of the 5nm development, Samsung has been unable to resolve the yield issue. As a result, Qualcomm, which had initially requested Samsung, had to request aid from TSMC. Its most recent Snapdragon 8 Gen 2 still uses TSMC 4nm technology. Samsung’s ability to raise production rates is limited in the near term. Also, collaboration with the advanced manufacturing process had to begin a year and a half ago. Thus, even making an order with Samsung is merely symbolic.

In addition to Nvidia’s H100 order for TSMC 4nm, the RTX 40 series with the largest order scale has also shifted to TSMC 4nm. Coupled with the largest customers Apple and MediaTek, TSMC’s 5/4nm production capacity utilization rate is still at full capacity. This also complements the 7nm order gap.

After entering the 5/4nm generation, except for Samsung itself, almost all chip companies including Intel have cooperated with TSMC. Intel has already booked a large number of 3nm production capacity. However, the mass-produced N3 in the fourth quarter of this year do not have enough production capacity. Intel had to readjust and revised its roadmap so that the current main customer of the 3nm process is Apple.

It is rumored that TSMC’s N3E and other processes will be fully launched in 2023. However, very few clients currently have the funds to do so. Also, the immediate need for 3nm chips is low. The 5nm advanced chips are doing quite well for now.

Chip prices

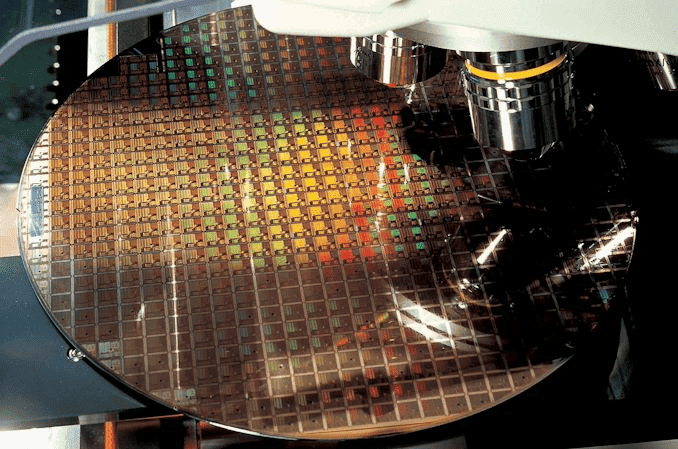

According to Digitimes, TSMC released a 90nm chip quotation in 2004 for around 2,000 US dollars. However, by 2016 the price of 10nm had increased to 6,000 US dollars. After entering the 7nm and 5nm process generations, it suddenly broke through 10,000, with 5nm reaching as high as 16,000 US dollars. This figure still does not account for TSMC’s 6% increase in 2023.

According to reports, NVIDIA’s RTX 4090 GPU has increased by 5–10% since the 3090 was released in the same period of 2020. The starting price of the RTX 4080 has increased by 20–30% since the RTX 3080 was launched in the same period of 2020. The ascending tactic has been questioned.

Despite the restricted performance offer, Huang Renxun openly stated that the price increase for new products is fair because the quote of a 12-inch wafer foundry has increased significantly in comparison to the past and is not just slightly more expensive.

According to the most recent estimate from market research company Strategy Analytics, TSMC’s foundry income will surpass $20 billion in the third quarter of 2022, surpassing the total of all other manufacturers (including Samsung). In the third quarter, Buffett also added to his holdings in TSMC, which currently has a market valuation of about $4.1 billion.