Apple was the smartphone market leader in the fourth quarter of 2021

AppleWednesday, 19 January 2022 at 08:19

The fourth quarter of 2021 was again one of the best for Apple. The company managed to minimize the damage from problems with the production of the iPhone 13, and it became the leader in the smartphone market. This is the second quarter in a row that Apple has held the title of number one company in the market.

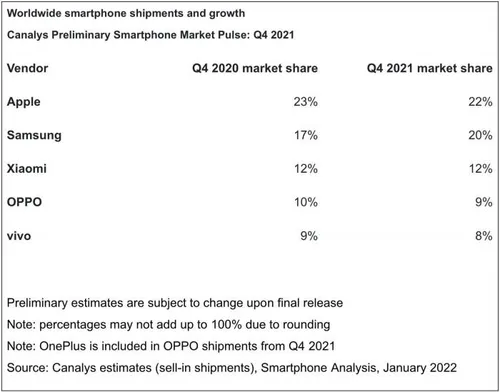

This conclusion comes from the report of Canalys analysts. Among the reasons for Apple's success, they cite the popularity of the iPhone 13 series in China and aggressive pricing in this country. As a result, Apple's share in the global smartphone market was 22%, while the second-best Samsung has a 20% share. This means that one in five smartphones sold globally between October and December 2021 was an iPhone.

But against the backdrop of the fourth quarter of 2020, Apple's position slightly weakened, and Samsung managed to increase its share. So, in the fourth decade of 2020, the share of the Cupertino company was 23%, and Samsung 17%.

In third place was Xiaomi, which controlled 12% of the market share in the 4th quarter of last year. And this result is similar to the one that the company demonstrated based on the results of work from October to December 2020. Fourth and fifth place belongs to Oppo and Vivo, whose share is estimated at 10% and 9% respectively. Compared to the same period in 2020, the drop was 1% for each of the brands.

Canalys: Apple retakes top spot in global smartphone market in Q4 2021

“Apple is back at the top of the smartphone market after three quarters; driven by a stellar performance from the iPhone 13,” said Canalys Analyst Sanyam Chaurasia. “Apple saw unprecedented iPhone performance in Mainland China, with aggressive pricing for its flagship devices keeping the value proposition strong. Apple’s supply chain is starting to recover; but it was still forced to cut production in Q4 amid shortages of key components; and could not make enough iPhones to meet demand. In prioritized markets, it maintained adequate delivery times; but in some markets its customers had to wait to get their hands on the latest iPhones.”

“Supply chain disruption affected low-end vendors the most,” said Canalys VP Mobility Nicole Peng. “Component manufacturers are eking out additional production, but it will take years for major foundries to significantly increase chip capacity. Smartphone brands are already innovating to make the most of their circumstances; tweaking device specs in response to available materials, approaching emerging chipmakers to secure new sources for ICs; focusing product lines on the best-selling models and staggering new product releases. These practices lend an advantage to larger brands, and they are set to stay for the short term, as bottlenecks will not ease until the second half of 2022.”

Popular News

Latest News

Loading