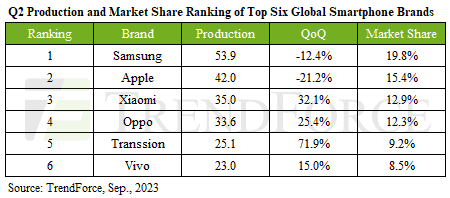

The global smartphone market is in dire straits due to the ongoing economic downturn. The numbers from TrendForce paint a grim picture. In the first quarter of this year, smartphone sales plummeted by nearly 20%. Followed by a 6.6% drop in the second quarter.

So far, 2023 has been nothing short of a disaster. With 272 million smartphones manufactured in Q2, the total for the first half of the year stands at 522 million units. That’s a staggering 13.3% decline compared to the same period in 2022.

Different companies have weathered the storm differently. Samsung, with 53.9 million units produced in Q2 (a 12.4% drop from Q1), maintains its lead with a market share just under 20%. However, the launch of the Galaxy Z foldables in Q3 might be their saving grace, as the Galaxy S23 series struggled to find buyers.

Apple, typically facing a tough Q2 as people await the next iPhone release, is grappling with production issues for the new generation. Their success in Q3 is uncertain, and TrendForce suggests that Apple could leapfrog Samsung if the iPhone 15 series exceeds expectations.

Xiaomi, including its Redmi and Poco brands, increased production by a notable 32.1% compared to Q1, totaling 35 million units. This boost allowed them to surpass rival Oppo and claim the third spot.

TrendForce Report: Global Smartphone Sales Plunge to Record Low

Oppo, including Oppo, Realme, and OnePlus phones, slipped to fourth place despite a 25.4% quarterly production increase, reaching 33.6 million smartphones. Strong performances in Southeast Asia and other markets in Q2 may keep them neck and neck with Xiaomi in Q3.

In a surprising turn of events, Transsion, including Tecno, Infinix, and itel, entered the Top 5 for the first time, displacing vivo. Their foray into the mid-to-high-end market played a pivotal role in this achievement. As their production spiked by a staggering 71.9% from Q1 to Q2.

Vivo, including iQOO, now occupies the sixth spot, with a relatively modest 15% production increase. Reaching 23 million units, compared to Transsion’s 25.1 million.

The first half of 2023 marks the lowest point in global smartphone production over the past decade. Unfortunately, the outlook for the next year remains bleak, with TrendForce forecasting only a minor 2-3% annual increase.

“Demand in consumer markets such as China, Europe, and North America has not shown a significant rebound as we move into the second half of the year. Even if economic indicators in the Indian market improve, it is still difficult to reverse the global decline in smartphone production. TrendForce predicts that the smartphone market may undergo another shift in Q2 this year due to poor global economic conditions, and production for the second half may consequently be further reduced. Looking ahead to 2024, the current economic outlook is not optimistic. TrendForce maintains its forecast of a 2~3% annual increase in global production, depending on regional economic trends. Whether this will further drag down production remains to be seen” TrendForce analysts report.

Gizchina News of the week

Potential reasons for the decline in the global smartphone market and insights into how the market may recover

Here are the potential reasons for the decline in the global smartphone market and insights into how the market may recover:

- Economic downturn: The global economy is facing a number of challenges, including rising inflation, supply chain disruptions, and the ongoing war in Ukraine. These factors are making consumers more cautious about spending money, which is putting a damper on demand for new smartphones.

- Rising prices: The prices of smartphones have been rising in recent years, due to factors such as the increasing cost of components and the rising cost of labor. This is making it more difficult for consumers to afford new smartphones, especially in developing countries.

- Saturation of the market: The global smartphone market is becoming increasingly saturated. There are now billions of smartphones in use around the world, and many consumers are holding onto their devices for longer periods of time. This is reducing the number of new sales being made.

- Lack of innovation: In recent years, there have been fewer major innovations in the smartphone market. This has made it more difficult for manufacturers to differentiate their products and attract new customers.

Things that manufacturers can do to help the market recover

Here are the things that manufacturers can do to help the market recover:

- Focusing on affordability: Manufacturers need to make smartphones more affordable for consumers. This could involve reducing prices, offering discounts, or introducing financing options.

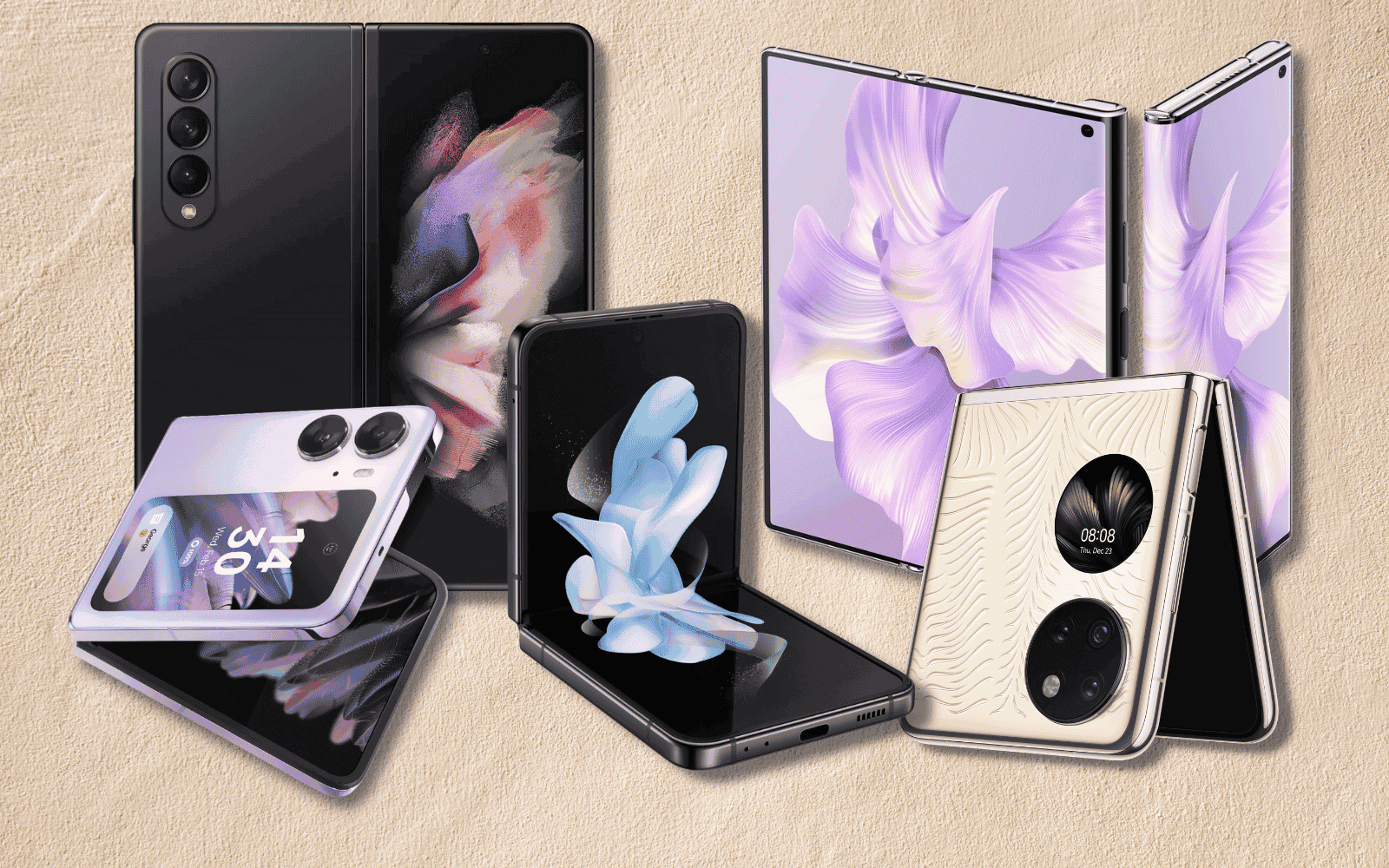

- Innovating: Manufacturers need to come up with new and innovative features that will make smartphones more desirable to consumers. This could involve developing new technologies, such as foldable screens or augmented reality, or improving existing features, such as cameras or battery life.

- Targeting new markets: Manufacturers need to focus on growing markets, such as developing countries. These markets offer a large potential customer base that has not yet been fully tapped.

By addressing these challenges, manufacturers can help the global smartphone market recover and grow in the years to come.

Additional insights into how the market may recover

Here are some additional insights into how the market may recover:

- The market for foldable smartphones is still in its early stages, but it has the potential to grow rapidly in the coming years. Foldable smartphones offer a unique and compelling experience that many consumers are interested in.

- The demand for 5G smartphones is also growing rapidly. 5G offers faster speeds and lower latency than 4G, which is making it an attractive option for consumers who want the best possible mobile experience.

- The increasing popularity of mobile gaming is also driving demand for new smartphones. Mobile games are becoming more sophisticated and demanding, which requires more powerful hardware. This is creating a need for new smartphones with better processors and graphics chips.

Overall, the global smartphone market is facing some challenges, but there are also some positive signs. With the right strategies, manufacturers can help the market recover and grow in the years to come.