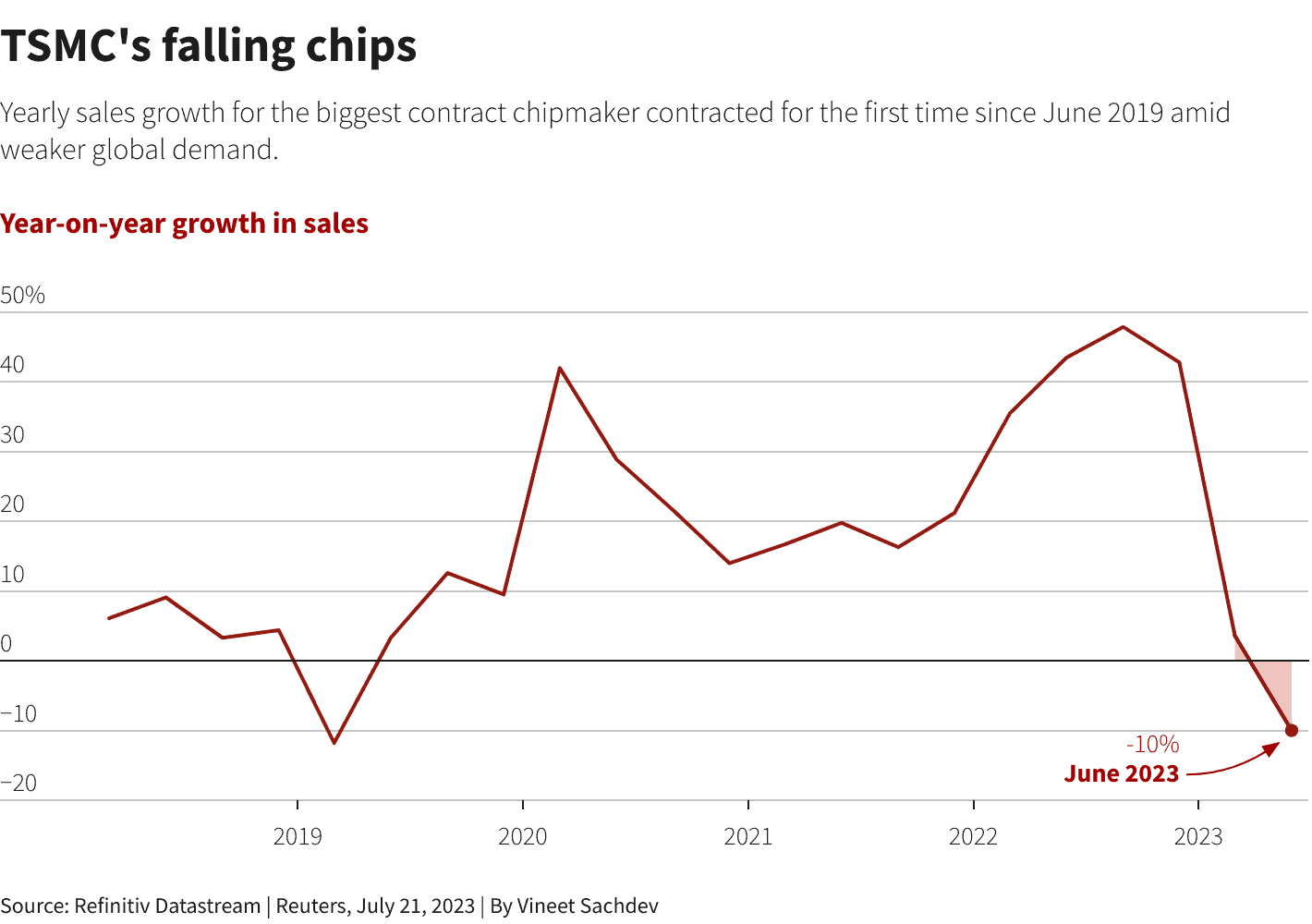

On July 21, Reuters reported that shares of Taiwan’s TSMC (Taiwan Semiconductor Manufacturing Company) experienced a significant drop of over 3% in value. This decline was in response to TSMC’s announcement, where the world’s largest contract chipmaker projected a 10% decrease in sales for the year 2023. Additionally, TSMC revealed that it would delay its Arizona plant production which it initially planned to begin next year.

The previous day, TSMC had reported a sharp 23.3% decline in net profit for the second quarter of the year. This marked the first time since the second quarter of 2019 that the company experienced a year-on-year drop in quarterly profit. The decline in net profit was attributed to the ongoing global economic challenges. These challenges have affected the demand for chips used in various industries, including automotive and mobile devices.

On Friday, shares of Taiwan Semiconductor Manufacturing Co Ltd (TSMC) closed with a decline of 3.28%, in contrast to the broader market index, which experienced a 0.78% loss (.TWII).

TSMC Shares Dropped but Outlook Looks Promising

Regarding TSMC’s Q2 2023 earnings report, Brady Wang, an associate director at Counterpoint Research, stated that the results presented a mixed picture. While the company’s revenue and profit decline were disappointing, there are positive indicators for its long-term growth prospects. Wang emphasized that despite facing challenges from macroeconomic conditions, TSMC’s outlook remains promising. He expects the company to benefit from significant technological trends. These include the widespread adoption of 5G and the growing demand for high-performance computing (HPC) solutions. These factors are likely to support TSMC’s growth in the future.

Gizchina News of the week

As part of its global expansion efforts, TSMC has encountered a delay in production at its first plant in Arizona. Due to this, it has postponed production until 2025. The delay is attributed to a shortage of specialized workers required for the plant’s operations.

TSMC Surpassed its Q2 Market Forecast

Despite the production delay, TSMC’s earnings for the quarter ending in June were T$181.8 billion ($5.85 billion), surpassing market forecasts. While the company has revised its full-year revenue outlook, analysts anticipated this adjustment.

Goldman Sachs, in a research note, mentioned that the downward revision in revenue guidance might be the final one for TSMC. The research note highlighted that the ongoing inventory correction cycle is likely to end in the fourth quarter of 2023. As a result, Goldman Sachs remains optimistic about TSMC’s prospects. It expects the company to experience strong growth in 2024, positioning it favorably for the future.

According to other analysts, the delay in TSMC’s U.S. expansion is not surprising and was already anticipated by investors.

Moreover, analysts remain positive about TSMC’s future prospects, particularly due to the strong demand for artificial intelligence (AI) chips. These chips currently contribute approximately 6% of the company’s total revenue. Citi Research analysts expressed optimism about this. It states that TSMC’s leading position in AI chip manufacturing will likely lead to a solid outlook for the company from 2024 onwards. This indicates that TSMC’s expertise and capabilities in AI chip production position it favorably to capitalize on the growing demand for AI-related technologies in various industries.